Aridis (ARDS) Up on Regulatory Update for Pneumonia Drug

Aridis Pharmaceuticals, Inc. ARDS announced that its AR-301 clinical program is being considered for availing the FDA’s Limited Population Pathway for Antibacterial and Antifungal Drugs (“LPAD”). This consideration by the FDA signifies that the AR-301 program satisfies the unmet medical need of a predefined limited population, as required, under the LPAD guidance.

Aridis reported that the official determination regarding the use of the LPAD pathway will be made after the company’s request following the filing of a biologics license application (BLA). AR-301, ARDS’ proprietary monoclonal antibody candidate, is currently being developed as an adjunctive therapy to be implemented along with standard-of-care antibiotics for the treatment of pneumonia caused by Gram-positive bacteria, Staphylococcus aureus (S. aureus), in mechanically ventilated hospitalized patients.

The stock of the company jumped about 5.4% on Tuesday, following the encouraging news. Year to date, shares of Aridis have plunged 77.4% compared with the industry’s 7.2% decline.

Image Source: Zacks Investment Research

The FDA’s LPAD eligibility is accredited with providing more streamlined approaches, such as smaller, shorter, or fewer clinical trials, as per the regulatory body’s guidance, evaluating prospective therapies in the treatment of patients with serious bacterial diseases, where there is an unmet medical need.

We would like to remind the investors that, In May 2023, ARDS announced that the FDA has accepted the company’s proposal of a single confirmatory phase III AR-301-003 study of AR-301 for treating pneumonia. The agreement with FDA encompasses certain key details regarding the confirmatory phase III study, such as its design, which is required to support the submission of a BLA.

Aridis has also reached an agreement with the FDA regarding the expansion plan of the study. The target patient group affected by S. aureus ventilator-associated pneumonia (VAP) shall include ventilated hospital-acquired pneumonia and ventilated community-acquired pneumonia patients.

In the confirmatory phase III AR-301-003 study, the primary efficacy endpoint will be the clinical cure rate of pneumonia on day 21, as used in the previous phase III AR-301-002 study, but will now be observed in older adults. This decision is pursuant to the observation made in the previous study, where the absolute efficacy is higher in older adults than in the overall population.

Key secondary efficacy outcomes of reduction in duration of hospitalization, time in ICU and mechanical ventilation days, same as the previous study, will be observed in the overall population, i.e. ≥65 and <65 years of age.

VAP is a challenging disease in the hospital setting, with approximately 251,600 cases of hospital-acquired pneumonia reported in the United States, annually, caused by S. aureus. Patients are usually at high risk of mortality and also remain at risk of developing other life-threatening co-morbidities and a rise in antibiotic resistance.

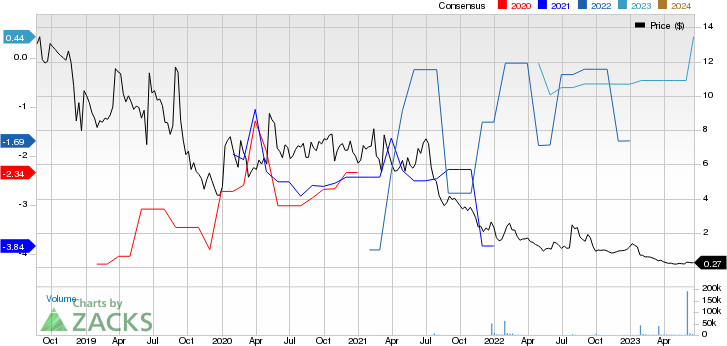

Aridis Pharmaceuticals Price and Consensus

Aridis Pharmaceuticals price-consensus-chart | Aridis Pharmaceuticals Quote

Zacks Rank and Stocks to Consider

Aridis currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the biotech sector are Adaptimmune Therapeutics ADAP, Akero Therapeutics AKRO and ADMA Biologics, Inc. ADMA, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 90 days, the Zacks Consensus Estimate for Adaptimmune Therapeutics’ 2023 loss per share has narrowed from 63 cents to 46 cents. During the same period, the estimate for Adaptimmune Therapeutics’ 2024 loss per share has narrowed from 59 cents to 56 cents. Year to date, shares of ADAP have fallen by 28.8%.

ADAP beat estimates in each of the trailing four quarters, delivering an average earnings surprise of 36.89%.

In the past 90 days, the Zacks Consensus Estimate for Akero Therapeutics’ 2023 loss per share has narrowed from $2.96 to $2.80. During the same period, the estimate for Akero Therapeutics’ 2024 loss per share has narrowed from $3.40 to $3.27. Year to date, shares of AKRO have gained 0.4%.

AKRO beat estimates in three of the trailing four quarters, missing the mark on one occasion, delivering an average earnings surprise of 7.96%.

In the past 90 days, the Zacks Consensus Estimate for ADMA Biologics’ 2023 loss per share has narrowed from 19 cents to 9 cents. The consensus estimate for 2024 earnings is currently pegged at 7 cents per share. Year to date, shares of ADMA have gained by 0.5%.

ADMA beat estimates in each of the trailing four quarters, delivering an average earnings surprise of 19.13%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ADMA Biologics Inc (ADMA) : Free Stock Analysis Report

Adaptimmune Therapeutics PLC (ADAP) : Free Stock Analysis Report

Aridis Pharmaceuticals (ARDS) : Free Stock Analysis Report

Akero Therapeutics, Inc. (AKRO) : Free Stock Analysis Report