Arista (ANET) Beats Q3 Earnings Estimates on Solid Revenues

Arista Networks, Inc. ANET reported healthy third-quarter 2023 results, with solid revenues driven by robust demand trends. Easing supply chain woes and steady customer additions backed by the company’s best-in-class portfolio strength ensured a top-line expansion year over year. Both the bottom and the top line beat the respective Zacks Consensus Estimate.

Net Income

GAAP net income in the reported quarter improved to $545.3 million or $1.72 per share from $354 million or $1.13 per share in the year-ago quarter. The improvement was mainly propelled by higher net sales.

On a non-GAAP basis, net income was $581.4 million or $1.83 per share compared with $391.9 million or $1.25 per share in the year-earlier quarter. The bottom line beat the Zacks Consensus Estimate by 25 cents.

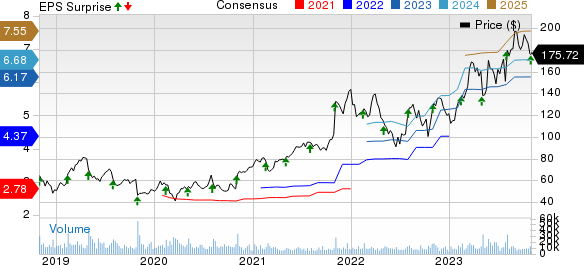

Arista Networks, Inc. Price, Consensus and EPS Surprise

Arista Networks, Inc. price-consensus-eps-surprise-chart | Arista Networks, Inc. Quote

Revenues

During the quarter, revenues surged to $1,509.5 million from $1,176.8 million in the prior-year quarter, owing to an improvement in component supply that enhanced the manufacturing output consistency and healthy contributions from enterprise customers in EMEA and APAC regions.

The company introduced various solutions for cloud, Internet service providers and enterprise networks to meet the rising demands of AI/ML-driven network architectures. These innovations enabled Arista to deliver a superior customer experience and increase customer engagement. The top line beat the consensus estimate of $1,479 million.

Net sales from Product totaled $1,285.5 million compared with $1,008.7 million in the year-ago quarter. It exceeded our estimate of $1,250.3 million. Service revenues increased to $223.9 million from $168.1 million but missed our estimates of $227.2 million. Arista witnessed positive demand trends owing to its strong product portfolio that is highly scalable, programmable and provides data-driven automation, analytics and world-class support services.

Net sales from the Americas contributed 78.5% to total revenues, while international revenues accounted for the remainder. Healthy contributions from enterprise customers in EMEA and APAC regions supported the top-line growth in the international market. Driven by its innovation, Arista maintains a strong leadership position in the Data Center and Cloud Networking vertical.

Other Details

Non-GAAP gross profit rose to $951.8 million from $719.8 million, with non-GAAP gross margin of 63.1% and 61.2%, respectively. The margin was above the company’s guidance.

Total operating expenses were $339.7 million, up from $292.6 million in the year-ago quarter. Research & development costs rose to $212.4 million from $187.8 million. Sales and marketing expenses also increased to $102 million from $81.4 million due to a rise in headcount, new product introduction costs and higher variable compensation expenditures.

Cash Flow & Liquidity

In the first nine months of 2023, Arista generated $1,507.6 million of net cash from operating activities compared with $452.3 million in the prior-year period. As of Sep 30, 2023, the company had $1,748.8 million in cash and cash equivalents and $68 million in other long-term liabilities.

Outlook

For the fourth quarter of 2023, management expects revenues in the range of $1.5-$1.55 billion. Non-GAAP gross margin is estimated at 63% and non-GAAP operating margin is approximated at 42%.

The company expects further easing of supply chain anomalies and an improvement in lead time before normalizing in 2024. However, it anticipates a moderation in consumer spending, mainly for cloud titan customers. It expects a steady improvement in gross margin owing to the optimization of manufacturing output.

Zacks Rank & Other Stocks to Consider

Arista currently has a Zacks Rank #2 (Buy).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Bandwidth Inc. BAND, carrying a Zacks Rank #2, is another key pick from the broader industry. It delivered an earnings surprise of 372.9%, on average, in the trailing four quarters.

Headquartered in Raleigh, NC, Bandwidth operates as a Communications Platform-as-a-Service provider, offering avant-garde software application programming interfaces for voice and messaging services. It is the only application programming interface platform provider that owns a Tier 1 network with enhanced network capacity, primarily catering to business enterprises.

United States Cellular Corporation USM, carrying a Zacks Rank #2, is the fourth largest full-service wireless carrier in the United States. The company provides a range of wireless products and services, and a high-quality network to increase the competitiveness of local businesses and improve efficiency of government operations.

U.S. Cellular has taken concrete steps to accelerate subscriber additions and improve churn management. The company aims to offer the best wireless experience to customers by providing superior quality network and national coverage. It is well-positioned to support the investment required for network enhancements, including the deployment of 5G technology. The company is well-positioned for continued demand for broadband.

Comtech Telecommunications Corp. CMTL, carrying a Zacks Rank #2, is another solid pick. Headquartered in Melville, NY, the company is a leading global provider of next-generation 911 emergency systems and secure wireless communications technologies to commercial and government customers.

Comtech’s key satellite earth station modems incorporate forward error correction and bandwidth compression technologies, which enable its customers to optimize their satellite networks by either reducing their satellite transponder lease costs or increasing data throughput. It holds leadership positions in the market for high-throughput modems used in cellular backhaul.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

United States Cellular Corporation (USM) : Free Stock Analysis Report

Comtech Telecommunications Corp. (CMTL) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Bandwidth Inc. (BAND) : Free Stock Analysis Report