Argenx Is Tracking Well Above the Industry

Argenx SE (NASDAQ:ARGX) is a fast-growing pharmaceutical company focused on developing next-generation medicines to combat various autoimmune diseases.

Investment thesis

In anticipation of the release of Argenx's fourth-quarter financial results later this month, its share price corrected to a strong support zone ranging from $369 to $380.

Source: TradingView

We believe the recent completion of a technical correction in its share price represents a notable investment opportunity for investors seeking undervalued assets in the pharmaceutical industry.

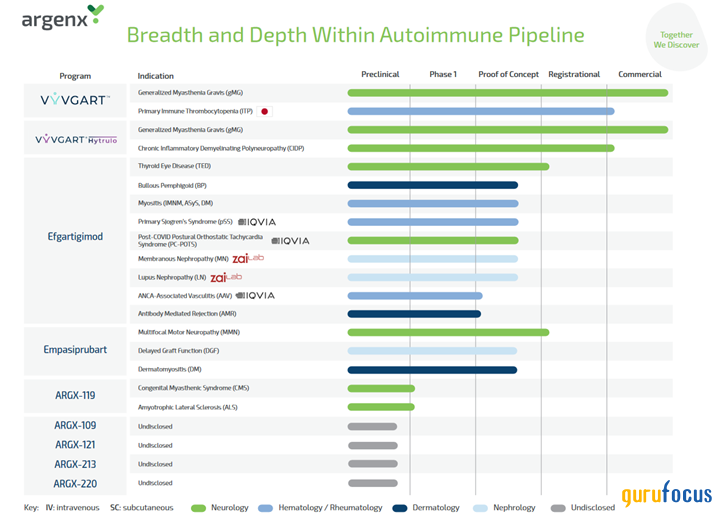

The first investment thesis we highlight is the rich portfolio of both Food and Drug Adminstration-approved medicines and the company's product candidates, including those being developed using such revolutionary technologies as the SIMPLE Antibody platform technology, SMART-Ig, ENHANZE drug delivery technology and ACT-Ig.

Source: Argenx presentation

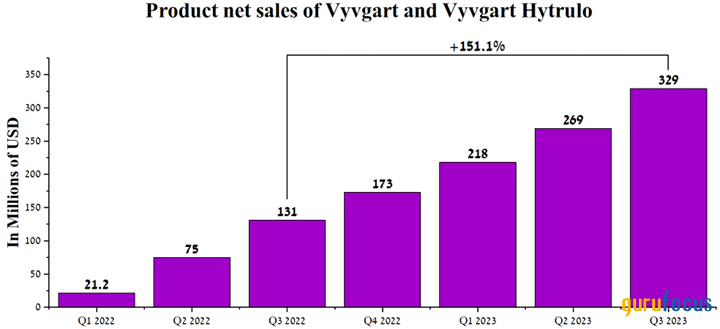

The company's flagship products are Vyvgart and Vyvgart Hytrulo, which had preliminary sales of $374 million in the three months ended Dec. 31, up 116% year over year. We expect demand growth to accelerate in 2024 as Vyvgart is likely to be approved for the treatment of patients with primary immune thrombocytopenia in Japan, and we also expect the FDA to approve it for the treatment of chronic inflammatory demyelinating polyradiculoneuropathy, which affects approximately 16,000 people.

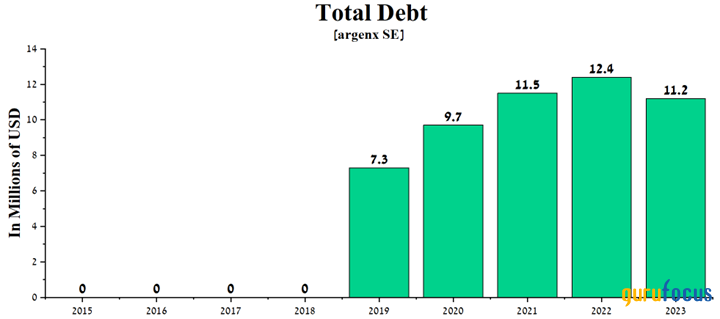

Another investment thesis is argenx's extremely low total debt, which stood at $11.20 million at the end of September.

Source: Author's elaboration, based on GuruFocus data.

With the company's total cash and short-term investments totaling approximately $2 billion, its management will continue to resort to an active research and development policy. One of the ultimate goals of this strategy is to accelerate the development of empasiprubart for the treatment of rare diseases for which there are no approved treatments or have relatively low efficacy.

We initiate our coverage of argenx with an outperform rating for the next 12 months.

Current financial position and outlook

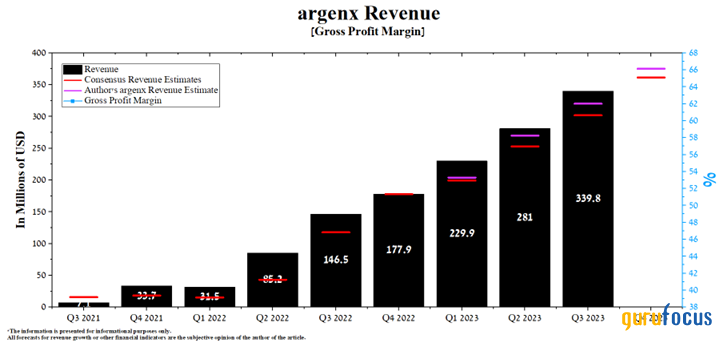

Argenx's revenue for the third quarter of 2023 was about $339.80 million, exceeding our expectations by about $19.8 million and, more importantly, growing 131.9% year over year.

