Armour Residential REIT Is at an Inflection Point

Armour Residential REIT Inc. (NYSE:ARR) announced a one-for-five reverse stock split on Tuesday as part of its dividend reinvestment plan. Although the company is set to lower its stock float with reinvested dividends, the mortgage real estate investment trust's common share dividends remain highly lucrative at 40 cents per share, adding allure to the asset's total return profile.

Mortgage REITs and Armour, in particular, provide an interesting talking point if one considers the current interest rate environment. As such, I decided to delve into the asset's prospects to weigh in on its recent events.

As such, here are a few related factors to consider.

Assessing Armour's portfolio

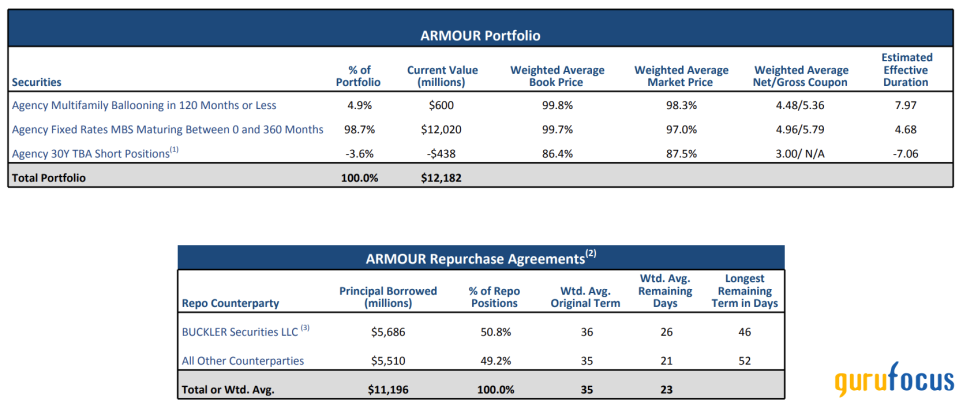

It was publically disseminated on Aug. 13 that 98.7% of Armour Residential's portfolio consists of fixed-rate mortgage-backed securities maturing between zero and 360 months. The asset value of the aforementioned equates to approximately $12 billion and averages out an effective duration of 4.68 years, meaning the highest point of cash inflows is likely to occur 4.68 years from today.

Furthermore, the REIT's current portfolio exposure includes $600 million in agency multifamily balloon payments with an effective duration of 7.97 years and $438 million in short positions on "To Be Announced" contracts in 30-year agency short positions.

Regarding the latter, Armour holds a $500 million short position in Fannie Mae's (FNMA) forward contracts. However, capital has been reallocated toward 9.5-year credit mortgage-backed securities. Thus, the majority of the company's short exposure is a hedging bet used to facilitate a "down on duration" move and not a speculative play on a standalone basis.

Source: Armour Residential REIT

As for commentary from my side, I believe the REIT's portfolio is well situated to reap the benefits from an inflection point in the current interest rate environment. I base this on the fact that Armour has locked in a substantial amount of its business at record-high mortgage rates in the past 12 months, allowing its fixed-rate instruments to generate significant cash flows.

Further, a potential interest rate pivot in early 2024 might send the aforementioned instruments' valuations higher as the negative correlation between interest rates and bond valuations takes effect. Moreover, credit spreads are on a downward trajectory as sentiment of an interest rate event continues to abate; lower credit spreads might lead to higher asset valuations, while Armour's cash flow benefits are retained on fixed-rate contracts.

Source: St. Louis Fed

Lastly, and as previously mentioned, Armour's short positions are being used to reduce its portfolio's duration. I believe a lower credit risk environment will assist shorter-duration assets unless a hard economic landing occurs.

