Archer Daniels (ADM) to Acquire FDL, To Expand Flavor Business

Archer Daniels Midland Company ADM announced a significant move to bolster its flavor portfolio by signing an agreement to acquire the U.K.-based Fuerst Day Lawson Limited (“FDL”). FDL is a distinguished developer and producer of premium flavor and functional ingredient systems. Post acquisition, FDL will become an integral part of ADM's strategic expansion in the nutrition sector. ADM expects to complete the acquisition by the end of January 2024 after satisfying customary closing conditions.

With anticipated 2023 sales of $120 million, FDL runs three production facilities and two customer innovation centers in the U.K. The company boasts 235 employees, including 40 dedicated innovation specialists. FDL has gained prominence for creating more than 10,000 proprietary flavor formulations, facilitating accelerated speed to market. The company's clientele spans various channels, with a notable presence in the $900-billion European foodservice segment.

ADM remains on track with ongoing investments to expand its flavors portfolio, which is likely to fortify the company's position as a global leader in nutrition. The FDL acquisition is expected to enhance ADM's global flavor capabilities through the addition of the former’s innovative formulation expertise, end-use application knowledge and robust customer base. Further, the deal is likely to be a win-win for both companies, particularly in expanding their reach in key channels, notably the foodservice sector.

Per FDL’s management, ADM is expected to be an ideal partner for FDL, with its existing global nutrition and flavor capabilities. The company ascertains this collaboration as an opportunity to strengthen FDL's taste and nutrition solutions, bringing new possibilities to both companies. The FDL management expects its diverse portfolio of flavor and functional ingredient systems, intellectual property, and capabilities, emphasizing the entrepreneurial spirit and innovativeness to complement ADM’s broad offerings.

The acquisition of FDL forms part of ADM's broader strategy to augment its flavor ingredients and solutions portfolio, aligning with its vision of becoming a global leader in nutrition. Since the acquisition of WILD Flavors in 2014, ADM has consistently expanded its flavor offerings through strategic acquisitions in various sectors, including dairy, savory, citrus and vanilla. The company has also invested organically in flavor production facilities and innovation centers across the globe.

Conclusion

ADM’s acquisition move reflects its commitment to continuous growth and innovation in the nutrition and flavor segment. The synergy between ADM's global reach and FDL's expertise is poised to bring forth new and innovative ingredient solutions for the food and beverage industry worldwide. This strategic acquisition underlines ADM's dedication to meeting the evolving demands of consumers and staying at the forefront of the dynamic nutrition market.

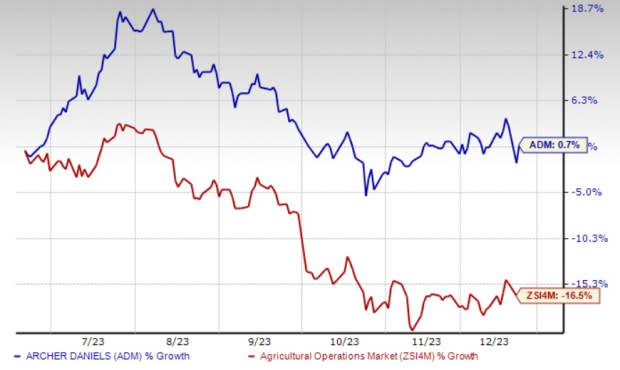

We note that shares of ADM have gained 0.7% in the past six months against the industry’s 16.5% decline. The company currently has a Zacks Rank #3 (Hold).

Image Source: Zacks Investment Research

Stocks to Consider

We highlighted some better-ranked stocks from the broader Consumer Staples space, namely Dole DOLE, Adecoagro AGRO and Celsius Holdings CELH.

Dole, a producer of fresh bananas and pineapples, currently sports a Zacks Rank #1 (Strong Buy). DOLE has a trailing four-quarter earnings surprise of 78.3%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for DOLE’s current financial year’s earnings suggests growth of 19.6% from the year-ago reported numbers.

Adecoagro, an agricultural company in South America, with operations in Argentina, Brazil and Uruguay, currently has a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for Adecoagro’s current financial-year earnings suggests growth of 16.8% from the year-ago reported figure.

Celsius Holdings currently carries a Zacks Rank #2. CELH specializes in commercializing healthier, nutritional, and functional foods, beverages and dietary supplements.

The Zacks Consensus Estimate for CELH’s current financial-year sales and earnings indicates growth of 98.5% and 185.2%, respectively, from the year-ago reported figures. The company had an earnings surprise of 110.9% in the last reported quarter.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Archer Daniels Midland Company (ADM) : Free Stock Analysis Report

Dole PLC (DOLE) : Free Stock Analysis Report

Adecoagro S.A. (AGRO) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report