Arhaus (NASDAQ:ARHS) Posts Better-Than-Expected Sales In Q4, Provides Encouraging Full-Year Guidance

Luxury furniture retailer Arhaus (NASDAQ:ARHS) beat analysts' expectations in Q4 FY2023, with revenue down 3.5% year on year to $344 million. Revenue guidance for the full year also exceeded analysts' estimates but next quarter's guidance of $265 million was less impressive, coming in 9.4% below expectations. It made a non-GAAP profit of $0.22 per share, down from its profit of $0.34 per share in the same quarter last year.

Is now the time to buy Arhaus? Find out by accessing our full research report, it's free.

Arhaus (ARHS) Q4 FY2023 Highlights:

Revenue: $344 million vs analyst estimates of $335.5 million (2.5% beat)

EPS (non-GAAP): $0.22 vs analyst estimates of $0.16 (34.1% beat)

Revenue Guidance for Q1 2024 is $265 million at the midpoint, below analyst estimates of $292.3 million

Management's revenue guidance for the upcoming financial year 2024 is $1.35 billion at the midpoint, beating analyst estimates by 1.8% and implying 4.8% growth (vs 6.1% in FY2023)

Free Cash Flow was -$13.82 million, down from $509,000 in the same quarter last year

Gross Margin (GAAP): 41%, down from 50% in the same quarter last year

Same-Store Sales were down 6.8% year on year

Store Locations: 90 at quarter end, increasing by 9 over the last 12 months

Market Capitalization: $1.80 billion

With an aesthetic that features natural materials such as reclaimed wood, Arhaus (NASDAQ:ARHS) is a high-end furniture retailer that sells everything from sofas to rugs to bookcases.

Home Furniture Retailer

Furniture retailers understand that ‘home is where the heart is’ but that no home is complete without that comfy sofa to kick back on or a dreamy bed to rest in. These stores focus on providing not only what is practically needed in a house but also aesthetics, style, and charm in the form of tables, lamps, and mirrors. Decades ago, it was thought that furniture would resist e-commerce because of the logistical challenges of shipping large furniture, but now you can buy a mattress online and get it in a box a few days later; so just like other retailers, furniture stores need to adapt to new realities and consumer behaviors.

Sales Growth

Arhaus is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale. On the other hand, one advantage is that its growth rates can be higher because it's growing off a small base.

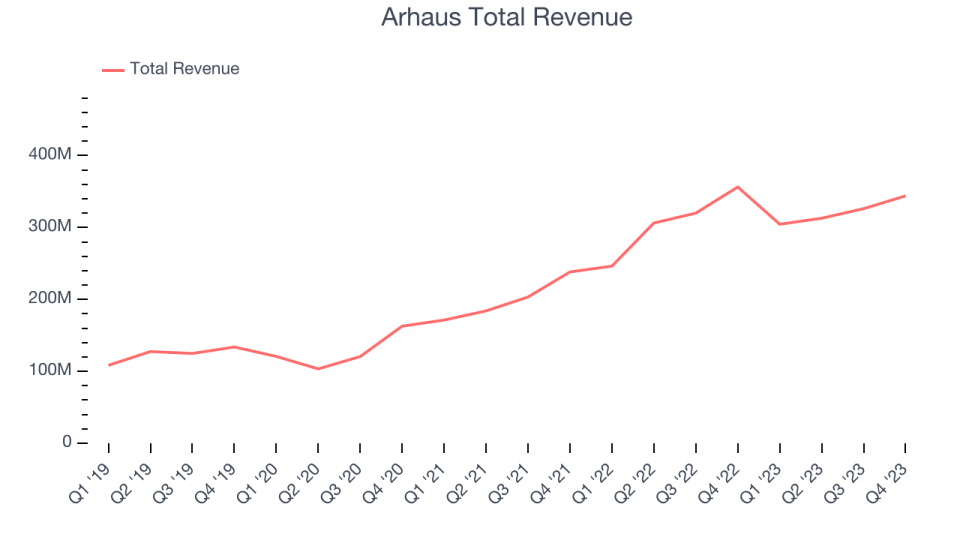

As you can see below, the company's annualized revenue growth rate of 27% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was incredible as it added more brick-and-mortar locations and increased sales at existing, established stores.

