Archer-Daniels-Midland's Valuation Supported by Favorable USDA Trends

Archer-Daniels-Midland Co. (NYSE:ADM), which is more commonly referred to by its ticker symbol, is headquartered in Chicago and has been a key U.S.-based player in both the global processing of food and the global trade in agricultural commodities since being founded in 1902.

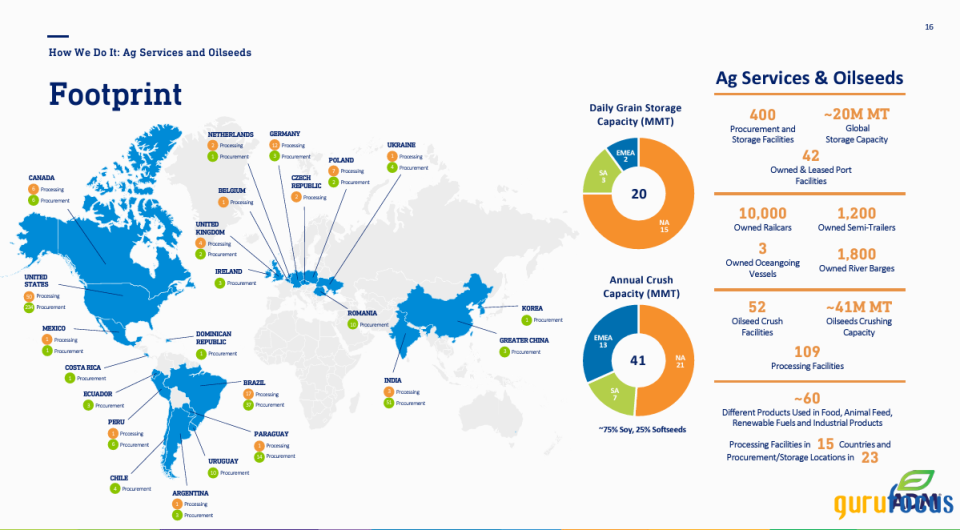

Since its inception, ADM has had explosive growth. Starting out as just a domestic operator, the company very quickly expanded and now runs a large-scale logistical network enabling the transport of various goods, whether it be by rail, road or sea. Its extensive operations include over 400 crop procurement locations, 750 storage facilities and 100 processing plants spread across six continents that serve more than 200 countries. This global footprint enables ADM to transform various different cereal grains and oil seeds into products that are crucial for the food and animal feed sectors.

Source: 2022 annual report

Further strengthening its global presence, ADM, through its various subsidiaries, owns 10 oceangoing vessels and charters many others out daily, thus positioning it as a player within both the agricultural commodity and dry bulk shipping spaces.

ADM works closely with farmers in its day-to-day operations and not only delivers its own fertilizers to these farmers, but also facilitates the transportation and storage of various agricultural products produced by the very same farmers.

This serves as a very nice feedback loop that benefits both the farmers and ADM, as the company's primary revenue stream stems from service fees collected through the transportation, storage and processing of these agricultural goods on a domestic and global scale. This strategic approach stands to ensure a steady income for the company while positioning ADM as a crucial link in the global supply chain, connecting farmers to producers and end consumers.

Signs of increased demand

Given that grains, oilseeds, livestock and other agricultural products are at the core of ADM's business, I think it is important we look into macro supply and demand data from an official source which covers the greater agricultural spaces ADM does business in. One such source would be through the data obtained and reported by the United States Department of Agriculture, otherwise known as the USDA.

The USDA is responsible for overseeing various aspects of the nation's food supply. This includes food safety, nutrition and the promotion of sustainable agricultural practices. In addition to these responsibilities, the USDA also provides support to farmers and conducts research on agriculture and rural development and sets regulatory standards for the nation's food supply.

As a component of its research initiatives, the USDA reliably issues monthly reports that delve into the various supply and demand dynamics within agricultural sectors. The most comprehensive out of these reports are the World Agricultural Supply and Demand Estimates, which offer thorough forecasts and analysis of domestic and global supply and demand for key agricultural commodities.

Considering the expansive scope of the USDA's agricultural operations, incorporating the latest data and projections from its reports into our own macro views on a company's performance within the sector could provide valuable insights. From this point onward, I will be summarizing the latest report while focusing on aspects that point toward either increased production or increased demand across various different categories.

Wheat

The projected wheat for 2023-24 U.S. ending stocks were lowered by 11 million bushels due to decreased supplies and a reduction in seed use to 64 million bushels. The average farm price for the season is forecasted to end at $7.20 per bushel, this will reflect a 10-cent decrease based on current prices and expectations for the remainder of 2023-24.

