Archer-Daniels Midland Co Reports Mixed Results Amidst Global Challenges

Reported EPS: Full-year reported EPS at $6.43, with adjusted EPS at $6.98.

Segment Operating Profit: $5,900 million GAAP and $6,244 million adjusted.

Return on Invested Capital: Trailing four-quarter average adjusted ROIC at 12.2%.

Share Repurchases: Announces an additional $2 billion in share repurchases.

Segment Performance: Mixed results across segments with notable declines in Nutrition.

2024 Guidance: Adjusted EPS forecasted in the range of $5.25 to $6.25 per share.

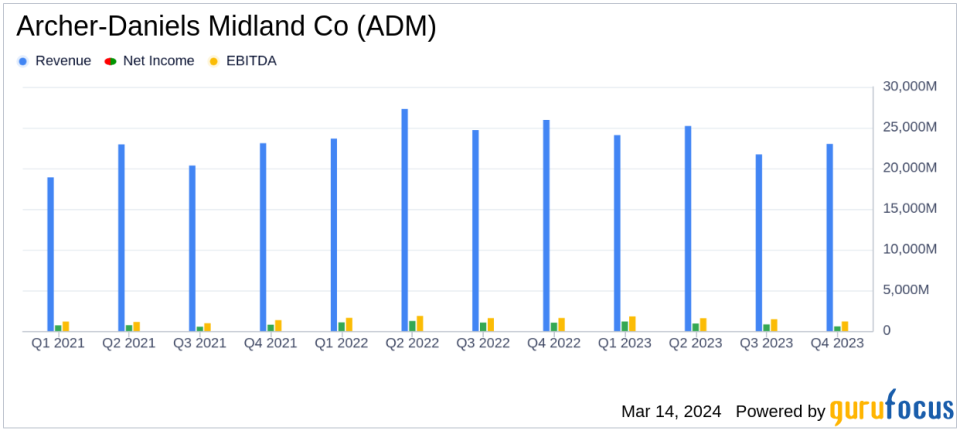

On March 12, 2024, Archer-Daniels Midland Co (NYSE:ADM) released its 8-K filing, detailing its fourth quarter earnings and full-year results for 2023. The company, a global leader in agricultural processing and food ingredients, reported a full-year reported EPS of $6.43 and an adjusted EPS of $6.98, reflecting the company's ability to navigate a complex global market environment.

Archer-Daniels Midland's segment operating profit stood at $5,900 million on a GAAP basis, with an adjusted segment operating profit of $6,244 million. The company's trailing four-quarter average adjusted return on invested capital (ROIC) was reported at 12.2%, showcasing the company's efficient use of capital in generating profits.

Financial Performance and Challenges

Despite facing lower pricing and execution margins, which led to a decline in earnings per share, ADM managed to mitigate some of the impact through improved manufacturing costs, primarily due to lower input and energy costs. However, challenges such as unplanned downtime at the Decatur complex and lower equity earnings, particularly from Wilmar, negatively affected the company's performance.

The company's Ag Services & Oilseeds segment saw a decrease in operating profit, attributed to lower margins as global grain and oilseed supplies recovered, pressuring commodity price levels. The Carbohydrate Solutions segment, however, reported a 12% increase in operating profit for the fourth quarter, driven by higher pricing and lower input costs.

The Nutrition segment faced significant challenges, with a 110% decrease in operating profit for the fourth quarter, primarily due to operational issues leading to lower volumes and increased manufacturing costs. The segment also faced negative impacts from deconsolidation and write-down of a joint venture, as well as an investment valuation loss.

Strategic Financial Moves

ADM announced an additional $2 billion in share repurchases, signaling confidence in its financial stability and commitment to delivering value to shareholders. This move is part of the company's existing 200 million share repurchase program, which has seen ADM repurchase $8.6 billion of its common stock since 2015.

Looking Ahead

For 2024, ADM expects adjusted earnings per share in the range of $5.25 to $6.25, reflecting moderating margin conditions and higher costs offset by improved volumes. The company anticipates global soybean crush margins to decline, with vegetable oil demand growth from renewable diesel and low single-digit soybean meal demand growth supporting structural margin improvement.

In conclusion, Archer-Daniels Midland Co (NYSE:ADM) has demonstrated resilience in the face of market volatility and operational challenges. While some segments experienced declines, the company's strategic financial management and diversified portfolio have positioned it to continue delivering value to its stakeholders. Investors and value seekers should keep a close eye on ADM's performance as it navigates the evolving agricultural and food ingredient markets.

For a more detailed analysis of Archer-Daniels Midland Co's financial results and strategic outlook, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Archer-Daniels Midland Co for further details.

This article first appeared on GuruFocus.