Armata Pharmaceuticals Inc (ARMP) Earnings: Navigates Through R&D to Narrow Losses

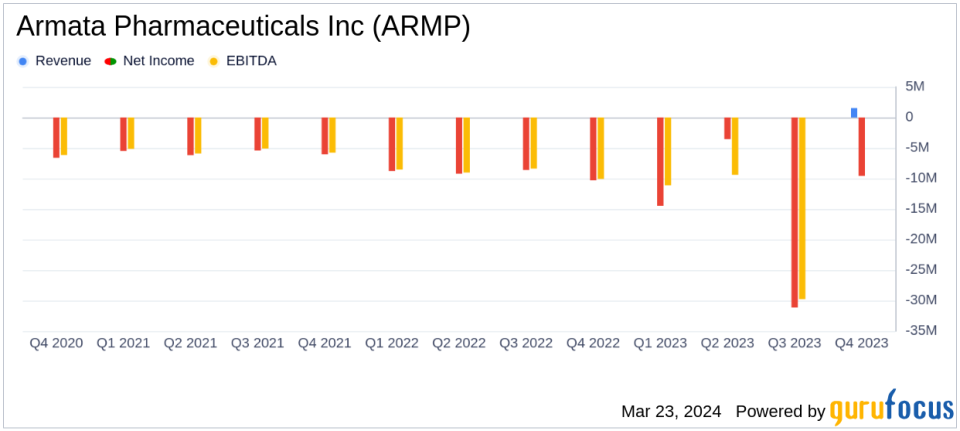

Revenue: Q4 grant revenue of $1.5 million, surpassing the estimated $1.071 million.

Net Loss: Q4 net loss of $19.8 million, a significant increase from the estimated -$12.371 million.

Earnings Per Share: Q4 EPS at -$0.55, more than double the estimated -$0.24.

Research and Development: Decreased R&D expenses to $7.9 million from $9.6 million year-over-year.

Cash Position: Cash and equivalents at $13.5 million, down from $14.9 million at the end of 2022.

Operational Milestones: Advancements in clinical trials and manufacturing capabilities for bacteriophage therapeutics.

On March 21, 2024, Armata Pharmaceuticals Inc (ARMP) released its 8-K filing, announcing the financial results for the fourth quarter and full year ended December 31, 2023. The company reported a quarterly grant revenue of approximately $1.5 million, which is higher than the estimated $1.071 million. However, the net loss widened significantly to $19.8 million, compared to the estimated -$12.371 million, and the earnings per share (EPS) for the quarter stood at -$0.55, which is more than double the analyst estimate of -$0.24.

Armata Pharmaceuticals Inc is at the forefront of developing pathogen-specific bacteriophage therapeutics for antibiotic-resistant and difficult-to-treat bacterial infections. The company is advancing a broad pipeline of natural and synthetic phage candidates, with clinical candidates for Pseudomonas aeruginosa and Staphylococcus aureus, among others. In collaboration with Merck, Armata is also developing proprietary synthetic phage candidates to target an undisclosed infectious disease agent. With a commitment to in-house phage specific GMP manufacturing, the company is poised to address the global challenge of antibiotic resistance.

Despite the challenges faced in the biotechnology industry, Armata Pharmaceuticals Inc (ARMP) has managed to reduce its research and development (R&D) expenses to $7.9 million from $9.6 million in the same quarter of the previous year. This strategic decrease in personnel costs and stock-based compensation expense reflects the company's commitment to optimizing operations while continuing to invest in its primary development programs. The company's CEO, Dr. Deborah Birx, highlighted the progress in clinical trials and the optimization of production capabilities to enhance the purity of phage candidates, which is believed to contribute to their favorable safety profile.

However, general and administrative expenses rose to $3.2 million, up from $1.8 million year-over-year, primarily due to increased legal and professional expenses related to fundraising activities. The loss from operations narrowed to $(9.6) million from $(10.3) million for the same period in 2022. The company's cash position decreased slightly to $13.5 million as of December 31, 2023, from $14.9 million at the end of the previous year.

Armata Pharmaceuticals Inc (ARMP) has also entered into a credit and security agreement for a loan of $35.0 million, bearing an annual interest rate of 14%, which matures on June 4, 2025. As of March 21, 2024, the company had approximately 36.1 million common shares outstanding.

The financial achievements and operational milestones of Armata Pharmaceuticals Inc (ARMP) are crucial as the company prepares for pivotal studies likely to commence in the first half of 2025. With the completion of its state-of-the-art manufacturing facility on the horizon, the company is well-positioned to support late-stage trials and commercial production. These developments are significant for investors and stakeholders in the biotechnology sector, as they demonstrate Armata's potential to become a leader in the development of phage-based therapeutics.

Overall, the financial results and corporate updates provided by Armata Pharmaceuticals Inc (ARMP) reflect a company that is making strategic advancements in its R&D efforts while managing expenses prudently. The progress in clinical trials and enhancements in manufacturing capabilities are promising signs for the future of the company's bacteriophage therapeutic candidates.

Explore the complete 8-K earnings release (here) from Armata Pharmaceuticals Inc for further details.

This article first appeared on GuruFocus.