Ardelyx (ARDX) Up on FDA Nod to Xphozah for Hyperphosphatemia

Ardelyx, Inc. ARDX announced the FDA approval of Xphozah (tenapanor) as an add-on therapy in the treatment of adult patients with chronic kidney disease (CKD) who have an inadequate response to phosphate binders or are intolerant of any dose of phosphate binder therapy.

Xphozah becomes Ardelyx's second FDA-approved drug.

Hyperphosphatemia is a serious condition resulting in an elevated level of phosphate in the blood, which affects most CKD patients on maintenance dialysis. Per ARDX, approximately 550,000 patients in the United States suffer from CKD.

ARDX’s Xphozah, a twice-daily oral tablet, is the first and only phosphate absorption inhibitor that is indicated to reduce serum phosphorus in adult CKD patients on dialysis. Xpozah has a novel mechanism of action that blocks phosphate absorption through its primary pathway.

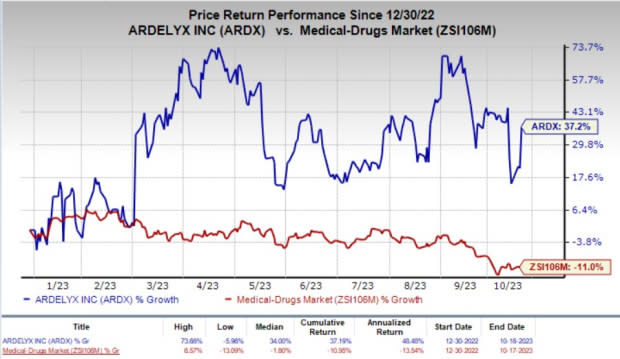

The company’s stock soared 13.3% on Wednesday, in response to the encouraging news. Year to date, shares of Ardelyx have rallied 37.2% compared with the industry’s 11% fall.

Image Source: Zacks Investment Research

The FDA approval was based on compelling evidence from the company’s development program for Xphozah. It evaluated the safety and efficacy of Xphozah as monotherapy and in combination with phosphate binder therapy in more than 1,000 patients in three phase III clinical studies (PHREEDOM, BLOCK and AMPLIFY).

Per ARDX, all three late-stage studies met their primary and key secondary endpoints. The results from the late-stage studies observed that Xphozah significantly reduced elevated serum phosphorus in patients receiving maintenance hemodialysis.

The data readout also reported diarrhea as the only adverse event observed in at least 5% of Xphozah-treated patients with CKD on dialysis across the studies. The treatment-related adverse event was mild-to-moderate in severity and resolved over time, or with dose reduction.

Ardelyx also reported completing two additional studies (OPTIMIZE and NORMALIZE) evaluating different options for integrating Xphozah into clinical practice.

Ardelyx’s first commercial product, Ibsrela (tenapanor), received FDA approval in September 2019 for the treatment of irritable bowel syndrome with constipation (IBS-C) in adults.

Ibsrela is a twice-daily 50 mg oral pill that inhibits the sodium-hydrogen exchanger in the gastrointestinal tract, resulting in an increase in bowel movements and a decrease in abdominal pain for IBS-C patients.

In a separate press release, Ardelyx announced amending its February 2022 debt financing agreement with investment affiliates managed by SLR Capital Partners (SLR).

Per the amendment, ARDX now has access to an additional $50 million in committed debt financing. This $50 million, at Ardelyx’s will and subject to SLR credit approval, may be further increased by an additional $50 million to a total of $100 million.

Ardelyx is currently planning to draw the second tranche in October to support the commercial launch of its newly approved drug, Xphozah.

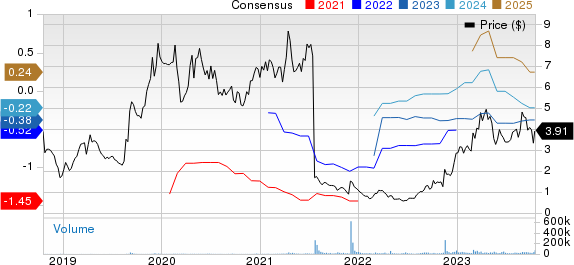

Ardelyx, Inc. Price and Consensus

Ardelyx, Inc. price-consensus-chart | Ardelyx, Inc. Quote

Zacks Rank and Stocks to Consider

Ardelyx currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the overall medical sector are Dynavax Technologies DVAX, Anixa Biosciences ANIX and Adicet Bio, Inc. ACET. While DVAX sports a Zacks Rank #1 (Strong Buy), ANIX and ACET carry a Zacks Rank #2 (Buy) each at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 30 days, the Zacks Consensus Estimate for Dynavax’s 2023 loss per share has narrowed from 23 cents to 22 cents. The estimate for Dynavax’s 2024 earnings per share is currently pegged at 8 cents. Year to date, shares of DVAX have gained 36.7%.

DVAX’s earnings beat estimates in two of the trailing four quarters and missed the mark in the other two, delivering an average surprise of 25.78%.

In the past 30 days, the Zacks Consensus Estimate for Anixa Biosciences’ 2023 loss per share has remained constant at 32 cents. The estimate for Anixa Biosciences’ 2024 loss per share has remained constant at 37 cents. Year to date, shares of ANIX have lost 23%.

ANIX beat estimates in each of the trailing four quarters, delivering an average earnings surprise of 26.29%.

In the past 30 days, the estimate for Adicet Bio’s 2023 loss per share has remained constant at $2.93. The estimate for Adicet’s 2024 loss per share has remained constant at $2.40. Year to date, shares of ACET have lost 83.9%.

ACET’s earnings beat estimates in two of the trailing four quarters, missing the mark on the other two occasions, delivering an average negative surprise of 7.70%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dynavax Technologies Corporation (DVAX) : Free Stock Analysis Report

Adicet Bio, Inc. (ACET) : Free Stock Analysis Report

Ardelyx, Inc. (ARDX) : Free Stock Analysis Report

ANIXA BIOSCIENCES INC (ANIX) : Free Stock Analysis Report