Arista Networks Is a Prime Beneficiary of Hyperscalers' AI Ambitions

Since the release of OpenAI's ChatGPT, artificial intelligence has captured the world's attention with its limitless possibilities of productivity benefits. The projected gains from AI's potential productivity boost have created a mad rush for enterprises to adopt AI applications in their organizations. At the same time, technology companies, led by hyperscale cloud companies, or hyperscalers, such as Microsoft (NASDAQ:MSFT) and Meta Platforms (NASDAQ:META) are also racing to build the back-end infrastructure to meet enterprise demand for AI.

Most recently, Meta Platforms informed analysts on its full-year 2023 earnings call that they should expect to see higher capital expenditures due to increased infrastructure projects related to AI-specific data center projects.

Arista Networks Inc. (NYSE:ANET) is one of the biggest beneficiaries that stands to make the most of Meta Platform's AI data center projects. Despite the impressive 15% gains that Arista's investors have enjoyed so far for the year, I still see upside from current levels.

Business model recap

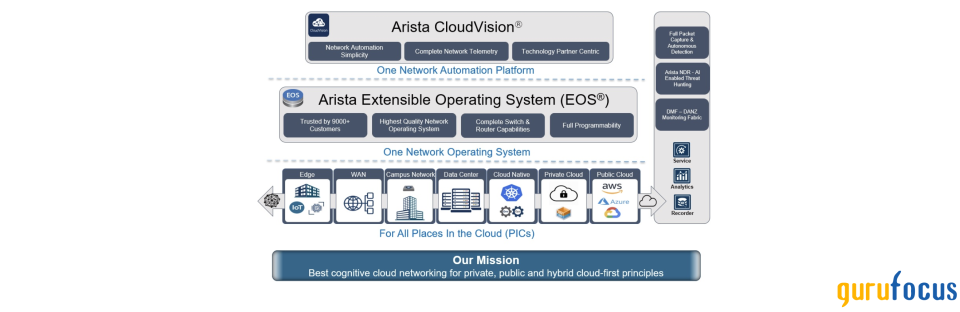

Arista Networks is a leader in data center and cloud networking that has filled the innovation gap left behind by one of the largest incumbent competitors in the networking space, Cisco (NASDAQ:CSCO). Arista is the pioneer of low-latency switching technology, a technical framework built upon network components such as network applications and ethernet switching and routing platforms. These network components are extremely crucial for hyperscalers to maintain the high service levels of their cloud platforms and products, so they heavily rely on companies like Arista to provide low-latency, highly optimized network architecture.

I have added an overview of Arista's cloud networking solutions below. But I will also mention here that data center and cloud products contribute significantly to its revenue since these products are also deployed with AI use cases in mind.

The company has two primary sources of revenue, with product revenue accounting for over 86% of total revenue per its third-quarter 10-Q filing. Product revenue usually comprises sales of its network products such as ethernet switches and routing platforms. Arista currently sells to about 9,000 customers worldwide, as per the last known reports in its 2022 10-K filing.

Hyperscalers are accretive to Arista's networking business growth

Over the years, Arista has been able to forge strong business relationships with cloud computing companies. Arista's networking products have become extremely relevant in solving the most important business problems for most cloud computing companies, using its networking products to achieve incredible computational speed and minimal latency. Arista's products have been especially relevant to hyperscalers such as Microsoft and Meta Platforms, who, as I mentioned, have significantly ramped up their data center infrastructure to scale their cloud compute infrastructure. The hyperscalers, or "cloud titans," as Arista likes to call them, plan and allocate for capital expenditures at the start of every financial year, which may be upgraded based on various factors such as macroeconomic situations improving, cloud applications and platform demand expanding.

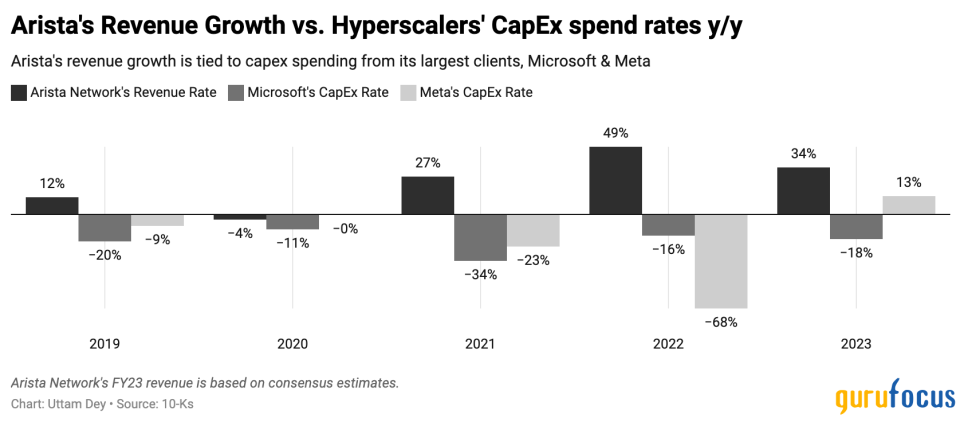

Currently, Microsoft and Meta Platforms account for 16% and 26% of Arista's total revenue, respectively. Based on commentary from participants at the Wells Fargo TMT Summit last year, analysts usually estimate Microsoft and Meta Platforms account for around 43% of Arista's revenue. And with the proliferation of AI, both of these hyperscalers will continue to increase their data center capital expenditures over the next few years to meet infrastructure demand. I agree with these views since Meta recently announced during its fourth-quarter earnings call that it would be increasing capital expenditures by 23% in 2024, which immensely boosts Arista's revenue outlook for the year. The chart below shows how Arista's revenue grows stronger as its top two clients increase their own respective capex spends.

