ARES MANAGEMENT LLC Acquires Significant Stake in Frontier Communications Parent Inc

ARES MANAGEMENT LLC (Trades, Portfolio), a renowned investment firm, recently added a substantial number of shares in Frontier Communications Parent Inc (NASDAQ:FYBR) to its portfolio. This article provides an in-depth analysis of the transaction, the profiles of the guru and the traded company, and the potential implications of this significant move.

Profile: ARES MANAGEMENT LLC (Trades, Portfolio)

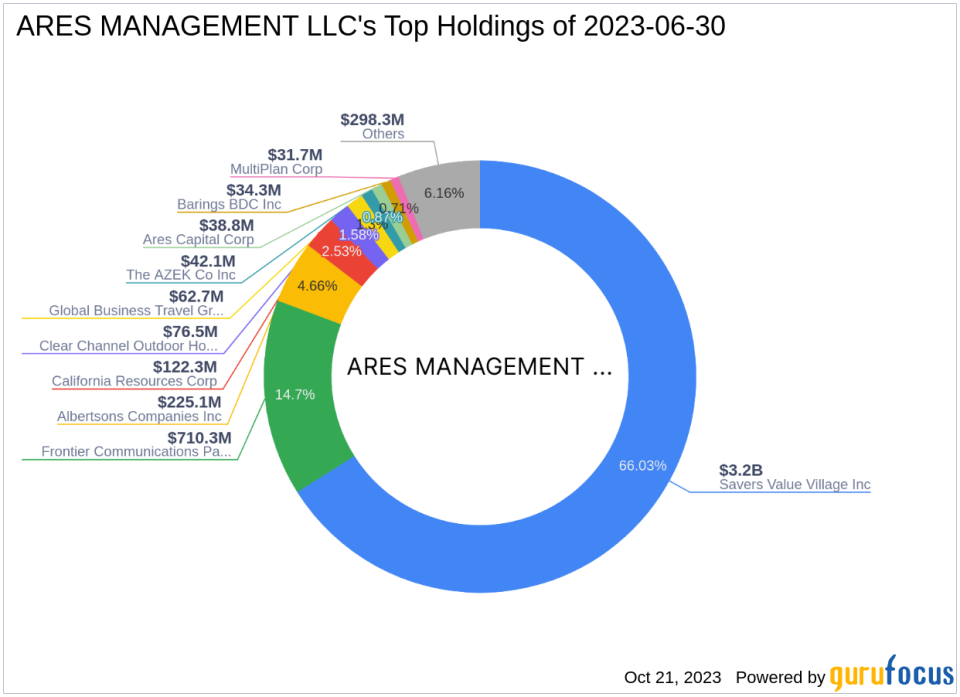

ARES MANAGEMENT LLC (Trades, Portfolio), based in Los Angeles, CA, is a prominent investment firm with a diverse portfolio. The firm's top holdings include Clear Channel Outdoor Holdings Inc (NYSE:CCO), Albertsons Companies Inc (NYSE:ACI), California Resources Corp (NYSE:CRC), Frontier Communications Parent Inc (NASDAQ:FYBR), and Savers Value Village Inc (NYSE:SVV). With an equity of $4.83 billion, the firm primarily invests in the Consumer Cyclical and Communication Services sectors.

Transaction Details

The transaction took place on October 18, 2023, with ARES MANAGEMENT LLC (Trades, Portfolio) adding 150,000 shares of Frontier Communications Parent Inc to its portfolio at a trade price of $18.93 per share. This acquisition increased the firm's total holdings in FYBR to 38,912,895 shares, representing 15.23% of its portfolio and 15.83% of the traded stock. The transaction had a 0.06% impact on the firm's portfolio.

