ArcelorMittal (MT) Invests in New EAF to Drive Decarbonization

ArcelorMittal S.A. MT has confirmed the plan to invest in a new electric arc furnace (EAF) at its Belval location as part of its decarbonization process.

This investment is part of a series of projects that were the subject of a memorandum of understanding (MoU) signed between ArcelorMittal Luxembourg and the Ministry of Economy last September. This MoU underlines the Luxembourg government's commitment to financially support this type of strategic investment through the different available aid mechanisms. The Luxembourg State has provided around €15 million in subsidies for this project in particular.

One of the main projects of this MoU is the new Belval electric arc furnace. It will enhance energy efficiency and expand steel manufacturing capacity in Luxembourg by around 15% to 2.5 million tons per year. With this new facility replacing the current EAF, which has been in operation since 1997, and additional investments planned in other areas of the Belval steel plant, ArcelorMittal Luxembourg plants are expected to be self-sufficient in crude steel production capacity to meet the Grand Duchy's needs for finished rolled products.

Electric furnaces make steel from recycled scrap and may run entirely on renewable energy. Aside from the benefits of recycling scrap, this steelmaking process reduces CO2 emissions compared with traditional steel manufacturing via blast furnaces. The new electric furnace in Belval will be installed this year, with commissioning in 2025.

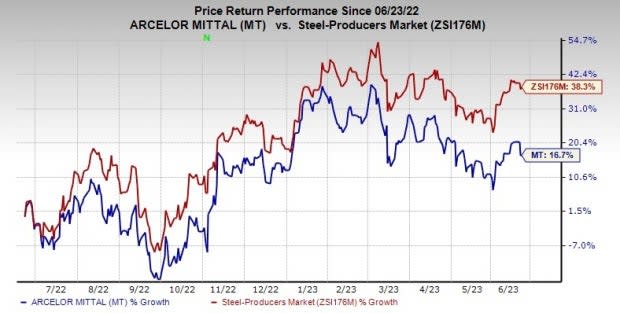

Shares of ArcelorMittal have gained 16.7% over the past year compared with a 38.3% rise of its industry.

Image Source: Zacks Investment Research

Last month, MT stated that its apparent demand conditions improved once the destocking phase reached maturity in the first quarter of 2023. Despite ongoing obstacles to real demand, the absence of further destocking is likely to maintain stronger apparent demand in 2023 compared with 2022, the company noted.

The company estimates world apparent steel consumption, excluding China, to rise 2-3% year over year in 2023. ArcelorMittal expects its steel shipments to grow roughly 5% in the year.

ArcelorMittal Price and Consensus

ArcelorMittal price-consensus-chart | ArcelorMittal Quote

Zacks Rank & Key Picks

ArcelorMittal currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks to consider in the basic materials space include Koppers Holdings Inc. KOP, Silvercorp Metals Inc. SVM and Linde plc LIN. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Koppers currently carries a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for current-year earnings for KOP is currently pegged at $4.40, implying year-over-year growth of 6.3%. It has a trailing four-quarter earnings surprise of roughly 13.64%, on average. The stock has gained around 50.1% in a year.

Silvercorp Metals currently carries a Zacks Rank #1. The consensus estimate for current fiscal-year earnings for Silvercorp is currently pegged at 27 cents, suggesting year-over-year growth of 28.6%. The stock has gained roughly 4.6% in the past year.

Linde currently carries a Zacks Rank #2. The Zacks Consensus Estimate for LIN’s current-year earnings has been revised 3.8% upward in the past 60 days. Linde beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 6.9% on average. The stock has gained roughly 24.8% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ArcelorMittal (MT) : Free Stock Analysis Report

Koppers Holdings Inc. (KOP) : Free Stock Analysis Report

Linde PLC (LIN) : Free Stock Analysis Report

Silvercorp Metals Inc. (SVM) : Free Stock Analysis Report