Arch Capital Group Ltd Reports Strong Q4 Earnings with Net Income Surge

Net Income: $2.3 billion, a significant increase from $849 million in Q4 2022.

Earnings Per Share: $6.12 per share, up from $2.26 per share in the same quarter last year.

Underwriting Income: Slight decrease to $715 million from $734 million in Q4 2022.

Combined Ratio: Improved to 78.9%, down from 82.0% in Q4 2022.

Book Value Per Share: Increased to $46.94, marking a 21.5% rise from the previous quarter.

Gross Premiums Written: Increased by 12.0% to $4.251 billion.

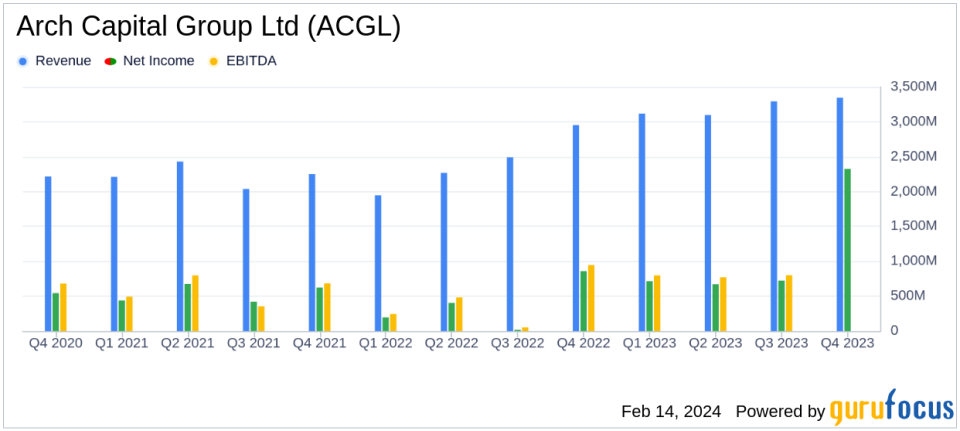

On February 14, 2024, Arch Capital Group Ltd (NASDAQ:ACGL) released its 8-K filing, detailing a robust performance for the fourth quarter of 2023. The company, a global provider of insurance and reinsurance solutions, reported a substantial increase in net income available to common shareholders, which soared to $2.3 billion, or $6.12 per share. This represents a 58.2% annualized net income return on average common equity, a significant rise from the $849 million, or $2.26 per share, reported in the fourth quarter of 2022.

The company's after-tax operating income available to common shareholders also saw an increase, reaching $945 million, or $2.49 per share, compared to $806 million, or $2.14 per share, in the prior-year quarter. This performance was bolstered by the establishment of a net deferred tax asset of $1.18 billion, or $3.10 per share, following the enactment of Bermuda's new corporate income tax.

Financial Performance and Segment Analysis

ACGL's underwriting results showed a slight decline in underwriting income to $715 million, down from $734 million in the same period last year. However, the combined ratio, excluding catastrophic activity and prior year development, improved to 78.9% from 82.0% in the fourth quarter of 2022. The company's book value per common share increased by 21.5% from the previous quarter, ending at $46.94 as of December 31, 2023.

The insurance segment reported a 17.6% increase in gross premiums written and a 19.1% increase in net premiums written, reflecting growth across most lines of business. The reinsurance segment also saw growth, with gross premiums written up by 9.7% and net premiums earned increasing by 32.2%. The mortgage segment, however, experienced a slight decline in gross premiums written and net premiums earned.

ACGL's CEO, Marc Grandisson, expressed optimism about the company's prospects, citing a strong operating return on equity for the year and the positive market conditions in which the company operates.

Investment and Corporate Highlights

The company's investment returns benefited from higher interest rates and strong operating cash flows, with net realized gains of $189 million for the quarter. The corporate segment, which includes net investment income and realized gains or losses, contributed positively to the overall results.

ACGL's effective tax rate on income before income taxes was a benefit of 85.6% for the quarter, largely due to the one-time deferred tax benefit from Bermuda's new corporate income tax. The company expects to incur and pay increased taxes in Bermuda beginning in 2025.

Arch Capital Group Ltd, with a market capitalization of approximately $21.1 billion as of December 31, 2023, is part of the S&P 500 index and continues to provide a diverse range of insurance, reinsurance, and mortgage insurance products globally.

For more detailed financial information and performance analysis, investors and analysts can refer to the company's Financial Supplement dated December 31, 2023, and are encouraged to join the conference call scheduled for February 15, 2024.

Value investors and potential GuruFocus.com members interested in Arch Capital Group Ltd's detailed financial performance can access the full earnings report and additional financial data on the company's website or through the provided 8-K filing link.

Explore the complete 8-K earnings release (here) from Arch Capital Group Ltd for further details.

This article first appeared on GuruFocus.