Archer Daniels (ADM) Announces Accelerated Share Repurchases

Archer Daniels Midland Company ADM is significantly progressing on its three strategic pillars, which are optimize, drive and growth. The company is actively managing productivity and innovation, and aligning work to the interconnected trends in food security, health and wellbeing.

In the latest developments, the company has entered into an accelerated share repurchase (ASR) agreement with delayed share delivery with Merrill Lynch International, an affiliate of BofA Securities, Inc., to buy back $1 billion of the company’s common stock. Under the ASR agreement, the company will receive monthly share deliveries at the end of every month starting this month.

The overall number of shares to be repurchased via the ASR will be determined using a formula based on the company’s share price within the term of the transaction, with the purchase price determined by a formula on its daily volume-weighted average price during the term of the transaction, net of a discount, and is likely to be completed no later than the end of second-quarter 2024. The ASR is expected to be completed under the company’s present 200-million share repurchase program that runs through 2024.

The company ended the fourth quarter of 2023 with cash and cash equivalents of $1.4 billion; long-term debt, including current maturities, of $8.3 billion; and shareholders’ equity of $24.1 billion. As of Dec 31, 2023, ADM provided $4.5 billion in cash for operating activities. It repurchased shares worth $2.7 billion and cash dividends of $977 million in 2023.

The company repurchased $1.5 billion of shares in fourth-quarter 2023 and about $330 million of shares in first-quarter 2024 as of Mar 12. Management intends to actualize $ 2 billion of additional share repurchases for the rest of the year. This includes $1 billion, which will be executed via this accelerated share repurchase program that runs through the second quarter.

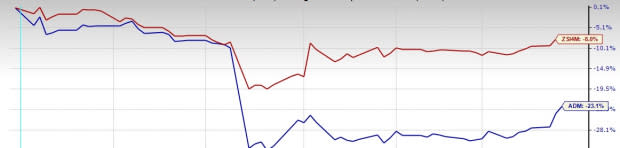

Image Source: Zacks Investment Research

What Else?

Regarding the three pillars, under the optimize pillar, the company had revealed plans to expand alternative protein capabilities in Decatur, IL, and starch production in Marshall, MN. ADM concluded its alternative protein expansion in Serbia. As part of the company’s optimizing pillar, it continues to adapt to consumers changing nutritional preferences.

Under its drive pillar, the company continues to adapt its organizational structure to meet operational excellence and set goals. Further, under the growth pillar, it is looking to expand its footprint in fast-growing alternative protein. Notably, Archer Daniels inked an agreement with Benson Hill to process and commercialize a portfolio of proprietary ingredients derived from their ultra-high protein soybeans.

In response to the growing trends for all things sustainable, the company has been making efforts to expand its solutions portfolio, which is part of its Carbohydrate Solutions unit. It collaborated with LG Chem to produce lactic and polylactic acids for bioplastics, which is a plant-based product. Earlier, the company collaborated with LG Chem for two joint ventures. This is helping produce lactic acid and polylactic acid for a variety of applications, including bioplastics across the United States.

We note that shares of this Zacks Rank #4 (Sell) company have lost 23.1% in the past three months compared with the industry’s 8% decline.

Stocks to Consider

We highlighted some better-ranked stocks from the broader Consumer Staples space, namely Church & Dwight Co. CHD, Colgate-Palmolive CL and Inter Parfums IPAR.

Church & Dwight, offering a broad range of household, personal care and specialty products, currently carries a Zacks Rank #2 (Buy). CHD has a trailing four-quarter earnings surprise of 10.1%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Church & Dwight’s current financial year’s sales and earnings suggests growth of 8.7% and 6.4%, respectively, from the year-ago numbers.

Colgate, a leading consumer goods company, currently carries a Zacks Rank of 2. CL has a trailing four-quarter earnings surprise of 4.2%, on average.

The Zacks Consensus Estimate for CL’s current financial-year sales and earnings suggests growth of 3.5% and 7.7%, respectively, from the year-ago reported figures.

Inter Parfums is engaged in the manufacturing, distribution and marketing of a wide range of fragrances and related products. It currently carries a Zacks Rank of 2.

The Zacks Consensus Estimate for IPAR’s current financial-year sales and earnings indicates advancements of 20.9% and 20.2%, respectively, from the prior-year figures. It has a trailing four-quarter earnings surprise of 45.7%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Archer Daniels Midland Company (ADM) : Free Stock Analysis Report

Colgate-Palmolive Company (CL) : Free Stock Analysis Report

Church & Dwight Co., Inc. (CHD) : Free Stock Analysis Report

Inter Parfums, Inc. (IPAR) : Free Stock Analysis Report