Archon Capital Management LLC Boosts Stake in Red Robin Gourmet Burgers Inc

Archon Capital Management LLC (Trades, Portfolio), a Seattle-based investment firm, recently increased its holdings in Red Robin Gourmet Burgers Inc (NASDAQ:RRGB). This article provides an in-depth analysis of the transaction, the profiles of both the guru and the traded company, and the potential implications for value investors.

Details of the Transaction

On October 4, 2023, Archon Capital Management LLC (Trades, Portfolio) added 56,000 shares of Red Robin Gourmet Burgers Inc to its portfolio. The shares were traded at a price of $7.45 each. This transaction had a 0.09% impact on the firm's portfolio, increasing its total holdings in the company to 1,870,692 shares. This represents 2.89% of the firm's portfolio and 11.74% of Red Robin's total shares.

Profile of Archon Capital Management LLC (Trades, Portfolio)

Archon Capital Management LLC (Trades, Portfolio) is an investment firm located at 1301 5th Avenue, Seattle, WA. The firm manages a portfolio of 36 stocks, with a total equity of $481 million. Its top holdings include Apyx Medical Corp(NASDAQ:APYX), Accuray Inc(NASDAQ:ARAY), EZCORP Inc(NASDAQ:EZPW), Red Robin Gourmet Burgers Inc(NASDAQ:RRGB), and New Relic Inc(NYSE:NEWR). The firm's investments are primarily concentrated in the Technology and Healthcare sectors.

Overview of Red Robin Gourmet Burgers Inc

Red Robin Gourmet Burgers Inc is a North American restaurant operator that develops, operates, and franchises casual-dining and fast-casual restaurants. The company's brands include Red Robin, Red Robin Gourmet Burgers, Red Robin America's Gourmet Burgers and Spirits, Red Robin Burger Works, YUMMM, Red Robin Gourmet Burgers and Brews, and Red Robin Royalty. As of October 6, 2023, the company has a market capitalization of $125.839 million and a stock price of $7.9. The company's GF Value is $14.06, indicating that it may be undervalued.

Analysis of Red Robin Gourmet Burgers Inc's Financial Performance

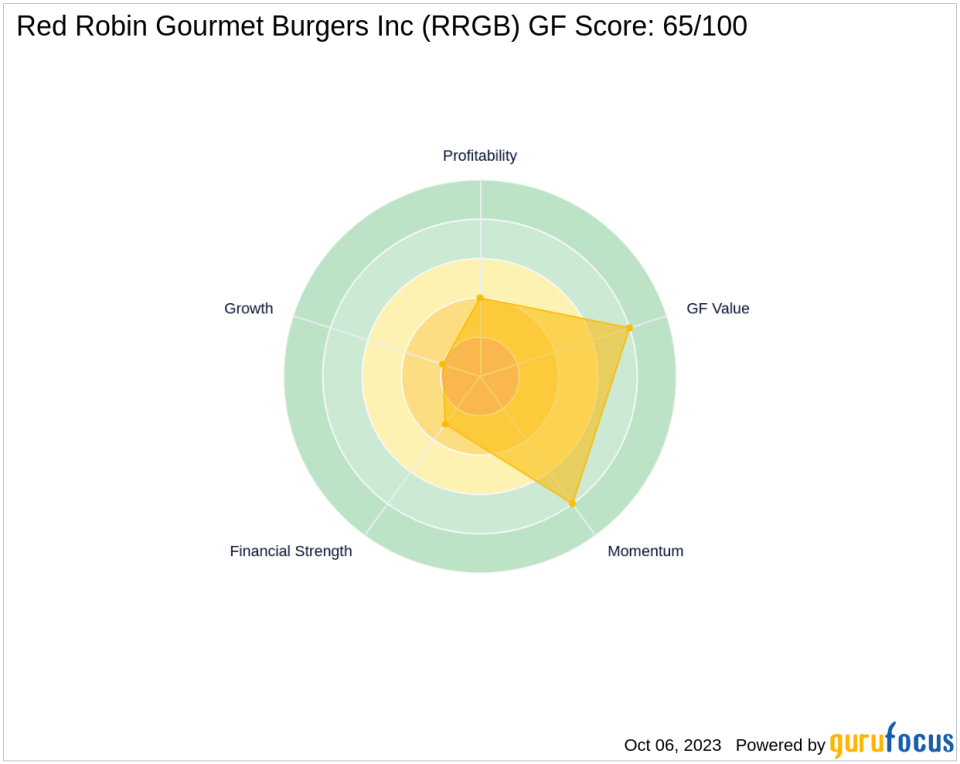

Red Robin Gourmet Burgers Inc currently has a PE Percentage of 0.00, indicating that the company is operating at a loss. The company's GF Score is 65/100, suggesting that it has a moderate potential for future performance. The company's Financial Strength is ranked 3/10, while its Profitability Rank is 4/10.

Comparison with the Largest Guru Holder of Red Robin Gourmet Burgers Inc

The largest guru holder of Red Robin Gourmet Burgers Inc is First Eagle Investment (Trades, Portfolio) Management, LLC. A comparison of the share percentages held by Archon Capital Management LLC (Trades, Portfolio) and First Eagle Investment (Trades, Portfolio) Management, LLC will be provided in a future update.

Conclusion

In conclusion, Archon Capital Management LLC (Trades, Portfolio)'s recent acquisition of additional shares in Red Robin Gourmet Burgers Inc is a significant move that increases its stake in the restaurant operator. This transaction could potentially influence the stock's performance and the firm's portfolio. As always, value investors are advised to conduct their own thorough research before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.