Archer Daniels (ADM) Q3 Earnings Beat Estimates, Revenues Miss

Archer Daniels Midland Company ADM posted third-quarter 2023 results, wherein the top line missed the Zacks Consensus Estimate, but the bottom line beat the same. Both metrics declined year over year.

Adjusted earnings of $1.63 per share in the third quarter outpaced the Zacks Consensus Estimate of $1.50. However, the figure declined 12.4% from $1.86 in the year-ago quarter. On a reported basis, Archer Daniels’ earnings were $1.52 per share, down 16.9% from the prior-year quarter’s $1.83.

Revenues fell 12.1% year over year to $21,695 million and missed the Zacks Consensus Estimate of $23,217 million.

Segment-wise, revenues for Ag Services & Oilseeds fell 13.9% year over year, whereas Carbohydrate Solutions’ revenues dropped 7.1% year over year. Also, Nutrition witnessed a year-over-year revenue decline of 4.3%.

Meanwhile, we projected revenues for Ag Services & Oilseeds and Carbohydrate Solution segments to decline by 7.8% and 0.5%, respectively. We estimated Nutrition revenues to grow by 1.9%.

The gross profit decreased marginally year over year to $1,810 million but exceeded our estimate of $1,478.1 million. Meanwhile, the gross margin expanded 100 basis points to 8.3% in the quarter under review. The metric fared better than our estimate of 6.4%. SG&A expenses fell 0.4% to $815 million. We expected SG&A expenses to decrease by 2.8% for the quarter under review.

Archer Daniels has reported an adjusted segmental operating profit of $1,492 million in third-quarter 2023, down 5.5% from the year-ago quarter. On a GAAP basis, ADM’s segmental operating profit fell 8.9% year over year to $1,421 million.

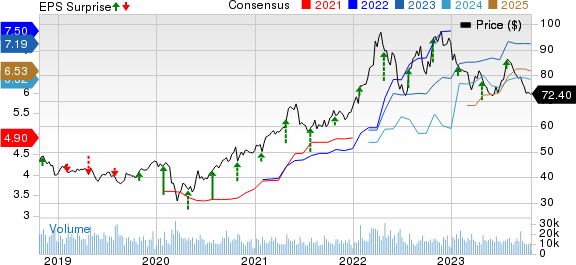

Archer Daniels Midland Company Price, Consensus and EPS Surprise

Archer Daniels Midland Company price-consensus-eps-surprise-chart | Archer Daniels Midland Company Quote

Segmental Operating Profit

Adjusted operating profit for Ag Services & Oilseeds fell 21.1% year over year to $848 million. This is mainly due to weak North America origination results, which were hurt by lower export volumes due to large South America supplies. However, South America origination results have been solid, driven by higher volumes and margins stemming from strong export demand. The segment benefited from its strong Brazilian export capabilities and the commissioning of the Spiritwood production facility to serve the high demand for renewable green diesel.

Crushing results declined year over year, driven by a drab year-over-year performance in global soy crush margins. On the flip side, robust soft seed margins, driven by the use of its flex capacity in EMEA, acted as upsides.

Refined Products and Other results have been robust year over year, benefiting from strong export demand for biodiesel and domestic demand for food oil in EMEA. As noted, there were net positive mark-to-market timing effects during the quarter.

The Carbohydrate Solutions segment’s adjusted operating profit increased 48.9% to $460 million. The Starches and Sweeteners sub-segment, including ethanol production from the wet mills, gained from solid demand as well as robust volumes and higher margins in North America. Meanwhile, the global wheat milling business witnessed higher margins, driven by solid demand.

Vantage Corn Processors’ results have been higher year-over-year, driven by strong demand and margins for ethanol.

In the Nutrition segment, the adjusted operating profit of $138 million fell 22% from $177 million in the year-ago quarter. The Human Nutrition unit’s results were lower year over year. The Flavors unit was robust on pricing actions in EMEA and had solid win rates in North America. Muted demand for plant-based proteins, particularly in the meat alternatives category, hurt the Specialty Ingredients unit. The Health & Wellness business’ results was strong year over year, backed by solid probiotic sales and a favorable impact associated with the revised commercial agreement with Spiber.

The Animal Nutrition unit was weak year over year due to lower contributions from amino acids. Also, continued demand fulfillment challenges in Pet Solutions acted as a deterrent.

Other Financials

This Zacks Rank #3 (Hold) player ended the quarter with cash and cash equivalents of $1,498 million; long-term debt, including current maturities, of $8,225 million; and shareholders’ equity of $25,265 million. As of Sep 30, 2023, ADM provided $1,891 million in cash for operating activities. It repurchased shares worth $1.1 billion and cash dividends of $738 million in the first nine months of 2023.

We note that shares of ADM have lost 12.9% in the past three months compared with the industry’s 17.6% decline.

Key Picks

Here, we have highlighted three better-ranked stocks, namely Inter Parfums IPAR, Post Holdings POST and Grocery Outlet Holding Corp. GO. Inter Parfums currently sports a Zacks #1 Rank (Strong Buy), and Post Holdings and Grocery Outlet each carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Inter Parfums manufactures, markets and distributes a range of fragrances and fragrance-related products. The Zacks Consensus Estimate for Inter Parfums’ current financial-year sales and earnings indicates 19.7% and 14.9% growth from their respective year-ago reported figures. IPAR has a trailing four-quarter earnings surprise of 45.9%, on average.

Post Holdings is a consumer-packaged goods holding company. POST has a trailing four-quarter earnings surprise of 59.6%, on average. The Zacks Consensus Estimate for Post Holdings’ current financial-year sales and earnings suggests growth of 13.2% and 189.9%, respectively, from the year-ago reported numbers.

Grocery Outlet is a retailer of consumables and fresh products. GO has a trailing four-quarter earnings surprise of 14.3%, on average. The Zacks Consensus Estimate for GO’s current financial-year sales and EPS indicates improvements of 11.2% and 4.9%, respectively, from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Archer Daniels Midland Company (ADM) : Free Stock Analysis Report

Inter Parfums, Inc. (IPAR) : Free Stock Analysis Report

Post Holdings, Inc. (POST) : Free Stock Analysis Report

Grocery Outlet Holding Corp. (GO) : Free Stock Analysis Report