Arcus Biosciences (RCUS): A Modestly Undervalued Gem?

With a daily gain of 3.73%, a 3-month gain of 7.06%, and a Loss Per Share of 3.96, Arcus Biosciences Inc (NYSE:RCUS) is on the radar of many investors. The question is, is this biopharmaceutical stock modestly undervalued? Let's delve into an in-depth valuation analysis to answer this question.

A Snapshot of Arcus Biosciences Inc (NYSE:RCUS)

Arcus Biosciences is a clinical-stage biopharmaceutical company that focuses on developing immunotherapies for the treatment of various types of cancers. With a market cap of $1.60 billion and sales of $121.20 million, the company has been making strides in the biotech industry. However, with a current stock price of $21.99, how does this compare with the company's intrinsic value?

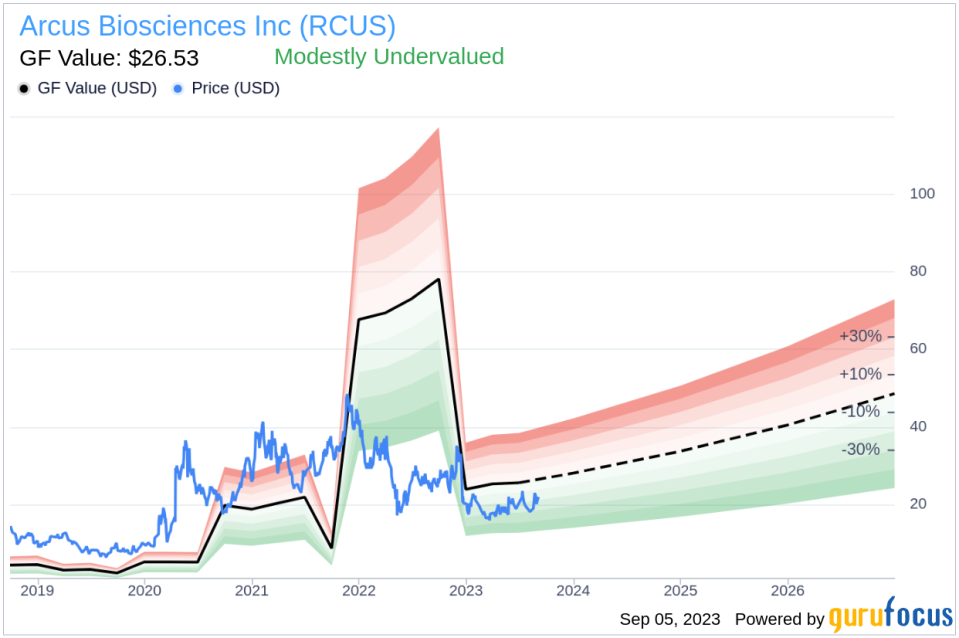

Understanding the GF Value

The GF Value is a proprietary measure that estimates the intrinsic value of a stock. It takes into account historical trading multiples, an adjustment factor based on past performance and growth, and future business performance estimates. If the stock price significantly deviates from the GF Value Line, it may indicate overvaluation or undervaluation.

For Arcus Biosciences (NYSE:RCUS), the GF Value suggests that the stock is modestly undervalued. This means that the long-term return of its stock is likely to be higher than its business growth.

Link: These companies may deliever higher future returns at reduced risk.

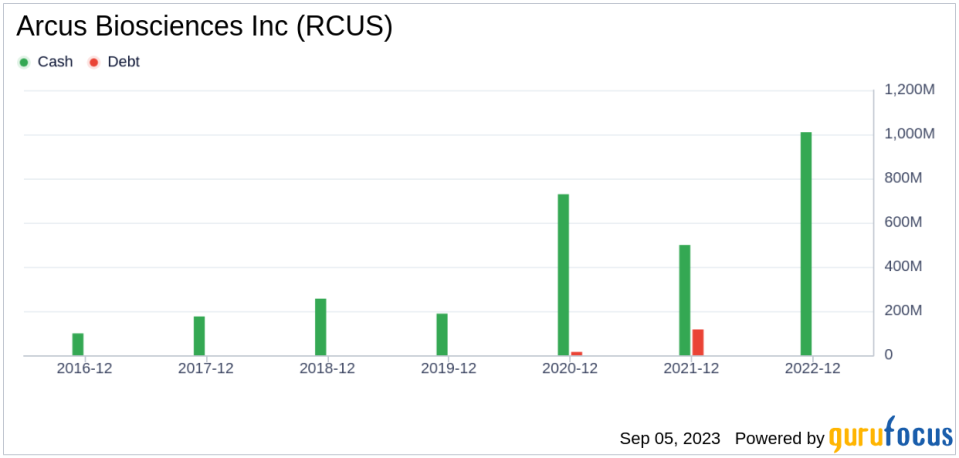

Financial Strength of Arcus Biosciences

Investing in companies with poor financial strength can lead to a higher risk of permanent capital loss. Therefore, it's crucial to assess a company's financial strength before investing. Arcus Biosciences boasts a cash-to-debt ratio of 10000, which ranks better than 99.93% of 1518 companies in the Biotechnology industry. This suggests that the financial strength of Arcus Biosciences is fair.

