ARMOUR Residential REIT Inc. Reports Solid Q4 Earnings with Increased Book Value Per Share

Net Income: $96.6 million or $1.96 per common share.

Net Interest Income: $5.8 million.

Distributable Earnings: $52.4 million, equating to $1.07 per common share.

Book Value: Increased to $22.54 per common share as of December 31, 2023.

Liquidity: $657.0 million, including cash and unencumbered securities.

Debt to Equity Ratio: 7.6 to 1, with implied leverage including TBA Securities at 8.0 to 1.

Dividends: Paid common stock dividends of $0.40 per share per month in Q4, adjusted to $0.24 per share per month for Q1 2024.

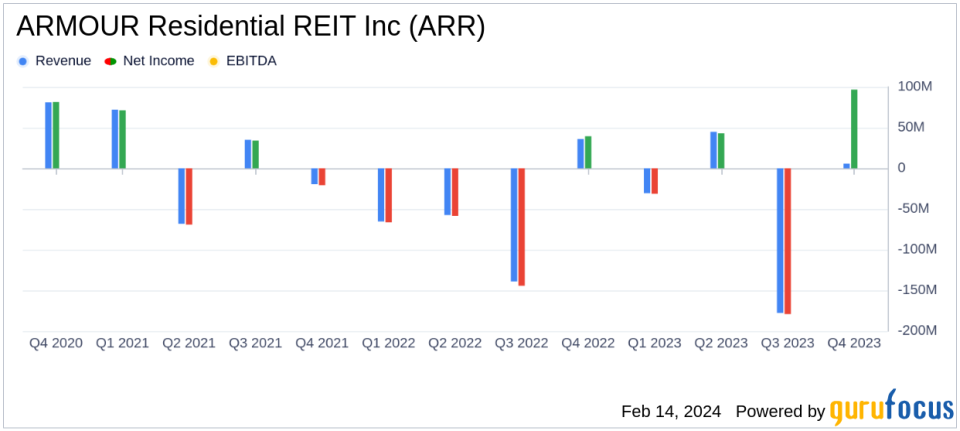

On February 14, 2024, ARMOUR Residential REIT Inc (NYSE:ARR) released its 8-K filing, announcing preliminary unaudited results for the fourth quarter of 2023. ARMOUR, a real estate investment trust specializing in residential mortgage-backed securities (RMBS), reported a net income attributable to common stockholders of $96.6 million, or $1.96 per common share, and a net interest income of $5.8 million for Q4 2023. The company's distributable earnings available to common stockholders stood at $52.4 million, representing $1.07 per common share.

ARMOUR's financial position as of December 31, 2023, showcased a book value per common share of $22.54, reflecting an increase from the previous quarter's $21.73. The company's liquidity, inclusive of cash and unencumbered agency and U.S. government securities, was reported at $657.0 million. The agency mortgage-backed securities portfolio totaled $11.5 billion, including To Be Announced (TBA) Security positions. ARMOUR's debt to equity ratio was 7.6 to 1, with implied leverage, including TBA Securities and forward settling sales and unsettled purchases, at 8.0 to 1.

Financial Performance and Challenges

The company's performance in Q4 2023 was marked by a significant recovery in net income compared to the previous quarter's loss, driven by gains on mortgage-backed securities (MBS) and a reduction in losses on interest rate swaps. However, ARMOUR faced challenges such as a decrease in the fair value of U.S. Treasury Securities and TBA Securities, as well as a loss on futures contracts. The importance of these performance metrics lies in their impact on the company's overall financial health and ability to generate income for shareholders.

ARMOUR's financial achievements, including the increase in book value per common share and solid liquidity position, are critical for the company and the REIT industry. These metrics indicate the company's ability to manage its portfolio effectively and maintain financial stability, which is essential for investor confidence and the company's capacity to sustain dividend payments.

Income Statement and Balance Sheet Summary

The condensed balance sheet as of December 31, 2023, showed total assets of $12.34 billion and total liabilities of $11.07 billion, resulting in total stockholders' equity of $1.27 billion. The condensed statements of operations for Q4 2023 reported a net income of $99.6 million, with a basic and diluted net income per share available to common stockholders of $1.98 and $1.96, respectively.

"The major drivers of the change in the Company's financial position were gains on MBS and amortization of prior unrealized losses, offset by losses on interest rate swaps and futures contracts," stated ARMOUR's management.

ARMOUR's financial tables highlighted the composition and performance of its investment securities, including agency fixed rates and agency CMBS, which are central to the company's investment strategy. The agency securities portfolio, valued at fair value, represented the largest portion of the company's assets.

Analysis of ARMOUR's Performance

ARMOUR's Q4 performance reflects a resilient strategy in a challenging interest rate environment. The company's ability to generate a positive net income and increase its book value per share demonstrates effective risk management and portfolio optimization. The adjustments to the common stock dividend rate for Q1 2024 indicate a cautious approach to maintaining financial flexibility and shareholder value.

For value investors and potential GuruFocus.com members, ARMOUR's latest earnings report presents a picture of a REIT that is navigating market volatility with a focus on maintaining a strong balance sheet and liquidity position. The company's performance metrics and financial stability make it a noteworthy consideration for those interested in the real estate investment trust sector.

For further details and insights into ARMOUR Residential REIT Inc's financial performance, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from ARMOUR Residential REIT Inc for further details.

This article first appeared on GuruFocus.