Arista Networks Inc (ANET) Reports Robust Revenue Growth and Net Income Surge in FY 2023

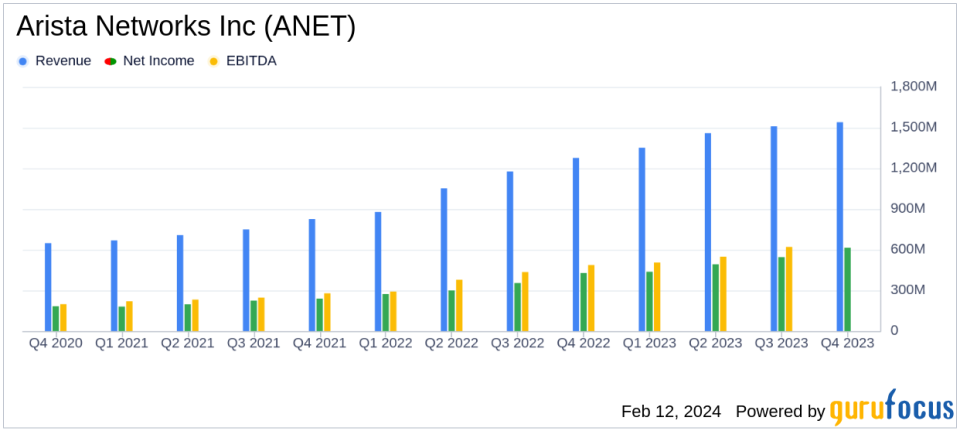

Annual Revenue: Increased by 33.8% to $5.86 billion in FY 2023.

Q4 Revenue: Grew by 20.8% year-over-year to $1.54 billion.

Annual Net Income: Rose significantly to $2.09 billion, a 54.3% increase from FY 2022.

Q4 Net Income: Increased to $613.6 million from $427.1 million in Q4 2022.

Gross Margin: Improved both annually and quarterly, with GAAP gross margin reaching 61.9% for FY 2023 and 64.9% for Q4.

Earnings Per Share: GAAP EPS for FY 2023 was $6.58, up from $4.27 in FY 2022.

On February 12, 2024, Arista Networks Inc (NYSE:ANET), a leading provider of data-driven, client to cloud networking solutions, released its 8-K filing, detailing its financial performance for the fourth quarter and full year ended December 31, 2023. The company, known for its Ethernet switches and extensible operating system (EOS), has continued to gain market share since its inception in 2004, focusing on high-speed applications and counting industry giants like Microsoft and Meta Platforms among its largest customers.

Financial Performance Overview

Arista Networks reported a substantial increase in revenue for the full year 2023, reaching $5.86 billion, a 33.8% jump compared to the previous fiscal year. The company's focus on profitable revenue growth and expansion into enterprise and campus footprints has been a key driver of this success. The GAAP gross margin also saw an improvement, rising to 61.9% from 61.1% in FY 2022, while non-GAAP gross margin increased to 62.6% from 61.9%.

The fourth quarter results were equally impressive, with revenue climbing to $1.54 billion, a 2.1% increase from the third quarter of 2023 and a significant 20.8% increase from the fourth quarter of the previous year. The GAAP and non-GAAP gross margins for Q4 stood at 64.9% and 65.4%, respectively, indicating a strong finish to the year.

Net Income and Earnings Per Share

ANET's net income for FY 2023 was particularly noteworthy, with GAAP net income soaring to $2.09 billion, or $6.58 per diluted share, a substantial increase from $1.35 billion, or $4.27 per diluted share, in FY 2022. The non-GAAP net income followed suit, reaching $2.20 billion, or $6.94 per diluted share, up from $1.45 billion, or $4.58 per diluted share, in the prior year.

The fourth quarter GAAP net income was $613.6 million, or $1.92 per diluted share, compared to $427.1 million, or $1.35 per diluted share, in the fourth quarter of 2022. Non-GAAP net income for the quarter was $664.3 million, or $2.08 per diluted share, an increase from $445.1 million, or $1.41 per diluted share, in the same period last year.

Key Financial Metrics and Commentary

Ita Brennan, Aristas outgoing CFO, commented on the company's financial results, stating,

Our outstanding performance for 2023 epitomizes our focus on profitable revenue growth, expanding our enterprise and campus footprint while leveraging R&D and go-to-market investments across the business."

This sentiment reflects the company's strategic direction and its ability to meet the demanding requirements of enterprise, cloud, and AI customers.

Arista's balance sheet remains robust, with cash and cash equivalents of $1.94 billion as of December 31, 2023, compared to $671.7 million at the end of 2022. The company's total assets increased to $9.95 billion from $6.78 billion over the same period.

For the first quarter of 2024, Arista expects revenue between $1.52 billion to $1.56 billion, a non-GAAP gross margin of approximately 62%, and a non-GAAP operating margin of approximately 42%.

Strategic Highlights and Future Outlook

Throughout 2023, Arista Networks made significant strides in product development and market positioning. The company introduced the next-generation 7130 Series for ultra-low latency networking, expanded its zero trust networking architecture, and appointed Chantelle Breithaupt as the new CFO. Arista also continued to innovate in AI-driven network identity services and modernized routing in wide area networks.

As Arista Networks Inc (NYSE:ANET) moves into 2024, the company's financial results reflect a strong foundation for continued growth and innovation in the networking industry. Investors and potential GuruFocus.com members can find more detailed information and analysis on Arista's performance and future prospects on our website.

Explore the complete 8-K earnings release (here) from Arista Networks Inc for further details.

This article first appeared on GuruFocus.