Ardagh Metal Packaging S.A.'s (NYSE:AMBP) Shares Leap 26% Yet They're Still Not Telling The Full Story

Ardagh Metal Packaging S.A. (NYSE:AMBP) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 20% in the last twelve months.

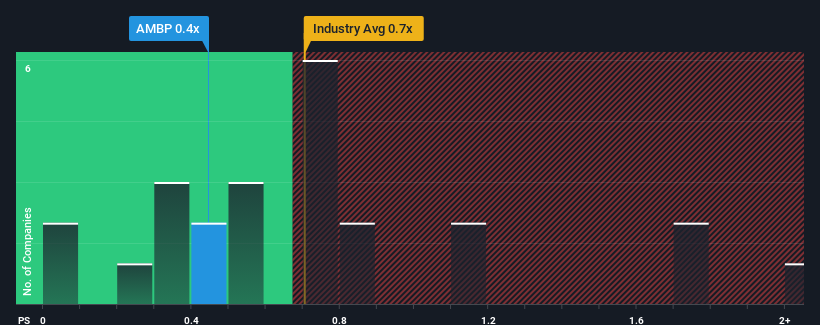

In spite of the firm bounce in price, it's still not a stretch to say that Ardagh Metal Packaging's price-to-sales (or "P/S") ratio of 0.4x right now seems quite "middle-of-the-road" compared to the Packaging industry in the United States, where the median P/S ratio is around 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Ardagh Metal Packaging

How Has Ardagh Metal Packaging Performed Recently?

Ardagh Metal Packaging certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. It might be that many expect the strong revenue performance to deteriorate like the rest, which has kept the P/S ratio from rising. Those who are bullish on Ardagh Metal Packaging will be hoping that this isn't the case, so that they can pick up the stock at a slightly lower valuation.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ardagh Metal Packaging.

Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Ardagh Metal Packaging's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Still, the latest three year period has seen an excellent 38% overall rise in revenue, in spite of its uninspiring short-term performance. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 3.8% over the next year. That's shaping up to be materially higher than the 0.8% growth forecast for the broader industry.

In light of this, it's curious that Ardagh Metal Packaging's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What Does Ardagh Metal Packaging's P/S Mean For Investors?

Ardagh Metal Packaging's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Looking at Ardagh Metal Packaging's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Having said that, be aware Ardagh Metal Packaging is showing 2 warning signs in our investment analysis, you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.