Arcutis Biotherapeutics Inc (ARQT) Reports Significant Revenue Growth in Q4 2023

Net Product Revenues: Q4 net product revenues for ZORYVE cream soared to $13.5 million, marking a 357% increase year-over-year and a 67% increase from Q3 2023.

R&D Expenses: R&D expenses saw a 39% decrease in 2023, totaling $111 million, with expectations of further reductions in 2024.

Net Loss: Net loss improved to $66.3 million in Q4 2023, down from $72.0 million in the same period last year.

Cash Position: Cash, cash equivalents, restricted cash, and marketable securities stood at $272.8 million as of December 31, 2023.

Product Launches: Successful commercial launches of ZORYVE cream and foam, with a PDUFA action date set for July 7, 2024, for roflumilast cream for atopic dermatitis.

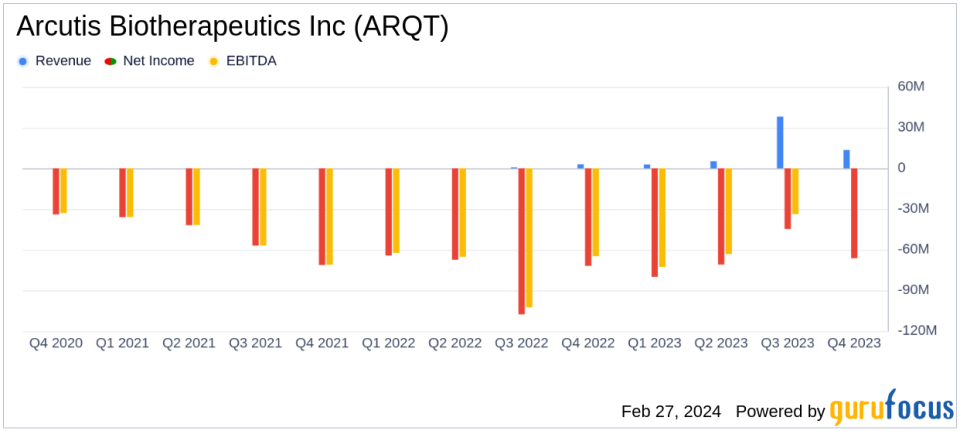

Arcutis Biotherapeutics Inc (NASDAQ:ARQT) released its 8-K filing on February 27, 2024, detailing a remarkable year-over-year revenue increase in the fourth quarter of 2023. The medical dermatology company, which focuses on developing treatments for immune-mediated dermatological diseases and conditions, reported net product revenues of $13.5 million for its lead product candidate ZORYVE cream. This represents a 357% increase compared to the fourth quarter of 2022 and a 67% increase from the third quarter of 2023, driven by improved gross-to-net (GTN) sales deductions and sustained demand growth.

Financial Highlights and Business Updates

The company's R&D expenses decreased significantly by 39% to $111 million in 2023 compared to the previous year, reflecting a strategic focus on investment in the commercial launches of ZORYVE for plaque psoriasis and seborrheic dermatitis. The decrease in R&D expenses is also indicative of the company's efficient allocation of resources towards its most promising clinical programs.

Despite the positive revenue trends, Arcutis faced a net loss of $66.3 million, or $0.72 per basic and diluted share, for the fourth quarter of 2023. However, this was an improvement from the net loss of $72.0 million, or $1.18 per basic and diluted share, for the same period in 2022. The company's strong cash position, with $272.8 million in cash, cash equivalents, restricted cash, and marketable securities, supports its ongoing investment in product launches and pipeline development.

Arcutis also highlighted the FDA approval and commercial launch of ZORYVE foam for seborrheic dermatitis and the anticipated PDUFA action date for roflumilast cream for atopic dermatitis, marking significant milestones in the company's journey to address unmet patient needs in dermatology.

"2023 was a year of successful execution and builds a strong foundation for 2024. We are very encouraged by the strong revenue growth trend we are seeing, reinforcing the demand for new treatment options and physician adoption of ZORYVE," said Frank Watanabe, president and chief executive officer.

Analysis of Financial Statements

The company's balance sheet reflects a robust financial position, with a total of $330.4 million in current assets. Selling, general, and administrative (SG&A) expenses increased to $185.1 million for the year, up from $122.1 million in the previous year, primarily due to the costs associated with the commercial launch of ZORYVE. The company's net cash used in operating activities was $247.1 million for the full year 2023.

Arcutis' commitment to innovation in medical dermatology is evident in its pipeline development and recent corporate highlights, including the awarding of new patents and the completion of a public offering that raised $102.3 million in gross proceeds.

Overall, Arcutis Biotherapeutics Inc (NASDAQ:ARQT) has demonstrated a strong financial performance in the fourth quarter of 2023, with significant revenue growth and a solid cash position to support its commercial and development initiatives. The company's strategic focus on its lead product candidate ZORYVE and its pipeline development positions it well for future growth and the potential to bring new treatments to patients with dermatological conditions.

For more detailed information on Arcutis Biotherapeutics Inc's financial results and business updates, investors and interested parties are encouraged to access the full earnings report and join the conference call and webcast hosted by the company's management.

Explore the complete 8-K earnings release (here) from Arcutis Biotherapeutics Inc for further details.

This article first appeared on GuruFocus.