Arena Pharmaceuticals Inc (NASDAQ:ARNA): Is Healthcare Attractive Relative To NasdaqGS Peers?

Arena Pharmaceuticals Inc (NASDAQ:ARNA), a $1.47B small-cap, operates in the healthcare industry, which has experienced tailwinds from issues such as higher demand driven by an aging population and the increasing prevalence of diseases and comorbidities. Healthcare analysts are forecasting for the entire industry, a fairly unexciting growth rate of 1.58% in the upcoming year , and a whopping growth of 39.93% over the next couple of years. Not surprisingly, this rate is more than double the growth rate of the US stock market as a whole. Below, I will examine the sector growth prospects, as well as evaluate whether Arena Pharmaceuticals is lagging or leading in the industry. Check out our latest analysis for Arena Pharmaceuticals

What’s the catalyst for Arena Pharmaceuticals’s sector growth?

Data analytics and other technology-enabled approaches are creating opportunities for innovations, however, stakeholders have been challenged to keep abreast of this structural shift while under pressure to cut costs. In the past year, the industry delivered growth in the teens, beating the US market growth of 10.41%. Arena Pharmaceuticals lags the pack with its sustained negative earnings over the past couple of years. The company’s outlook doesn’t seem to be much better given that analysts are forecasting continued unprofitability going forward.

Is Arena Pharmaceuticals and the sector relatively cheap?

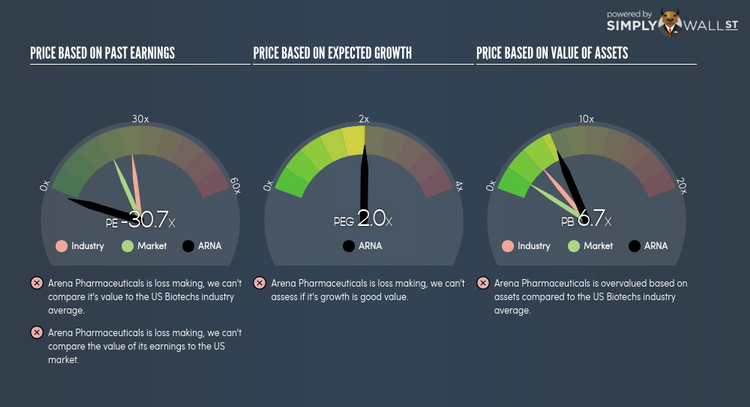

Biotech companies are typically trading at a PE of 27x, above the broader US stock market PE of 19.9x. This means the industry, on average, is relatively overvalued compared to the wider market. However, the industry did return a higher 16.12% compared to the market’s 10.43%, which may be indicative of past tailwinds. Since Arena Pharmaceuticals’s earnings doesn’t seem to reflect its true value, its PE ratio isn’t very useful. A loose alternative to gauge Arena Pharmaceuticals’s value is to assume the stock should be relatively in-line with its industry.

Next Steps:

Arena Pharmaceuticals’s uncertain outlook is concerning for investors, with the prospect of negative earnings persisting into the future. If Arena Pharmaceuticals has been on your watchlist for a while, now may not be the time to enter into the stock. However, before you make a decision on the stock, I suggest you look at Arena Pharmaceuticals’s fundamentals in order to build a holistic investment thesis.

1. Financial Health: Does it have a healthy balance sheet? Take a look at our free balance sheet analysis with six simple checks on key factors like leverage and risk.

2. Historical Track Record: What has ARNA’s performance been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of our analysis for more clarity.

3. Other High-Growth Alternatives : Are there other high-growth stocks you could be holding instead of Arena Pharmaceuticals? Explore our interactive list of stocks with large growth potential to get an idea of what else is out there you may be missing!

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.