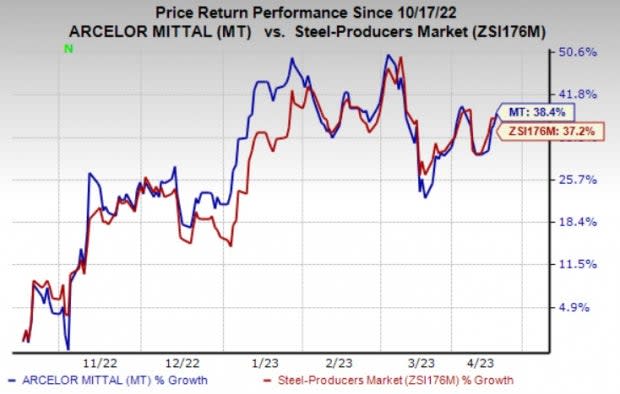

ArcelorMittal's (MT) Shares Pop 38% in 6 Months: Here's Why

ArcelorMittal S.A.’s MT shares have gained 38.4% over the past six months. The company has also outperformed its industry’s rise of 37.2% over the same time frame. It has also topped the S&P 500’s roughly 13% rise over the same period.

Let’s take a look into the factors that are driving this Zacks Rank #1 (Strong Buy) stock.

Image Source: Zacks Investment Research

What’s Going in MT’s Favor?

The steel giant is benefiting from improved market conditions and cost-improvement actions. ArcelorMittal, in its fourth-quarter call, said that it sees improved demand conditions in 2023 following aggressive destocking. The company expects world apparent steel consumption, excluding China, to recover by 2-3% year over year in 2023. ArcelorMittal also expects its steel shipments to grow by roughly 5% year over year in 2023.

Although real consumption growth is anticipated to remain lackluster in the United States, MT expects the end of destocking to lead to a rise in apparent consumption by 1.5-3.5% in 2023. The company also envisions apparent demand in Europe to recover by 0.5-2.5% in 2023.

ArcelorMittal also expects a strong recovery in economic growth in China in 2023 as COVID-19 restrictions are being lifted. However, factoring in the sustained softness in real estate during the year, it projects steel consumption to stabilize in 2023 (+1% to -1%) with potential upside dependent on China government’s infrastructure stimulus.

The company is also expanding its steel-making capacity and remains focused on shifting to high-added-value products. As part of this move, ArcelorMittal is expanding its automotive steel line of products. The company is expanding its global portfolio of automotive steels by launching a new generation of advanced high-strength steels

Moreover, the company’s cost-improvement initiatives will support profitability. MT, in 2022, set out a new value plan worth $1.5 billion to maintain cost position, to be achieved over three years. The plan is focused on creating value through commercial and operational improvements. These include volume, mix and variable cost improvement. The company realized improvements of $0.4 billion from actions taken in 2022.

ArcelorMittal Price and Consensus

ArcelorMittal price-consensus-chart | ArcelorMittal Quote

Stocks to Consider

Other top-ranked stocks worth considering in the basic materials space include Steel Dynamics, Inc. STLD, Olympic Steel, Inc. ZEUS and Linde plc LIN.

Steel Dynamics currently sports a Zacks Rank #1. The Zacks Consensus Estimate for STLD's current-year earnings has been revised 32.8% upward in the past 60 days. You can see the complete list of today’s Zacks #1 Rank stocks here.

Steel Dynamics’ earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 11.3%, on average. STLD has gained around 19% in a year.

Olympic Steel currently sports a Zacks Rank #1. The Zacks Consensus Estimate for ZEUS's current-year earnings has been revised 33.1% upward in the past 60 days.

Olympic Steel’s earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 26.2%, on average. ZEUS has rallied around 33% in a year.

Linde currently carries a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for LIN’s current-year earnings has been revised 2.5% upward in the past 60 days.

Linde beat Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 5.9% on average. LIN’s shares have gained roughly 14% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Steel Dynamics, Inc. (STLD) : Free Stock Analysis Report

ArcelorMittal (MT) : Free Stock Analysis Report

Olympic Steel, Inc. (ZEUS) : Free Stock Analysis Report

Linde PLC (LIN) : Free Stock Analysis Report