Profile: Frontier Communications Parent Inc

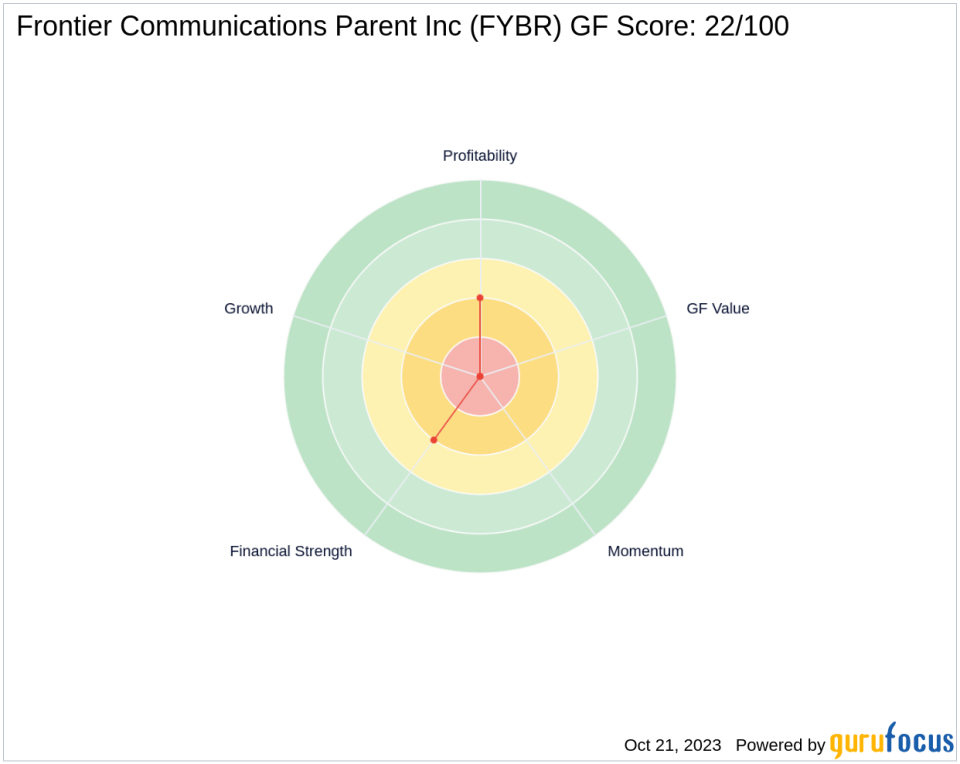

Frontier Communications Parent Inc (NASDAQ:FYBR), a US-based company, offers a range of services to residential and business customers over its fiber-optic and copper networks. These services include video, high-speed internet, advanced voice, and Frontier Secure digital protection solutions. The company operates in various segments, including Data and Internet services, Other, Subsidy and other revenue, Video services, and Voice services. With a market capitalization of $4.51 billion, the company's current stock price stands at $18.35. However, due to insufficient data, the GF Valuation cannot be evaluated. The company's GF Score is 22/100, indicating a poor future performance potential.

Stock Performance Analysis

Since the transaction, the stock's price has decreased by 3.06%. Since its IPO on May 4, 2021, the stock has declined by 28.9%, and the year-to-date price change ratio stands at -27.24%. The company's Financial Strength is ranked 4/10, and its Profitability Rank is also 4/10. However, the Growth Rank is not applicable due to insufficient data.

Industry Overview: Telecommunication Services

The Telecommunication Services industry, where Frontier Communications Parent Inc operates, is a dynamic and rapidly evolving sector. Despite the challenges posed by market saturation and regulatory pressures, the industry continues to innovate and expand, driven by the increasing demand for high-speed internet and advanced digital services.

Largest Guru Holding the Traded Stock

The largest guru holding Frontier Communications Parent Inc is Gotham Asset Management, LLC. However, the exact share percentage held by the firm is not available at the moment.

Conclusion

In conclusion, ARES MANAGEMENT LLC (Trades, Portfolio)'s recent acquisition of Frontier Communications Parent Inc shares is a significant move that could potentially influence the firm's portfolio and the traded stock's performance. As of October 21, 2023, the data and rankings provided in this article are accurate. However, investors are advised to conduct their own research and analysis before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.