Archon Capital Management LLC Boosts Stake in Red Robin Gourmet Burgers Inc

On August 23, 2023, Archon Capital Management LLC made a significant addition to its portfolio by acquiring 212,536 shares of Red Robin Gourmet Burgers Inc (NASDAQ:RRGB). The transaction was executed at a trade price of $10.46 per share, bringing the firm's total holdings in RRGB to 1,814,692 shares. This acquisition represents 3.93% of Archon's portfolio and 11.39% of RRGB's total shares.

About Archon Capital Management LLC

Archon Capital Management LLC is a Seattle-based investment firm with a diverse portfolio of 36 stocks, valued at approximately $481 million. The firm's top holdings include Apyx Medical Corp (NASDAQ:APYX), Accuray Inc (NASDAQ:ARAY), EZCORP Inc (NASDAQ:EZPW), Red Robin Gourmet Burgers Inc (NASDAQ:RRGB), and New Relic Inc (NYSE:NEWR). The firm's investment strategy is primarily focused on the Technology and Healthcare sectors.

Overview of Red Robin Gourmet Burgers Inc

Red Robin Gourmet Burgers Inc is a renowned restaurant operator based in the USA. The company, which went public on July 19, 2002, operates and franchises casual-dining and fast-casual restaurants across North America. Its revenue streams include franchise revenue, restaurant revenue, gift card breakage, and other miscellaneous revenue. As of August 25, 2023, the company's market capitalization stands at $165.98 million, with a current stock price of $10.42.

GuruFocus Valuation of RRGB

According to GuruFocus valuation, RRGB is modestly undervalued with a GF Value of $14.19. The price to GF Value ratio stands at 0.73, indicating a potential upside for investors. However, the stock has seen a decline of 0.38% since the transaction and a significant drop of 15.01% since its IPO. Despite this, the stock has shown a robust year-to-date growth of 79.35%.

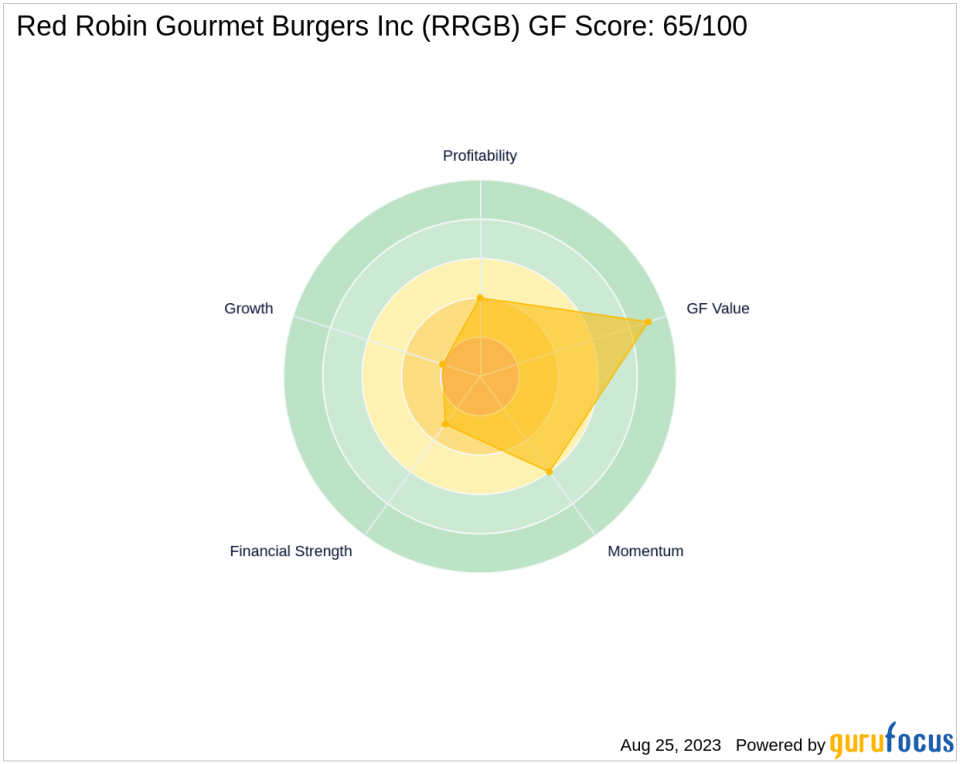

GuruFocus Score and Ranking of RRGB

RRGB has a GF Score of 65/100, suggesting a moderate future performance potential. The company's financial strength is rated 3/10, while its profitability rank is 4/10. The growth rank stands at 2/10, indicating a need for improvement. However, the stock's GF Value Rank is 9/10, and its momentum rank is 6/10, suggesting a positive outlook.

Financial Health and Performance of RRGB

RRGB's financial health is reflected in its Altman Z score of 1.27 and a cash to debt ratio of 0.08. The company's return on equity (ROE) stands at -252.56, and its return on assets (ROA) is -9.21. Over the past three years, the company has experienced a revenue growth of -7.60%, EBITDA growth of -41.20%, and earning growth of -100.40%.

RRGB's Momentum and Relative Strength Index (RSI)

The stock's RSI over 5 days, 9 days, and 14 days are 11.59, 17.48, and 24.63 respectively. The momentum index over 6 - 1 month and 12 - 1 month are 65.04 and 75.00 respectively, indicating a positive momentum for the stock.

Largest Guru Holding RRGB

First Eagle Investment (Trades, Portfolio) Management, LLC is the guru with the most shares of RRGB. However, the exact share percentage is not available at the moment.

Transaction Analysis

Archon Capital Management LLC's recent acquisition of RRGB shares signifies the firm's confidence in the stock's potential. Despite the stock's modest undervaluation and moderate GF Score, the firm's increased stake could be a strategic move to capitalize on the stock's future growth. This transaction not only strengthens Archon's portfolio but also reinforces RRGB's investor base.

This article first appeared on GuruFocus.