Funding costs and prepayments

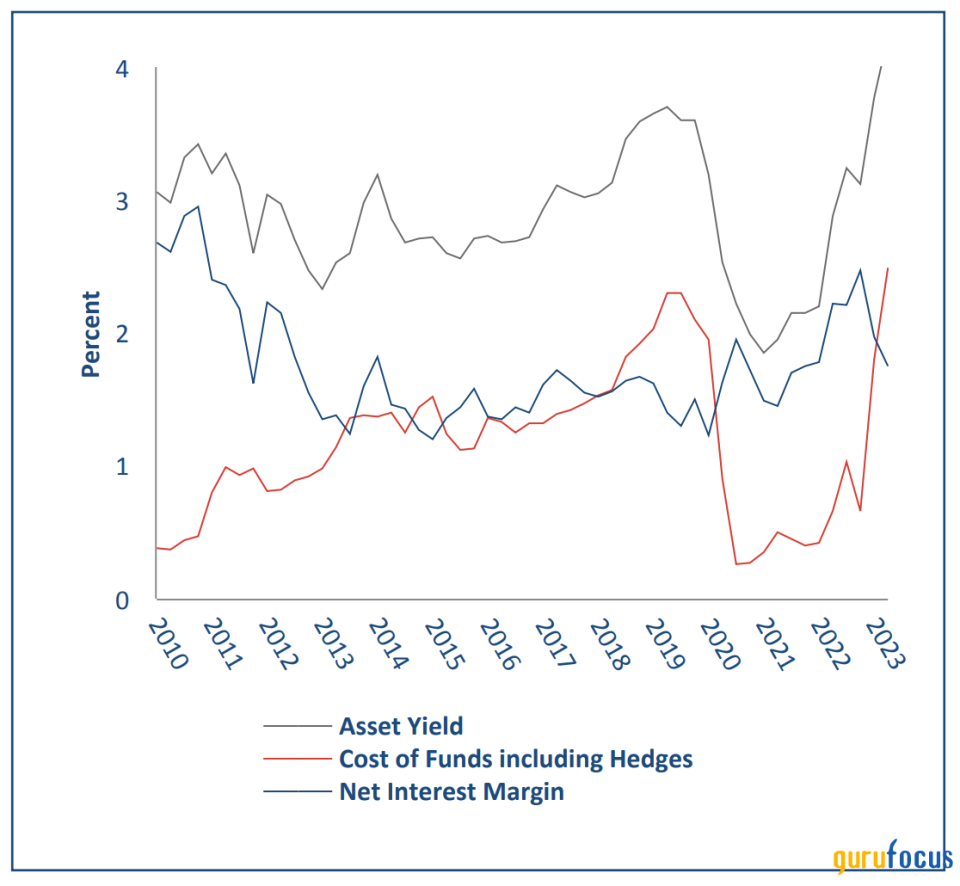

As with most businesses, Armour needs to fund its asset acquisitions externally. As things stand, its funding cost level remains below its asset yields, with a lag of nearly 1.5%. Approximately $11.196 billion of the company's funding stems from short-dated repurchase agreements, with the remaining horizon ranging between 46 to 52 days.

The fund attempts to utilize these funds and profit from basis mismatching, which is highly profitable in most circumstances but offers a lot of downside risk in volatile economic climates. As for now, I believe Armour will benefit from term and liquidity mismatches between its assets and liabilities; moreover, the fund has a considerable cushion between its funding costs and asset yields.

Source: Armour Residential

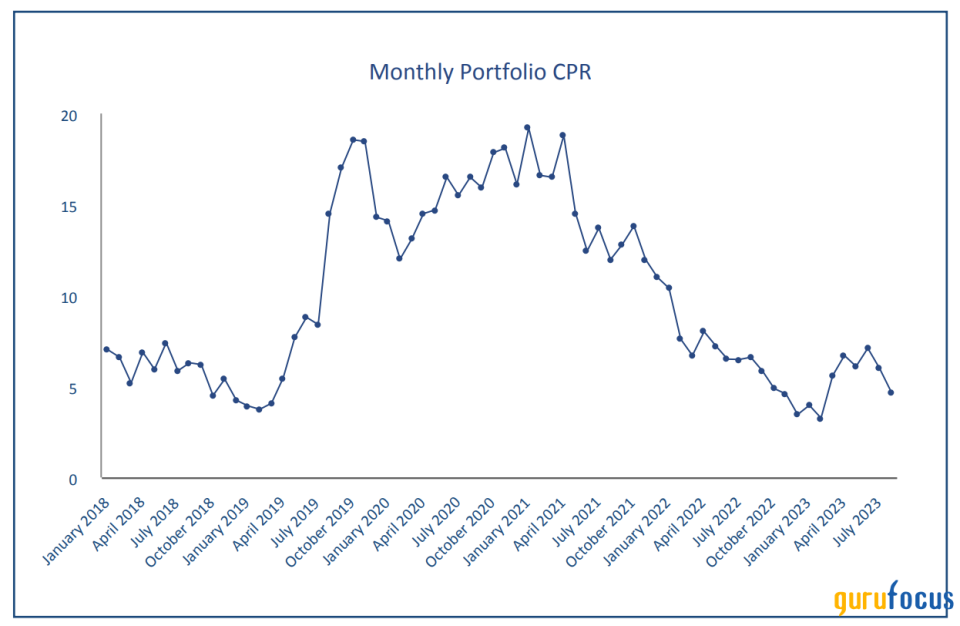

Further, Armour Residential's prepayment risk is at a multiyear low. A high volume of prepayments adds risk to a creditor's business model as it causes difficulties in predicting its cash flow distributions.