In addition, with large enterprises such as hyperscalers in Arista's client portfolio, the company enjoys strong margin growth at every level. The company's non-GAAP operating margin has grown from 37.70% in 2020 to 41% in 2022. On a year-to-date basis for 2023, Arista's non-GAAP operating margins have expanded to 43%, which is very impressive and bodes well for its valuation.

While reviewing the company's books, I also wanted to mention the company's debt profile versus its cash. Total debt stands at $48 million, primarily due to lease obligations. But the company can easily service its debt since its cash and cash equivalents stand at $4.50 billion.

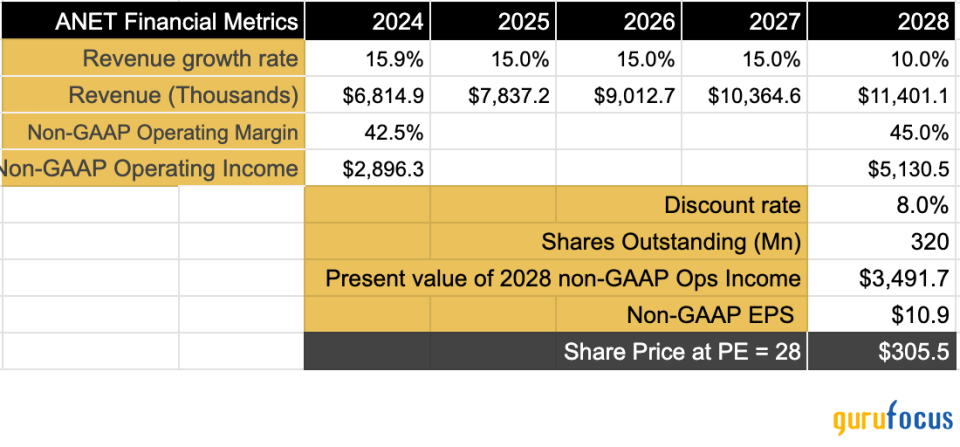

Arista still has room for upside based on valuation

Arista presented to a closed group of investors in their investor presentation on Nov. 9. In the absence of specific presentations or exclusive commentary, I will resort to reviewing management's follow-up commentary from the Wells Fargo TMT Summit. The company's long-term operating plan assumes it will gro revenue at a 15% compound annual growth rate from 2022 to 2027. At the same technology summit, management announced the company was on track to achieve 33% revenue growth in 2023, which is essentially more than twice the projected growth rate it expected over a five-year period. I believe management is being deliberate in tempering optimism about its future growth prospects. However, I will still assume 15% CAGR until 2027, with 2024 consensus expectations this year.

On the margin front, Arista has benefited from a boost in margins since demand for the company's networking products has given it more pricing power. However, management cautioned that margins would normalize in 2024. Assuming margins normalize, I will take the same margin rate this year as shown below.

My estimates project an 18.90% growth in income, which should warrant a forward price-earnings ratio of 28. At these premiums, Arista has enough room for upside, and I see this as a base case.

Risks and other factors to consider

By selling networking products and solutions, Arista directly competes with the largest competitor in this space, Cisco, as I mentioned earlier. So far, Arista has been resilient by addressing the need for selling very specific networking products to hyperscalers and has since been constantly innovating and scaling its products. Network latency is one of the key performance metrics for all networking products, and all networking companies try to optimize their products to reduce network latency and optimize network architecture. However, if Arista fails to innovate, it may lose market share or, worse, its clients. This also puts the company at significant risk since hyperscalers account for around 43% of its revenue. Although Arista continues to benefit from its relationship with Microsoft and Meta, there would be a significant impact if Arista's products failed to meet its customers' requirements.

Additionally, Arista recently had a change of guard in the chief financial officer role. I expect the new CFO to continue to execute on prior targets that were announced and work toward further optimizing its margins, cash and debt profiles.

Finally, if there are macro forces in the economy that cause Arista's clients, including hyperscalers, to reassess their capital expenditure budgets toward data center infrastructure spending, this could also impact its growth prospects.

Takeaways

With cloud infrastructure companies leading the way in ramping up spending to build AI-intensive datacenters and meet enterprise demand, Arista Networks immensely benefits from these industry trends. The company's long-term growth model is intact, in my opinion. For now, my base case valuation finds this company to be still undervalued.

This article first appeared on GuruFocus.