Globally, the outlook for the period indicates larger supply, increased consumption, rising trade volumes and higher ending stocks compared to the previous month, with global supplies raised to 1.05 billion tons.

Corn

In coarse grains, particularly corn, the 2023-24 U.S. outlook shows significantly greater production, larger food, seed and industrial use at a record high of 15.3 billion bushels, up 108 million, mainly driven by a record high yield of 177.3 bushels per acre.

Corn used for ethanol was increased by 50 million bushels to a total of 5.4 billion bushels, while feed and residual use was increased to 5.7 billion bushels, representing a 25 million bushel increase. The season average corn price received by producers was lowered by 5 cents to $4.80 per bushel.

Globally, coarse grain production for 2023-24 is forecasted to increase by 11.90 million tons to 1.51 billion, primarily attributed to increased production in China and increased trade volumes from major producing countries.

This increased yield and demand for both corn and wheat should especially benefit ADM as it has lots of exposure to these markets. According to its 2022 annual report, the company owns three out of five of the world's largest corn mills. They had a grind capacity of 2.5 million bushels per day. Additionally, ADM was able to process 950,000 bushels of wheat per day.

Source: 2022 annual report

Rice

The rice outlook in the U.S. indicates slightly higher supply, unchanged domestic use, lower exports and higher ending stocks. Globally, there is a reduction in supply, consumption, trade and ending stocks, with world ending stocks lowered to 167.3 million tons.

Oilseeds

In oilseeds, U.S. production for 2023-24 is estimated at 122.4 million tons, up 0.9 million from last month with increased soybean, rapeseed and sunflower seed crops, partly offset by peanut and cottonseed. The soybean production estimate went up to 4.2 billion bushels, an increase of 35 million bushels, the increase is expected to impact soybean supplies and ending stocks.

Global soybean production estimates rose 0.1 million tons to 399 million tons, representing a slight increase with notable increases in Argentina, the United States, Russia, China, Paraguay and Bolivia that were offset by lower Brazil production.

This net increase in oilseed production should have a positive impact on ADM operating cash flows as the company has the most exposure to this market, boasting a whopping 400 procurement and storage facilities with a global capacity of 20 million metric tons, 42 owned and leased port facilities, 10,000 owned Railcars, 1,200 owned semi-trailers, three owned oceangoing vessels, 1,800 owned river barges, 52 oilseed crush facilities with a total crushing capacity of 41 million metric tons and 109 processing facilities.

Source: 2022 annual report

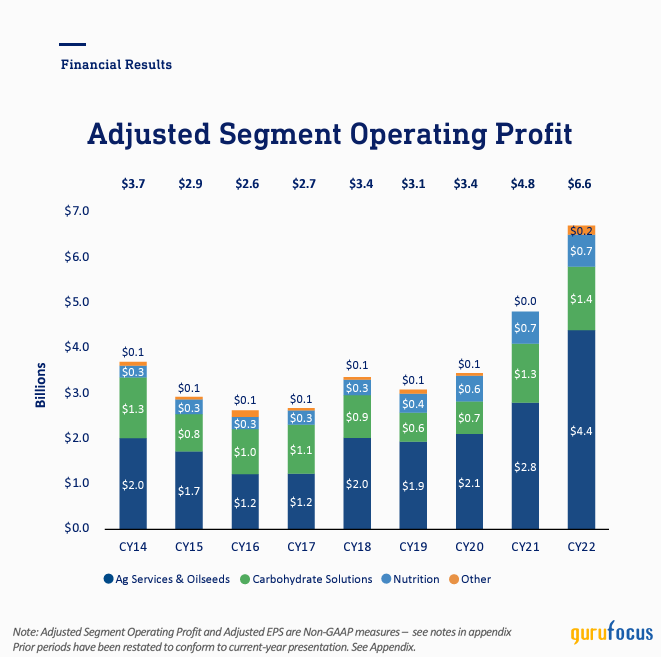

It is worth noting that operating profits between the period of 2020 and 2022 more than doubled, going from $2.1 billion in 2020 to $4.386 billion in 2022. This substantial increase was primarily fueled by increased demand in the company's Ag Services and Oilseed Crushing segment.

Source: 2022 Annual Report

Sugar

The sugar section projects Mexico's production for 2023-24 at 5.01 million metric tons, a decrease of 267,000 from last month. This decrease in production is primarily driven by the severity of drought conditions in municipalities where sugar processing plants are located. The current forecasts indicate far worse conditions than last year with current conditions being more comparable to that experienced in the low production year of 2019-20.

Despite the harsh conditions in Mexico, U.S. sugar supply has increased by 189,687 short tons, raw value on higher U.S. production and higher demand for imports. This has resulted in much higher U.S. exports of sugar than previous years and will primarily be delivered to Mexico.

