Arkema (ARKAY) Boosts Polymers Range With Majority Stake in PIAM

Arkema S.A. ARKAY, a leading global specialty materials company, has announced its proposed acquisition of a controlling stake in South Korea-based PI Advanced Materials (“PIAM”). The acquisition, valued at €728 million (around $798 million), will allow Arkema to fully consolidate PIAM in its accounts, expanding its range of high-performance polymers and aiding in its transformation into a pure specialty materials player.

PIAM holds over 30% of the global market share and is recognized as the global leader in polyimide films for flexible printed circuit boards and graphite sheets used in the high-growth markets of mobile devices and electric vehicles. The company's ultra-high-performance polyimides offer exceptional temperature resistance, dimensional stability, flexibility, and electrical insulation, making them ideal for applications in electric vehicles, consumer electronics, semiconductor manufacturing, and other advanced industrial sectors.

With two advanced production sites and two research and development centers in South Korea, PIAM is known for its innovation and employs roughly 320 people. The company has experienced strong sales growth of 12% annually on average, with an impressive EBITDA margin of 30%. Although PIAM’s sales were temporarily impacted by the destocking in the global consumer electronics market in 2022, it is expected to grow at a rate of around 13% per year in the coming years. This growth will be supported by its innovation pipeline, successful customer qualifications in 5G antennas and high-resolution OLED displays, and the increasing demand for flexible screens and materials in the electric vehicle market.

By acquiring Glenwood Private Equity's 54% stake in PIAM, Arkema aims to consolidate its position as a leading provider of specialty materials. The remaining 46% of PIAM's shares will continue to be listed on the Korean stock exchange. The acquisition aligns perfectly with Arkema's Advanced Materials segment, strengthening its high-performance polymer range in lucrative markets driven by megatrends.

The acquisition of PIAM offers significant pre-tax synergies estimated at around €30 million (around $33 million) at the EBITDA level, with anticipated achievement over the next five years. These synergies will result from complementary product ranges, Arkema's global reach, and PIAM's strong customer relationships in Asia. The transaction price represents roughly 20 times the average 2021/2022 EBITDA. Over time, the enterprise value/EBITDA multiple is expected to decrease to 8 times by 2027, benefiting from PIAM's organic growth and targeted synergies.

Arkema plans to finance the acquisition fully in cash while maintaining a strong balance sheet with a net debt level within its financial leverage objective. The deal is subject to the approval of Chinese and Korean anti-trust authorities and is projected to be finalized by the end of 2023.

With this strategic acquisition, Arkema strengthens its technological profile and is uniquely positioned to meet the increasing demand driven by megatrends. The company will focus on organic growth, leveraging its innovative technologies in attractive markets and applications. In terms of future mergers and acquisitions, Arkema will prioritize deconsolidation of its Intermediates segment and pursue bolt-on operations, particularly in adhesives.

Arkema's acquisition of PI Advanced Materials represents another significant milestone in its strategy to provide innovative materials for a sustainable world. The company remains committed to delivering high-performance solutions for high-growth end markets, supported by megatrends such as electric vehicles and advanced electronics.

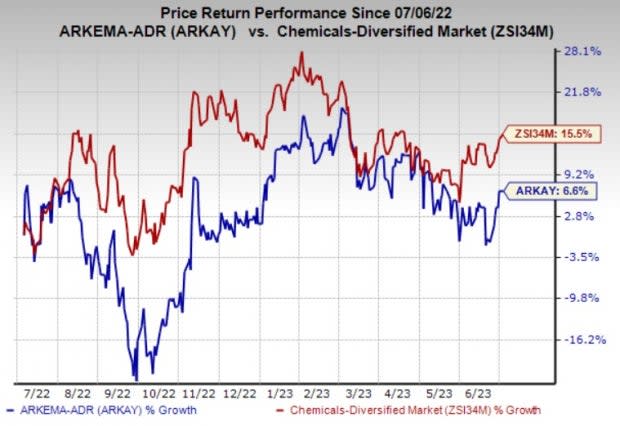

ARKAY’s shares have gained 6.6% in the past year against the 15.5% rise of its industry. The Zacks Consensus Estimate for the company’s current-year earnings has been revised 2.5% upward in the past 60 days.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

ARKAY currently has a Zacks Rank #3 (Hold).

Better-ranked stocks worth a look in the basic materials space include L.B. Foster Company FSTR, Koppers Holdings Inc. KOP and Linde plc LIN.

L.B. Foster currently carries a Zacks Rank #1 (Strong Buy). The Zacks Consensus Estimate for FSTR's current-year earnings has been stable over the past 60 days.

L.B. Foster’s earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 140.5%, on average. FSTR shares have gained around 13% in a year.

The Zacks Consensus Estimate for Koppers’ current-year earnings has been stable over the past 60 days. KOP currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for current-year earnings for KOP is currently pegged at $4.40, indicating year-over-year growth of 6.3%. Koppers’ shares have rallied roughly 60% in the past year.

Linde currently carries a Zacks Rank #2. The Zacks Consensus Estimate for LIN’s current-year earnings has been revised 0.7% upward in the past 60 days.

Linde beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 6.9% on average. LIN shares have risen roughly 38% in the past year.

Disclaimer: This article has been written with the assistance of Generative AI. However, the author has reviewed, revised, supplemented, and rewritten parts of this content to ensure its originality and the precision of the incorporated information.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

L.B. Foster Company (FSTR) : Free Stock Analysis Report

Koppers Holdings Inc. (KOP) : Free Stock Analysis Report

Arkema SA (ARKAY) : Free Stock Analysis Report

Linde PLC (LIN) : Free Stock Analysis Report