Ares Capital (ARCC) Dips Despite Q2 Earnings Beat, Costs Rise

Ares Capital Corporation’s ARCC second-quarter 2023 core earnings of 58 cents per share surpassed the Zacks Consensus Estimate by a penny. The bottom line also reflected a rise of 26.1% from the prior-year quarter.

Results were primarily aided by an improvement in total investment income. Also, the company’s portfolio activity was robust in the quarter. However, an increase in expenses hurt the results to some extent. Probably because of this, shares of the company lost 1.1% following the earnings release.

GAAP net income was $331 million or 61 cents per share, up from $111 million or 22 cents per share in the prior-year quarter. We projected net income of $258.9 million.

Total Investment Income Improves, Expenses Rise

Total investment income was $634 million, up 32.4% year over year. The rise was driven by an increase in almost all revenue components except for capital structuring service fees. The top line beat the Zacks Consensus Estimate of $623.6 million.

Total expenses were $314 million, up 48.1% year over year. Our estimate for the metric was $293.5 million.

Portfolio Activities Robust

Gross commitments worth $1.2 billion were made in the second quarter to new and existing portfolio companies. This compares with $3.1 billion of gross commitments in the prior-year quarter. We had projected gross commitments worth $2.4 billion.

In the reported quarter, the company exited $1.1 billion of commitments compared with $1.09 billion a year ago. Our estimate was pegged at $1.9 billion.

The fair value of Ares Capital’s portfolio investments was $21.5 billion as of Jun 30, 2023. The fair value of accruing debt and other income-producing securities was $19.06 billion.

Balance Sheet Strong

As of Jun 30, 2023, the company’s cash and cash equivalents totaled $411 million, up from $303 million as of Dec 31, 2022.

Ares Capital had $4.4 billion available for additional borrowings under the existing credit facilities as of Jun 30, 2023. Total outstanding debt was $11.4 billion.

As of Jun 30, 2023, total assets were $22.2 billion and stockholders’ equity was $10.4 billion.

Net asset value was $18.58 per share, up from $18.40 as of Dec 31, 2022.

Our Take

Driven by a rise in the demand for customized financing, growth in total investment income is expected to continue in the quarters ahead. An increase in investment commitments will likely keep supporting the company’s financials. However, elevated expenses may hurt profits in the near term.

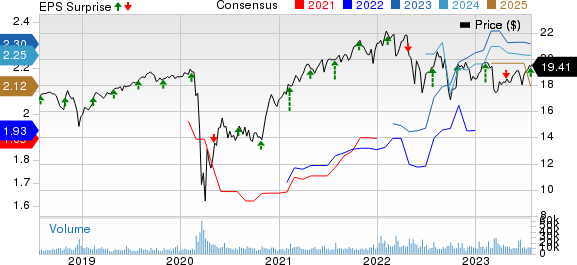

Ares Capital Corporation Price, Consensus and EPS Surprise

Ares Capital Corporation price-consensus-eps-surprise-chart | Ares Capital Corporation Quote

Currently, ARCC carries a Zacks Rank #3 (Hold). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Earnings Release Dates of Other Finance Stocks

LPL Financial LPLA is slated to announce second-quarter 2023 numbers on Jul 27.

Over the past week, the Zacks Consensus Estimate for LPL Financial’s quarterly earnings has been unchanged at $3.88, implying a 73.2% jump from the prior-year reported number.

Hercules Capital, Inc. HTGC is scheduled to announce quarterly numbers on Aug 3.

Over the past seven days, the Zacks Consensus Estimate for Hercules Capital’s second-quarter earnings has been unchanged at 50 cents. The estimate indicates a jump of 56.3% from the prior-year quarter’s reported number.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ares Capital Corporation (ARCC) : Free Stock Analysis Report

Hercules Capital, Inc. (HTGC) : Free Stock Analysis Report

LPL Financial Holdings Inc. (LPLA) : Free Stock Analysis Report