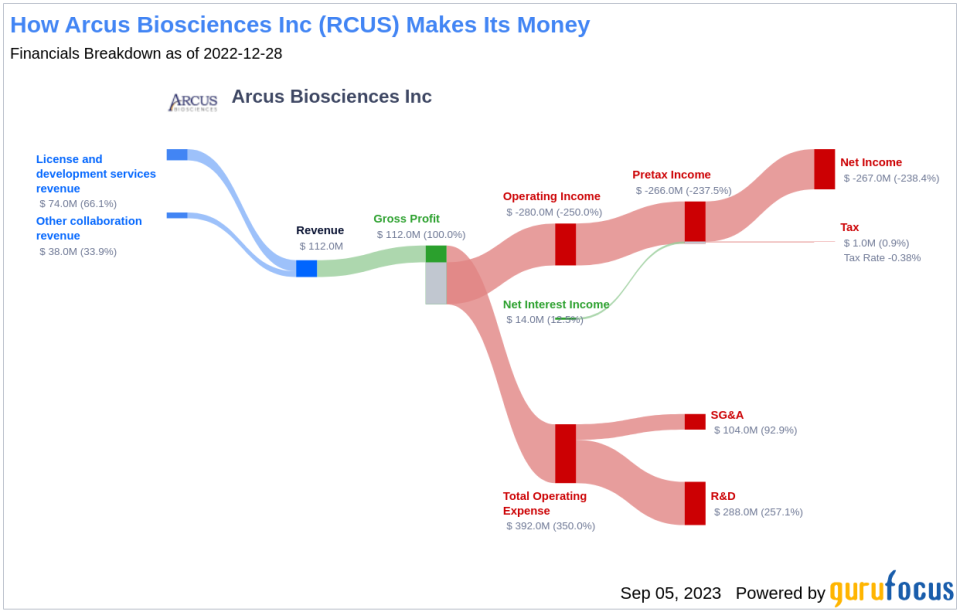

Profitability and Growth of Arcus Biosciences

Consistent profitability over the long term reduces risk for investors. Arcus Biosciences has been profitable once over the past 10 years. However, its operating margin of -258.04% ranks worse than 54.38% of 1028 companies in the Biotechnology industry. This indicates poor profitability.

On the growth front, Arcus Biosciences's 3-year average revenue growth rate is better than 86.09% of 762 companies in the Biotechnology industry. However, its 3-year average EBITDA growth rate is -24.6%, which ranks worse than 77.55% of 1256 companies in the Biotechnology industry. This indicates poor growth.

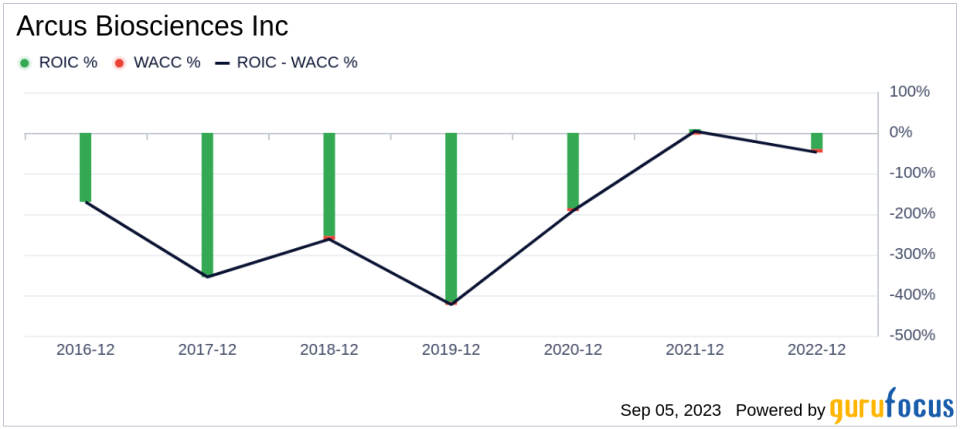

ROIC vs WACC

Comparing the Return on Invested Capital (ROIC) to the Weighted Average Cost of Capital (WACC) can also provide insights into a company's profitability. For Arcus Biosciences, the ROIC of -87.77 is significantly lower than the WACC of 7.19, which may be a cause for concern.

Conclusion

In summary, Arcus Biosciences (NYSE:RCUS) appears to be modestly undervalued. While its financial condition is fair, its profitability is poor, and its growth ranks worse than 77.55% of 1256 companies in the Biotechnology industry. For a more detailed financial analysis, check out Arcus Biosciences's 30-Year Financials here.

To find out high-quality companies that may deliver above-average returns, visit the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.