Sure, lower prepayments in a soft economic environment add to counterparty risk; however, unless a significant systemic event occurs, lower prepayments will likely remain a sentiment-based measure from debitors instead of an inability to pay.

Source: Armour Residential

Investor return outlook

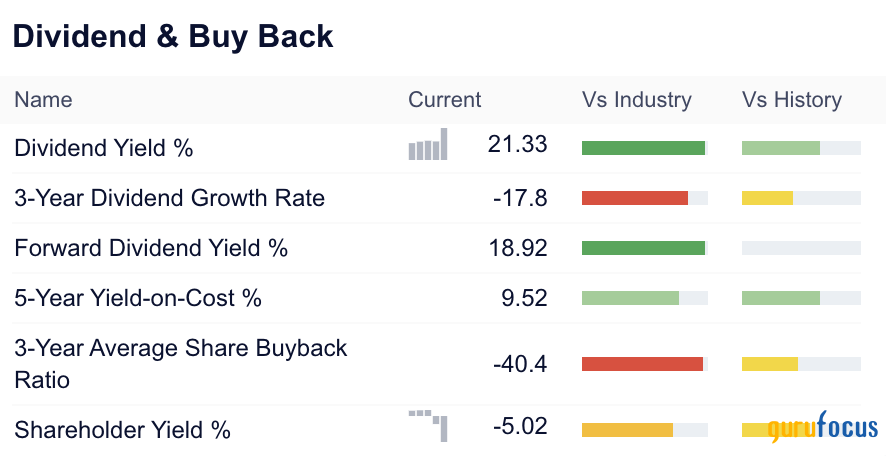

Armour Residential provides a dividend reinvestment plan to its investors to provide lucrative tax benefits. Although reinvestment plans provide cost basis and tax benefits, some investors prefer income-based investments, which remains an option under the company's shareholder remuneration umbrella as its reinvestment plan is optional.

For those interested in Armour's income-based prospects, the REIT has a forward dividend yield of 18.92%. Even though a bond vehicle's cash flows and value are often juxtaposed, Armour has significant exposure to fixed-rate instruments that are currently undervalued, as provided by the fund's tangible book value per share of 0.82.

Lucrative returns are not guaranteed; however, Armour's key metrics are well aligned.

Noteworthy tail risk

Unfortunately, investment returns are priced, meaning every asset has its inherent risks, and Armour Residential is no exception.

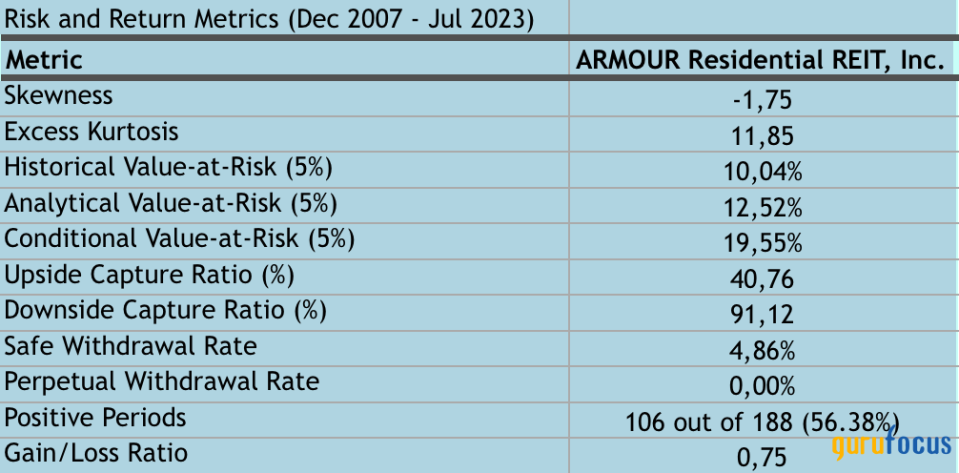

A noteworthy concern to point out is Armour's tail risk. As shown in the diagram below, the REIT's past returns possess negative skewness and a conditional value at risk of 19.55%. The prior means the company's significant drawdowns overshadow its occasional surges, while the latter suggests that the asset loses approximately 19.55% in 5% of its traded months, which includes severe economic tail risk.

Source: Author's work; Data from Portfolio Visualizer

Concluding thoughts

Key data points combined with qualitative analysis suggest Armour Residential REIT is well-placed to benefit from an inflection point in the U.S.'s interest rate environment.

The mortgage REIT secured lucrative fixed cash flows at the top of the lending cycle and might receive substantial valuation tailwinds amid a pivot in interest rates and credit spreads. Moreover, a solid total return profile accompanied by a seemingly undervalued asset base provides much allure to the asset.

This article first appeared on GuruFocus.