Moreover, the company's actual revenue beat analysts' consensus estimates in nine of the last 10 quarters by significant margins, which is one factor indicating that Mr. Market continues to underestimate the prospects for its business as the leader in neonatal Fc receptor (FcRn) inhibitors market.

Source: Author's elaboration

The company's portfolio consists of Vyvgart (efgartigimod alfa-fcab), which is a medicine approved by the FDA in late 2021 to treat patients with generalized myasthenia gravis, an autoimmune neurological disorder with a prevalence of 14 to 20 per 100,000 individuals.

Its mechanism of action is based on binding to FcRn, which ultimately prevents the recycling of immunoglobulin G and thus contributes to a significant reduction in the number of circulating IgG autoantibodies against acetylcholine receptors, which are also responsible for the development of generalized myasthenia gravis in the body of patients.

Total sales of Vyvgart and Vyvgart Hytrulo were $329 million for the three months ended Sept. 30, an increase of 151.10% from the third quarter of 2022.

Source: Author's elaboration, based on quarterly securities reports

We believe the main drivers of growth in demand for Vyvgart are its status as a first-in-class FcRn antagonist, the expansion of its geographic use and the approval of its subcutaneous version by the FDA and EMA in the second half of 2023.

The company is expected to report fourth-quarter 2023 financial results on Feb. 29. Argenx's revenue for the quarter is expected to range from $246 million to $385 million, up 18.9% from analysts' expectations for the previous quarter.

Source: Author's elaboration, based on GuruFocus data.

Conversely, we expect the company's total revenue to reach $377 million for the fourth quarter, which is about $16 million above the median of the above range, mainly due to the start of commercialization of Vyvgart in China and the rapid increase in its share in the global myasthenia gravis treatment market.

The company's operating income margin was -23.5% for the third quarter of 2023, an increase of 119% compared to the previous year and, more importantly, the trend for its improvement has continued since the launch of efgartigimod alfa. According to our estimates, this financial metric will reach -22.1% in 2023 and increase to 4.50% by 2024, mainly due to the quick label expansion for Vyvgart and its launch in Australia, South Korea and other countries in the first half of this year.

Source: argenx presentation

Furthermore, according to Seeking Alpha, the company's fourth-quarter earnings per share are expected to range from -$2.96 to -2 cents, up 17 cents from the third quarter of 2022. However, we expect its earnings to be above this range and reach -$1.10 due to higher sales of Vyvgart Hytrulo.

Source: Author's elaboration, based on GuruFocus data.

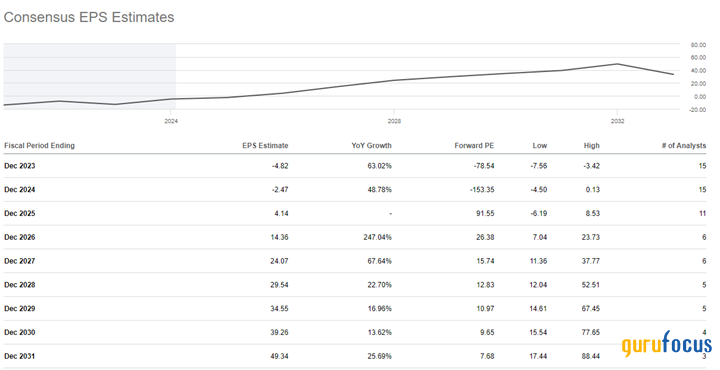

In addition, the company's trailing 12-month non-GAAP price-earnings ratio remains negative, indicating it is trading at a significant premium to most health care assets. However, argenx is a growth stock, showing substantial revenue increases as well as an expanding pipeline of experimental drugs that have the potential to become the most effective treatments for diseases such as thyroid eye disease, lupus nephropathy, bullous pemphigoid, multifocal motor neuropathy and more.

More globally, its strong operating income growth rate is anticipated to push its price-earnings ratio down to 10.97 by 2029, which we estimate is an attractive value for investors looking for undervalued assets in the pharmaceutical industry.

Source: Author's elaboration.

Conclusion

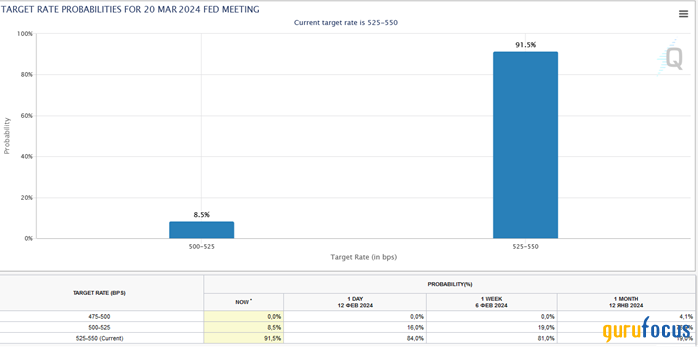

Key risks that could negatively impact Argenx's investment attractiveness include a slower pace of expansion of its product portfolio, increased competition in the global chronic inflammatory demyelinating polyradiculoneuropathy market and the release of higher U.S. inflation relative to analysts' expectations, which reduces the likelihood of a Federal Reserve interest rate cut in March.

Source: CME Group

On the other hand, the company continues to be a leader in the global myasthenia gravis treatment market, which is reflected in Vyvgart's extremely high sales growth rate, and also allows it to invest aggressively in the development of its pipeline of experimental drugs created using revolutionary technologies.

In my assessment, these factors, coupled with rising operating income margin, high total cash and short-term investments, low debt and Vyvgart's label expansion this year, are among the key investment theses.

We initiate our coverage of argenx with an outperform rating for the next 12 months.

This article first appeared on GuruFocus.