Cotton

Cotton forecasts for the period include lower U.S. production, exports and ending stocks. Production is reduced by 342,000 bales to 12.4 million bales, with Texas contributing to most of the decline. The season average upland price received by farmers is projected 1 cent lower this month at 76 cents per pound.

Livestock

The USDA's data on Livestock was much more comprehensive than the other categories as there was a lot to unpack.

According to the USDA's data, there was an increase in red meat and poultry production for 2023, driven by higher outputs of beef, pork and broilers in the last quarter. This uptick is attributed to November production figures and preliminary estimates for December, with egg production also experiencing a boost. Looking forward to 2024, the USDA predicts heightened beef production, particularly in the first half of the year, fueled by increased cattle slaughter and higher dressed weights.

Pork production is expected to rise in the first half of 2024, while broiler production also gets a boost based on recent hatchery statistics.

Conversely, turkey production is forecasted to dip in the first half of 2024 due to lower hatchery numbers and expected pricing pressures.

Egg production unfortunately faces a reduction due to culling related to Highly Pathogenic Avian Influenza.

The USDA notes a decline in beef exports for 2023 along with increased imports based on recent trade data.

Looking ahead to 2024 expectations, higher beef imports, primarily from Oceania, are projected, while export forecasts are lowered due to weakened sales in certain Asian markets.

For pork, imports remain unchanged for 2023, but exports are on the rise. In 2024, pork imports are expected to stabilize while exports are projected to experience a slight increase.

Broiler exports are up for both 2023 and 2024, while turkey exports show a decline in 2023 but a rebound in 2024, driven by competitive pricing expectations.

In terms of pricing, cattle prices for 2023 remained steady and hog prices are expected to decrease in 2024 due to soft demand and an increase in hog supplies. However, Broiler prices are projected to rise in 2024 due to the strong demand seen in late 2023.

Turkey prices for 2024 are expected to decrease, influenced by continued soft demand from the previous year.

Egg prices in 2024 are higher due to recent prices and the impact of Avian Influenza on flock size.

Financial overview and conclusion

The agricultural report presents a mixed outlook across the various agricultural commodities. However, the prevailing trend found in most categories presents us with notably increased production paired with relatively steady, if not decreasing, supplies. This indicates the broader demand for agricultural goods remains very high despite record amounts of production, this increased demand is made even more apparent when reviewing the price chart of Invesco's Diversified Agriculture Fund (DBA), which has sharply risen 5.62% over just an 11-day period, thus bringing it back above the highs of 2023 and signifying a bullish breakout of a cup with handle pattern that could bring much further upside.

The holdings of this exchange-traded fund consists of a basket of futures contracts for the various different agricultural goods reviewed, including wheat, corn, soybeans and sugar, with the addition of other similar goods, all of which are markets that ADM has a footprint in. This rising demand for agricultural goods should theoretically translate into higher demand for ADM's agricultural services, the effects of increased demand have seemingly already been felt when reviewing its total operating cash profits which have risen from $3.40 billion in 2020 to the all-time high of $6.60 billion in 2022.

Source: 2022 annual report

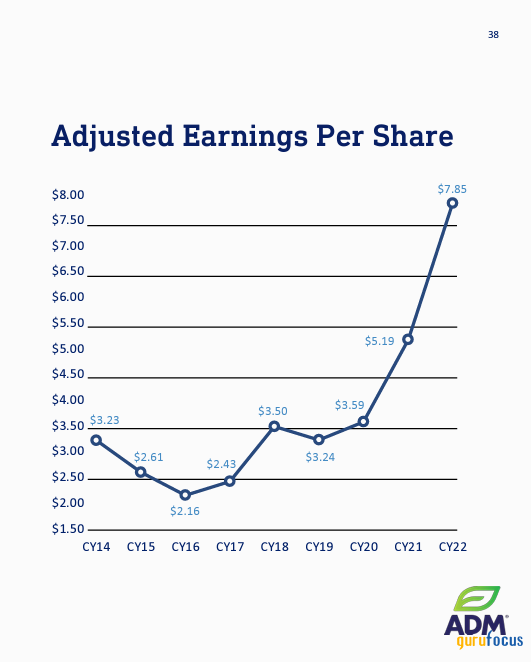

This growth has also been witnessed to an even greater extent in the company's earnings per share, which has consistently risen for the last several years, going from a low of $2.16 in 2016 all the way to a high of $7.85 in 2022.

