Armata Pharma (ARMP) Stock Surges 130% in a Month: Here's Why

Armata Pharma ARMP, a clinical-stage company, is currently developing and advancing two developmental candidates in early-mid-stage studies, which aim to address areas of significant unmet clinical need by targeting key antibiotic-resistant bacteria.

The company’s first developmental candidate, AP-PA02, is being evaluated in two different studies parallelly. The phase Ib/IIa SWARM-P.a. study is evaluating the candidate to treat patients with cystic fibrosis (CF) and the phase II Tailwind study is evaluating the candidate to treat non-CF bronchiectasis (NCFB) patients. Armata Pharma’s second clinical candidate, AP-SA02, is being evaluated in a phase Ib/IIa diSArm study to treat patients with Staphylococcus aureus bacteremia.

Shares of Armata Pharma have skyrocketed about 130% in a month against the industry’s 2.6% fall. The surge is due to encouraging developmental updates provided by the company regarding its two candidates in its second-quarter 2023 earnings release.

Image Source: Zacks Investment Research

In ARMP’s earnings press release, the company reported continuing enrollment in the Tailwind study of inhaled AP-PA02 in patients with NCFB and chronic Pseudomonas aeruginosa respiratory infection. The company completed its SWARM-P.a. study in December 2022. The company is currently analyzing the data obtained from the SWARM-P.a. study. Post thorough analysis of the data, Armata Pharma intends to advance AP-PA02 into a phase IIb/III registrational study in CF patients in 2024.

Per management, important findings from the SWARM-P.a. study have been incorporated into the ongoing phase II Tailwind study evaluating AP-PA02 in patients with NCFB.

During the second quarter, the company also completed enrollment in the phase Ib portion of the disarm study of AP-SA02 in the treatment of bacteremia. The phase II a portion of the AP-SA02 developmental program is expected to be initiated during the ongoing quarter.

ARMP also recently received clearance from the FDA for its investigational new drug application for AP-SA02 in the treatment of patients with prosthetic joint infection (PJI). The company is currently planning to begin an early-stage clinical study, evaluating AP-SA02 for PJI soon.

In the same press release, the company shared its financial performance for the second quarter.

For the quarter ended Jun 30, 2023, Armata Pharma reported a loss of 17 cents per share, narrower than the Zacks Consensus Estimate of a loss of 35 cents per share. The company had incurred a loss of 26 cents per share in the year-ago quarter.

In the absence of any marketed product, ARMP only recognizes grant revenues in its top line. The company reported total revenues of $1 million during the reported quarter, which missed the Zacks Consensus Estimate of $2 million. In the year-ago quarter, the company reported total revenues of $1.9 million.

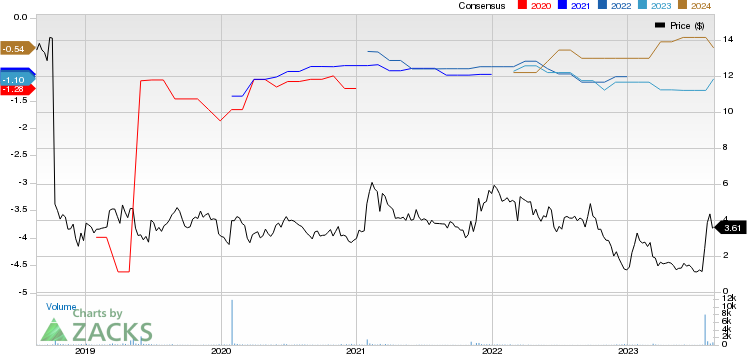

Armata Pharmaceuticals, Inc. Price and Consensus

Armata Pharmaceuticals, Inc. price-consensus-chart | Armata Pharmaceuticals, Inc. Quote

Zacks Rank and Stocks to Consider

Armata Pharma currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the pharma/biotech sector are J&J JNJ, Corcept Therapeutics CORT and Dynavax Technologies DVAX, each carrying a Zacks Rank #2 (Buy) at present.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 90 days, the Zacks Consensus Estimate for J&J’s 2023 earnings per share has increased from $10.67 to $10.75. During the same period, the estimate for JNJ’s 2024 earnings per share has increased from $11.01 to $11.30. Shares of JNJ have lost 2.2% in the past month.

JNJ beat estimates in each of the trailing four quarters, delivering an average earnings surprise of 5.58%.

In the past 90 days, the Zacks Consensus Estimate for Corcept’s 2023 earnings per share has gone up from 66 cents to 78 cents. The estimate for Corcept’s 2024 earnings per share has also improved from 64 cents to 83 cents. Shares of CORT have climbed 29.3% in the past month.

CORT’s earnings beat estimates in two of the trailing four quarters and missed the mark in the other two, delivering an average surprise of 6.99%.

In the past 90 days, the Zacks Consensus Estimate for Dynavax’s 2023 loss per share has narrowed from 56 cents to 24 cents. The estimate for Dynavax’s 2024 earnings per share is currently pegged at 2 cents. Shares of DVAX have risen by 3.6% in the past month.

DVAX’s earnings beat estimates in two of the trailing four quarters and missed the mark in the other two, delivering an average surprise of 25.78%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dynavax Technologies Corporation (DVAX) : Free Stock Analysis Report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Corcept Therapeutics Incorporated (CORT) : Free Stock Analysis Report

Armata Pharmaceuticals, Inc. (ARMP) : Free Stock Analysis Report