This quarter, Arhaus's revenue fell 3.5% year on year to $344 million but beat Wall Street's estimates by 2.5%. The company is guiding for a 13% year-on-year revenue decline next quarter to $265 million, a reversal from the 23.7% year-on-year increase it recorded in the same quarter last year. Looking ahead, Wall Street expects sales to grow 2.2% over the next 12 months, an acceleration from this quarter.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Same-Store Sales

Same-store sales growth is an important metric that tracks demand for a retailer's established brick-and-mortar stores and e-commerce platform.

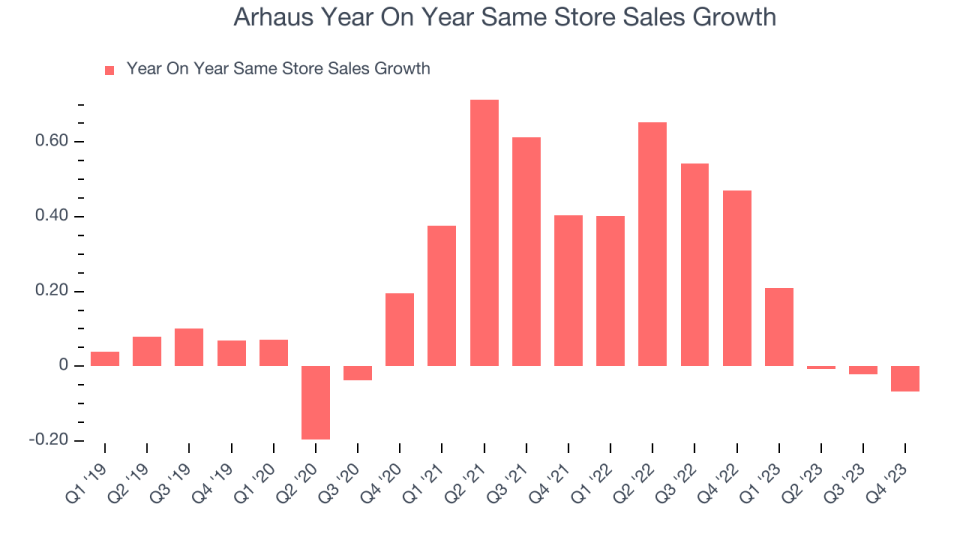

Arhaus has been one of the most successful retailers over the last two years thanks to skyrocketing demand within its existing stores. On average, the company has posted exceptional year-on-year same-store sales growth of 27.3%. This performance suggests that its steady rollout of new stores could be beneficial for shareholders. When a company has strong demand, more locations should help it reach more customers seeking its products.

In the latest quarter, Arhaus's same-store sales fell 6.8% year on year. This decline was a reversal from the 47% year-on-year increase it posted 12 months ago. We'll be keeping a close eye on the company to see if this turns into a longer-term trend.

Key Takeaways from Arhaus's Q4 Results

We were impressed by how significantly Arhaus blew past analysts' operating income and EPS forecasts this quarter. We were also excited its revenue outperformed Wall Street's estimates. Those two beats were driven by better-than-expected same-store sales performance (6.8% decline compared to an estimated 10.4% decline). Given the strong quarter, management shared upbeat revenue and EBITDA guidance for the full year 2024, easily topping analysts' estimates.

Because its free cash flow for the full year 2023 beat its internal projections, Arhaus is declaring a special, one-time cash dividend of $0.50 per share - this represents a ~4% yield on the current share price. The dividend will be payable on April 4, 2024, to shareholders of record on March 21, 2024.

Overall, this quarter's results seemed fairly positive and shareholders should feel optimistic. The stock is flat after reporting and currently trades at $12.75 per share.

So should you invest in Arhaus right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.