Arch Capital (ACGL) Up 13% YTD: Can it Retain the Bull Run?

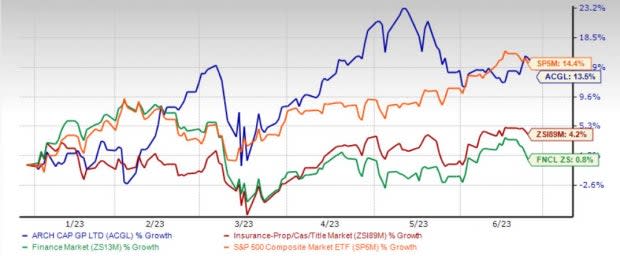

Arch Capital Group Ltd.’s ACGL shares have moved up 13.5% year to date, outperforming the industry’s growth of 4.2%. The Finance sector has increased 0.8%, while the Zacks S&P 500 composite has risen 14.4% in the same period. With a market capitalization of $26.5 billion, the average volume of shares traded in the last three months was 1.9 million.

Business opportunities, rate increases, growth in existing accounts and a solid capital position continue to drive this Zacks Rank #3 (Hold) insurer’s performance. This leading specialty P&C and mortgage insurer has a decent history of delivering earnings surprises in the last four quarters.

Return on equity in the trailing 12 months was 17.5%, better than the industry average of 6.9%. This highlights the company’s efficiency in utilizing shareholders’ funds.

The company has a VGM Score of B. The Style Score rates stocks on their combined weighted styles, helping to identify those with the most attractive value, best growth and most promising momentum.

Image Source: Zacks Investment Research

Can ACGL Retain the Momentum?

The Zacks Consensus Estimate for 2023 earnings is pegged at $6.25, suggesting a year-over-year increase of 28.3% on 24.8% higher revenues of $12.7 billion. The consensus estimate for 2024 earnings is pegged at $6.95, indicating a year-over-year increase of 11.3% on 10.5% higher revenues of $14 billion.

The expected long-term earnings growth rate is pegged at 10%. The company has a Growth Score of B. The Style Score analyzes the growth prospects of a company. Notably, earnings of the insurer increased 24.5% in the last five years, better than the industry average of 17%. Business diversification reduces earnings volatility.

New business opportunities, rate increases, growth in existing accounts and higher Australian single-premium mortgage insurance should aid premium upside. We expect 2023 premiums to increase 14.6% to $11 billion. With operations spread across geographies, a compelling product portfolio provides meaningful diversification and earnings stability to ACGL.

ACGL’s impressive inorganic growth encompasses international expansion, operation enhancements and business diversification at attractive risk-adjusted returns. The diversification of its Mortgage Insurance business via strategic acquisitions complements the strength of the specialty insurance and reinsurance businesses.

ACGL expects to deliver an increasing level of investment income with new money rates of 4.5-5% in the fixed-income portfolio and a growing base of invested assets. We expect net investment income to increases 30.6% in 2023. This in turn should aid bottom-line improvement.

Arch Capital’s solid balance sheet, with high liquidity and low leverage, shields it from market volatility and supports growth initiatives.

Stocks to Consider

Some better-ranked stocks from the insurance industry are RLI Corporation RLI, Kinsale Capital Group KNSL and HCI Group HCI, each sporting Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

RLI delivered a four-quarter average earnings surprise of 43.50%. Year to date, the insurer has lost 1.8%. The Zacks Consensus Estimate for RLI’s 2023 and 2024 earnings indicates a respective year-over-year increase of 7.9% and 3.9%.

Kinsale delivered a four-quarter average earnings surprise of 14.77%. Year to date, the insurer has gained 23.8%. The Zacks Consensus Estimate for KNSL’s 2023 and 2024 earnings indicates respective year-over-year increases of 36.2% and 21.4%.

HCI Group delivered a four-quarter average earnings surprise of 308.82%. Year to date, the insurer has gained 3%. The Zacks Consensus Estimate for HCI’s 2023 and 2024 earnings indicates respective year-over-year increases of 149.3% and 35.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RLI Corp. (RLI) : Free Stock Analysis Report

Arch Capital Group Ltd. (ACGL) : Free Stock Analysis Report

HCI Group, Inc. (HCI) : Free Stock Analysis Report

Kinsale Capital Group, Inc. (KNSL) : Free Stock Analysis Report