Arlo Technologies Inc (ARLO) Posts Record Service Revenue and Achieves First GAAP Net Earnings in Q4

Service Revenue: Record Q4 service revenue of $55.9 million, a 45.9% increase year over year.

Annual Recurring Revenue (ARR): ARR reached $210.1 million, marking a 52.5% growth year over year.

GAAP Net Earnings: Achieved first GAAP net earnings with $0.01 per diluted share in Q4.

Non-GAAP EPS: Record non-GAAP earnings per diluted share of $0.11 in Q4 and $0.28 for the full year.

Free Cash Flow: Full year free cash flow of $35.5 million with a FCF margin of 7.2%.

Total Revenue: Total revenue for the year slightly increased to $491.2 million.

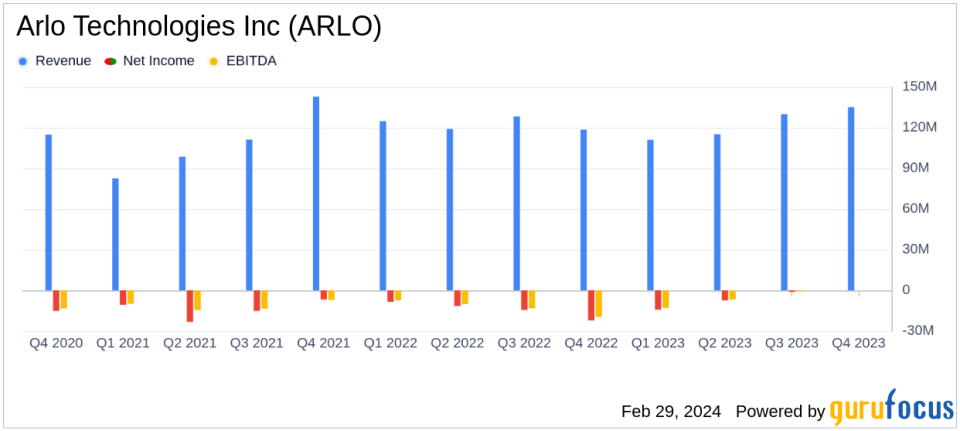

On February 29, 2024, Arlo Technologies Inc (NYSE:ARLO) released its 8-K filing, announcing its financial results for the fourth quarter and full year ended December 31, 2023. The company, known for its innovative security and video monitoring solutions, reported a record fourth quarter with service revenue reaching $55.9 million, a significant 45.9% increase compared to the same period last year. This growth contributed to an impressive annual recurring revenue (ARR) of $210.1 million, up 52.5% year over year.

Arlo Technologies Inc (NYSE:ARLO) operates primarily in the United States, with additional business in Spain, Ireland, and other countries. The U.S. remains the company's largest revenue-generating region. Arlo's product portfolio includes a range of security cameras, doorbells, and lighting systems, complemented by subscription services such as Arlo Secure and Arlo Safe.

Financial Performance and Market Position

The fourth quarter saw Arlo Technologies Inc (NYSE:ARLO) achieve its first ever GAAP net earnings, posting $0.01 per diluted share, and a record non-GAAP EPS of $0.11. This marks a significant milestone for the company, reflecting the successful execution of its growth strategy and operational efficiency. The full year non-GAAP EPS stood at $0.28, despite a GAAP net loss per share of $(0.24) for the same period.

The company's focus on service revenue has paid off, with a 47.4% increase to $201.2 million for the full year. This shift towards recurring revenue streams is crucial for the company's sustainability and reflects a growing customer base, which now exceeds 3 million subscribers. The increase in free cash flow to $35.5 million, with a free cash flow margin of 7.2%, further underscores Arlo's improved financial health and its ability to generate cash from operations.

Key Financial Metrics

Arlo Technologies Inc (NYSE:ARLO)'s financial achievements are particularly noteworthy in the context of the broader industry. The company's ability to grow its service revenue and ARR at such a rapid pace demonstrates the effectiveness of its subscription model and the high value customers place on its security solutions. The improvement in GAAP and non-GAAP gross margins, which are up 640 and 630 basis points year over year respectively, indicates better cost management and a stronger product mix.

Here are some key details from the financial statements:

Financial Metrics | Q4 2023 | Full Year 2023 |

|---|---|---|

Total Revenue | $135.1 million | $491.2 million |

GAAP Gross Margin | 35.0% | 34.1% |

Non-GAAP Gross Margin | 35.8% | 35.0% |

GAAP Net Income (Loss) per Share | $0.01 | $(0.24) |

Non-GAAP Net Income per Share | $0.11 | $0.28 |

These metrics are important as they provide insight into the company's profitability, efficiency, and overall financial health. Gross margin reflects the cost of goods sold as a percentage of revenue, indicating how well the company is managing its production costs relative to its sales. Net income per share is a direct measure of profitability and is critical for investors assessing the company's earnings performance.

Management Commentary

"Arlo finished the year strong with the largest product launch in our company history contributing to solid revenue growth of 14% and ARR growth of over 50% compared to Q4 of the prior year. This culminated in record non-GAAP earnings of $0.11 per share and our first ever profit on a GAAP basis," said Matthew McRae, Chief Executive Officer of Arlo technologies. "The growth is even more impressive when looking at Arlos full year results with our annual service revenue growing 47% to more than $200 million and an $83 million increase in our free cash flow from the prior year. Arlo is clearly well positioned for success in 2024 as evidenced by our announcement that we crossed the 3 million subscribers milestone, substantially earlier than originally projected in our Long-Range Plan."

Looking Ahead

Arlo Technologies Inc (NYSE:ARLO) has provided its business outlook for the first quarter of 2024, projecting revenue between $117 million and $127 million, with a GAAP net loss per diluted share of $(0.08) to $(0.02) and a non-GAAP net income per diluted share of $0.05 to $0.11. This forward-looking guidance reflects the company's confidence in its continued growth trajectory and its ability to maintain profitability on a non

Explore the complete 8-K earnings release (here) from Arlo Technologies Inc for further details.

This article first appeared on GuruFocus.