Arkema (ARKAY) Expands Organic Peroxide Production in China

Arkema S.A. ARKAY revealed plans for substantially increasing organic peroxide production capabilities at its Changshu facility in China. This strategic investment, totaling approximately €50 million (roughly $53 million), aims to better serve the rapidly growing Asian markets, particularly in the field of renewable energies.

The Luperox brand organic peroxides manufactured by Arkema are vital components as reaction initiators for various polymers and, notably, are crucial in producing photovoltaic panels, playing a pivotal role in the global shift towards clean energy. By significantly expanding its presence in Changshu, China, Arkema aims to support the increasing demand from Asian manufacturers participating in the booming global market.

This expansion in organic peroxide operations in China is in addition to the company's previously announced 70% increase in organic peroxide capacity in India in 2022, as well as the doubling of capacity at the Luperox 101 plant in Gunzburg, Germany, which commenced operations earlier this summer.

These initiatives have played a key role in validating several new and more environmentally friendly technologies, significantly reducing the environmental impact of Arkema's organic peroxide business. The new expansion at the Changshu plant, marked by laying the foundation stone in September, is set to become fully operational in early 2025.

Arkema is solidifying its role as a prominent producer of niche additives dedicated to advancing sustainable development through this investment in China. This expansion in industrial operations will integrate its cutting-edge technologies focused on reducing the environmental impact to a minimum.

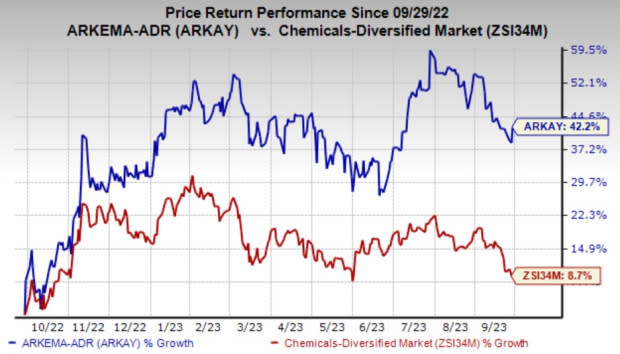

Shares of Arkema have gained 42.2% in the past year against an 8.7% rise of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Arkema currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the basic materials space are WestRock Company WRK and Hawkins, Inc. HWKN, both sporting a Zacks Rank #1 (Strong Buy), and Alamos Gold Inc. AGI, carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The earnings estimate for Westrock’s current year is pegged at $3.02. In the past 60 days, WRK’s current-year earnings estimate has been revised upward by 29%. WRK beat the Zacks Consensus Estimate in three of the last four quarters, with the average earnings surprise being 30.7%. The company’s shares have rallied 13.9% in the past year.

The consensus estimate for Hawkins’ current-year earnings is pegged at $3.40, indicating year-over-year growth of 18.9%. In the past 60 days, HWKN’s current-year earnings estimate has been revised upward by 32.3%. HWKN beat the Zacks Consensus Estimate in all the last four quarters, with the average earnings surprise being 25.6%. The company’s shares have rallied 55% in the past year.

The earnings estimate for Alamos’ current year is pegged at 43 cents, indicating a year-over-year growth of 53.6%. The Zacks Consensus Estimate for AGI current-year earnings has been revised 7.5% upward in the past 60 days. The company’s shares have risen roughly 56.8% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Arkema SA (ARKAY) : Free Stock Analysis Report

Alamos Gold Inc. (AGI) : Free Stock Analysis Report

WestRock Company (WRK) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report