Armstrong World Industries Inc Reports Record Results for Q4 and Full-Year 2023

Net Sales: Increased by 3% in Q4 and 5% for the full year, driven by strong AUV performance.

Operating Income: Grew by 16% for the full year, with a 6% decline in Q4 due to acquisition-related expenses.

Adjusted EBITDA: Rose by 7% in Q4 and 12% for the full year, reflecting margin expansion.

Diluted EPS: From continuing operations up by 16% for the full year, despite a 1% decrease in Q4.

Adjusted Free Cash Flow: Increased by 19% for the full year, highlighting strong cash generation.

2024 Guidance: Projects net sales growth of 3% to 6% and adjusted EBITDA growth of 5% to 9%.

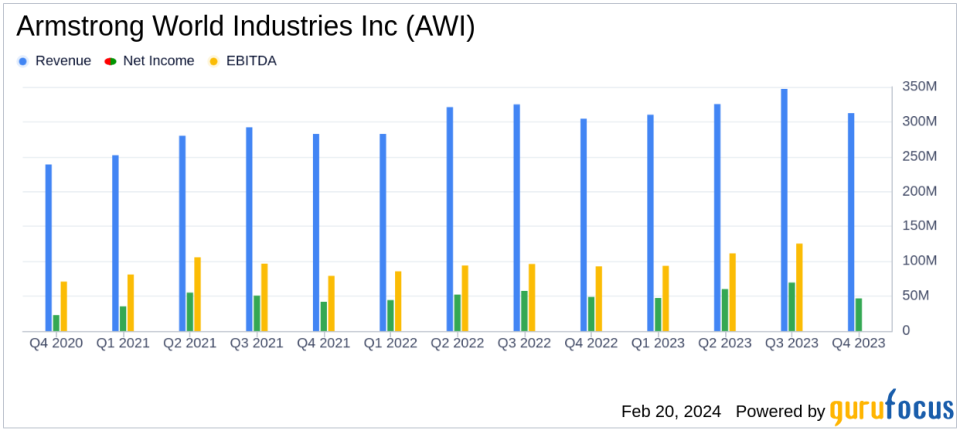

On February 20, 2024, Armstrong World Industries Inc (NYSE:AWI) released its 8-K filing, announcing record-setting financial results for the fourth quarter and full year of 2023. The company, a leader in the design and manufacture of ceiling and wall solutions in the Americas, reported a net sales increase of 3% in Q4 and 5% for the full year, attributing the growth to strong Average Unit Value (AUV) performance and better-than-expected Mineral Fiber volumes.

Despite facing soft market conditions, AWI achieved a 16% increase in operating income and a 12% rise in adjusted EBITDA for the full year. However, Q4 operating income saw a 6% decline primarily due to acquisition-related expenses, while adjusted operating income increased by 5%. Diluted earnings per share from continuing operations were down by 1% in Q4 but up by 16% for the full year.

President and CEO Vic Grizzle commented on the results, stating,

We delivered record fourth quarter net sales and adjusted EBITDA results, highlighted by adjusted EBITDA margin expansion in both our segments while continuing to face soft market conditions. These results contributed to record-setting sales and adjusted EBITDA for the full year that exceeded our guidance expectations."

Financial Performance Analysis

AWI's Mineral Fiber segment reported a 2.0% increase in net sales for Q4, driven by favorable AUV and higher volumes. The Architectural Specialties segment saw a 4.0% increase in net sales, primarily due to contributions from recent acquisitions. Full-year net sales were bolstered by favorable AUV and higher sales volumes, with Mineral Fiber net sales increasing by $45 million and Architectural Specialties by $17 million.

Operating income for the full year was positively impacted by a $33 million AUV benefit, a $23 million margin benefit from increased Architectural Specialties sales, and a $12 million increase in WAVE equity earnings. Cash flow from operating and investing activities was up by 6%, and adjusted free cash flow grew by 19%, demonstrating AWI's strong cash generation capabilities.

AWI's share repurchase program continued in Q4 with the repurchase of 0.4 million shares for $35 million. For the full year, 1.8 million shares were repurchased for $132 million. As of December 31, 2023, $717 million remained under the current authorized share repurchase program.

Looking Ahead: 2024 Outlook

Senior Vice President and CFO Chris Calzaretta provided insights into the company's future, stating,

Our 2024 outlook reflects a laser-focused approach to delivering profitable growth, margin expansion and adjusted free cash flow growth despite modestly softer economic conditions. Our capital allocation priorities remain unchanged as we continue to execute our strategy and create value for shareholders."

For 2024, AWI anticipates net sales growth of 3% to 6% and adjusted EBITDA growth of 5% to 9%, with adjusted diluted net earnings per share expected to increase by 5% to 11% and adjusted free cash flow by 5% to 10%.

Investors and analysts can access more details on AWI's performance in its Form 10-K for the year ended December 31, 2023, which the company expects to file with the SEC today. A live webcast conference call discussing the fourth-quarter and full-year 2023 results will also be available on the company's website.

For more information on Armstrong World Industries Inc's financial results and future outlook, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Armstrong World Industries Inc for further details.

This article first appeared on GuruFocus.