Ares Capital Corp (ARCC) Reports Strong Year-End Financials and Declares Q1 2024 Dividend

Dividend Declaration: ARCC declares a Q1 2024 dividend of $0.48 per share, payable on March 29, 2024.

GAAP Net Income: Q4 GAAP net income per share increased to $0.72 from $0.34 in Q4 of the previous year.

Core EPS: Core EPS remained stable at $0.63 for Q4, with an annual increase to $2.37 from $2.02.

Portfolio Growth: Total portfolio investments at fair value grew to $22.874 billion, up from $21.780 billion year-over-year.

Net Asset Value: Net assets per share increased to $19.24 from $18.40 as of the previous year-end.

Debt-to-Equity Ratio: Improved debt-to-equity ratio, net of available cash, from 1.26x to 1.02x.

Investment Activity: New investment commitments of approximately $2.4 billion in Q4, with 87% in first lien senior secured loans.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

On February 7, 2024, Ares Capital Corp (NASDAQ:ARCC) released its 8-K filing, announcing financial results for the fourth quarter and year ended December 31, 2023, along with the declaration of a first quarter 2024 dividend of $0.48 per share. The dividend is payable on March 29, 2024, to stockholders of record as of March 15, 2024.

Ares Capital Corp is a leading specialty finance company in the United States, focusing on direct loans and other investments in private middle-market companies. The company aims to generate current income and capital appreciation through a diversified portfolio that includes first lien senior secured loans, second lien senior secured loans, mezzanine debt, and equity investments.

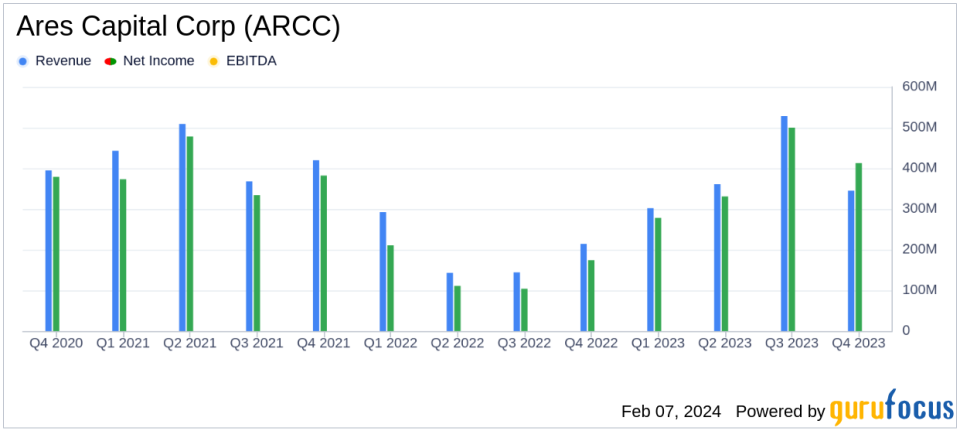

The company's financial results for the fourth quarter showed a significant increase in GAAP net income per share to $0.72, up from $0.34 in the same quarter of the previous year. Core EPS, which excludes certain gains and losses, remained stable at $0.63 for the quarter, contributing to an annual increase to $2.37 from $2.02. This stability in Core EPS reflects the company's consistent performance and operational efficiency.

ARCC's portfolio investments at fair value increased to $22.874 billion, up from $21.780 billion year-over-year, showcasing the company's growth and strategic investment capabilities. The net asset value per share also saw an uptick to $19.24 from $18.40 as of the previous year-end, indicating an increase in the intrinsic value of the company's shares.

The company's debt-to-equity ratio, net of available cash, improved from 1.26x to 1.02x, signaling a stronger balance sheet and better financial leverage. This metric is particularly important for a specialty finance company like ARCC, as it reflects the company's ability to manage its debt levels while continuing to invest in growth opportunities.

During the fourth quarter, ARCC made new investment commitments of approximately $2.4 billion, with a significant portion in first lien senior secured loans, which are typically less risky than unsecured loans. This investment activity demonstrates ARCC's focus on securing strong collateral positions and generating stable returns for investors.

CEO Kipp deVeer commented on the results, stating,

Our record fourth quarter Core EPS and net asset value per share concluded another successful year for our company. We continue to drive strong credit and financial results using our extensive sourcing, underwriting and portfolio management capabilities."

Chief Financial Officer Penni Roll highlighted the company's liquidity position,

With over $6 billion of available capital after considering the January notes issuance, we remain well positioned to invest opportunistically in a more active market environment."

ARCC's performance in the fourth quarter and throughout the year underscores its ability to navigate the market effectively, maintain a strong balance sheet, and provide value to its shareholders through consistent dividends. The company's strategic focus on secured lending and diversified investments positions it well for continued success in the asset management industry.

For more detailed information on ARCC's financial results, including income statements and balance sheets, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Ares Capital Corp for further details.

This article first appeared on GuruFocus.