Source: 2022 annual report

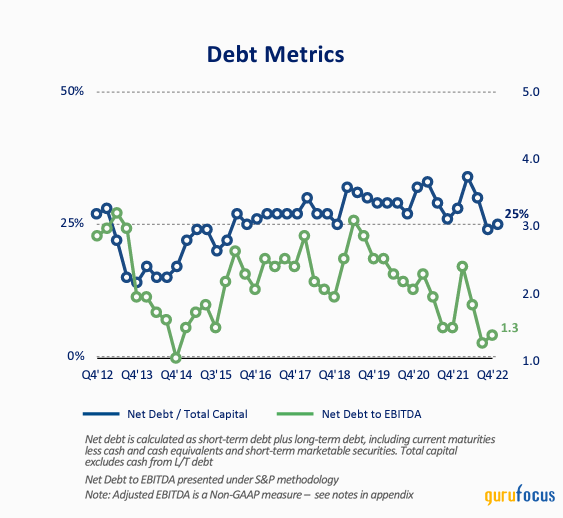

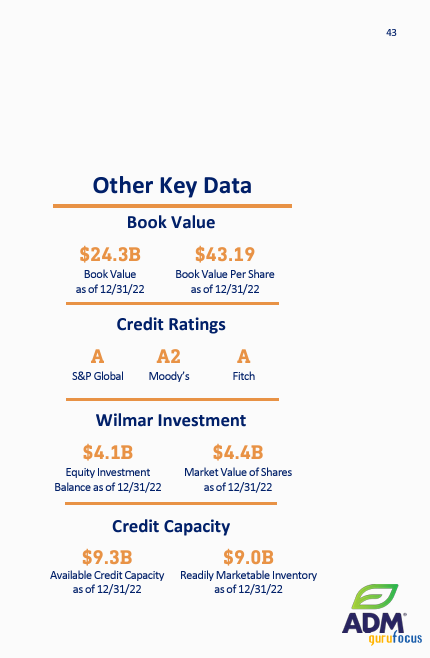

In addition to rising profits and operating cash flows, the company also maintains a low debt-to-Ebitda ratio of 1.30, thus signaling it is well positioned for any financial stresses that could come its way if the economy were to tighten.

Source: 2022 annual report

Along with its low debt, the company also maintains high credit ratings and high credit capacity, receiving investment-grade ratings from the top credit ratings agencies: S&P Global (NYSE:SPGI), Moody's (NYSE:MCO) and Fitch.

Source: 2022 annual report

Technical outlook

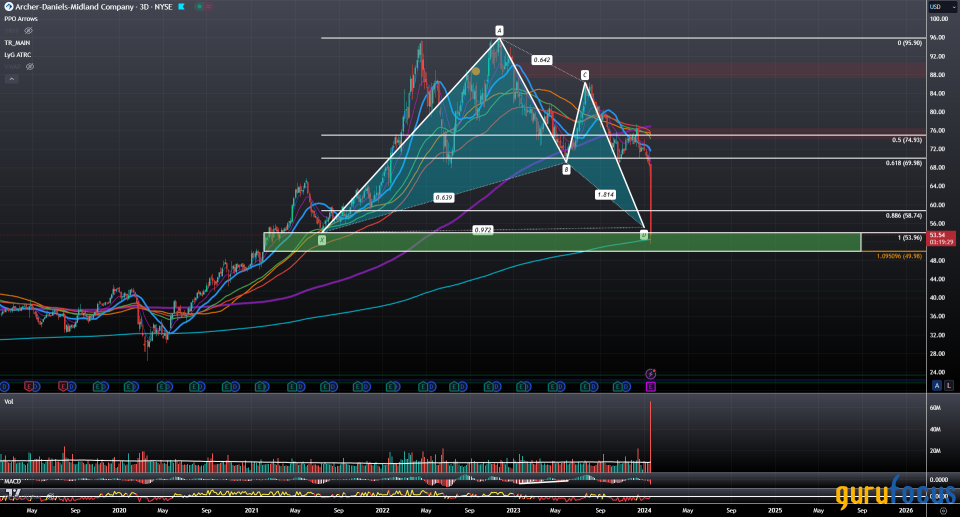

Source: tradingview.com

ADM currently sits within the pattern completion zone of a Bullish Gartley, aligning with the 800 period exponential moving average and the support zone of $53.96 to $49.98 with record-breaking volumes exceeding 60 million total shares traded during the last three days. This was also the highest three-day period trading volume seen since February of 2007. This heightened activity comes in light of the recent news surrounding Chief Financial Officer Vikram Luthar being put on administrative leave due to SEC investigations into the company's accounting practices, particularly focusing on the accounting done within the its nutrition segment. This volatile trading activity has since settled down at support following the company appointing a new interim CFO, Ismael Roig, which has seemingly put investors at ease. If the support level holds, it is very likely that ADM could see share prices appreciate to the nearest top level resistance zone of $85 to $90.

This article first appeared on GuruFocus.