Arcosa Inc (ACA) Reports Robust EBITDA Growth and Free Cash Flow Increase in Q4 and Full Year 2023

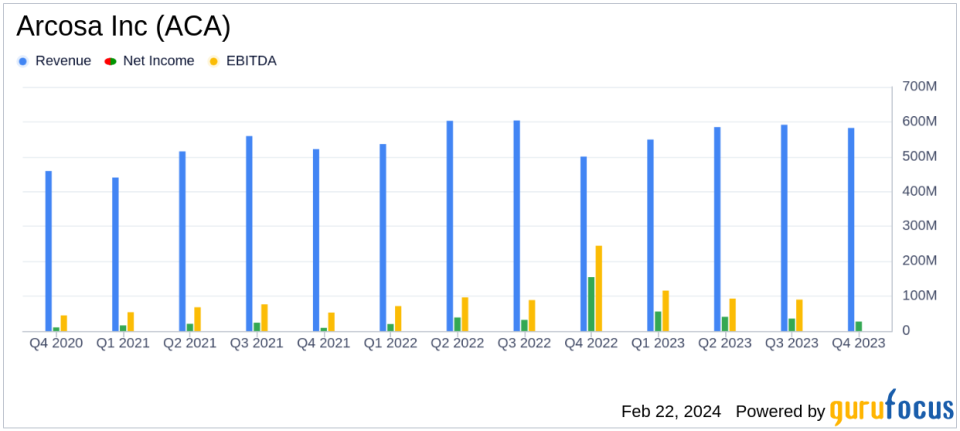

Revenue Growth: Q4 revenues rose 16% year-over-year to $582.2 million, with full-year revenues up 3% to $2.31 billion.

Adjusted EBITDA: Q4 Adjusted EBITDA surged 38% to $84.3 million, while full-year Adjusted EBITDA increased 13% to $367.6 million.

Net Income: Q4 Adjusted Net Income skyrocketed 191% to $33.2 million, with full-year Adjusted Net Income up 48% to $158.1 million.

Free Cash Flow: Full-year Free Cash Flow improved significantly by 37% to $94.1 million.

Capital Allocation: ACA invested in organic growth and executed six bolt-on acquisitions in Construction Products.

Arcosa Inc (NYSE:ACA), a leading provider of infrastructure-related products and solutions, announced its financial results for the fourth quarter and full year ended December 31, 2023. The company released its 8-K filing on February 22, 2024, showcasing strong performance across its three segments: Construction Products, Engineered Structures, and Transportation Products.

Company Overview

Arcosa Inc operates in critical infrastructure sectors, manufacturing products for construction, engineered structures, and transportation. The company's Construction Products segment saw an 8% revenue increase in 2023, with Adjusted Segment EBITDA growing by 23%. Engineered Structures, normalized for the divestiture of the storage tanks business, reported a 13% increase in Adjusted Segment EBITDA. Transportation Products demonstrated a remarkable performance, with full-year Adjusted Segment EBITDA more than doubling and margin expanding by 570 basis points.

Financial Highlights and Challenges

The company's financial achievements are significant, with a 16% increase in fourth-quarter revenues to $582.2 million and a 3% increase in full-year revenues to $2.31 billion. Adjusted EBITDA for the fourth quarter grew by 38% to $84.3 million, and by 13% to $367.6 million for the full year. Adjusted Net Income also saw a substantial increase, with a 191% jump to $33.2 million in Q4 and a 48% rise to $158.1 million for the full year.

Despite these achievements, the company faced challenges, including cost pressures and a strengthening peso impacting the Engineered Structures segment. Additionally, unplanned equipment maintenance and customer mix headwinds were factors that could potentially affect future profitability.

Strategic Growth and Capital Allocation

Antonio Carrillo, President and CEO, highlighted the company's strategic growth initiatives, including significant investments in organic growth projects and the execution of six bolt-on acquisitions in the Construction Products segment. These strategic moves, coupled with disciplined capital allocation, have positioned Arcosa for expected growth in 2024.

"2023 was a significant year for growth across our businesses as revenues and Adjusted EBITDA increased double-digits, normalizing for the storage tanks divestiture," said Antonio Carrillo, President and Chief Executive Officer.

Looking Ahead: 2024 Outlook and Guidance

For 2024, Arcosa anticipates consolidated revenues between $2.46 billion and $2.72 billion, with Adjusted EBITDA projected to be between $380 million and $420 million. This guidance reflects the company's confidence in continued growth, supported by infrastructure spending and a healthy commercial environment.

Arcosa's strong financial position, with Net Debt to Adjusted EBITDA at 1.3x and over $500 million in available liquidity, provides the flexibility to pursue strategic investments and support long-term growth.

Value investors and potential GuruFocus.com members interested in the construction and infrastructure sectors may find Arcosa Inc's robust financial performance and strategic growth initiatives compelling. The company's ability to navigate challenges while delivering strong financial results positions it as a noteworthy player in the industry.

For a more detailed analysis of Arcosa Inc's financial performance and future outlook, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Arcosa Inc for further details.

This article first appeared on GuruFocus.