Arnold Schneider Adds to Chesapeake Energy, Mallinckrodt Positions

- By Tiziano Frateschi

Arnold Schneider (Trades, Portfolio), founder and chief investment officer of Schneider Capital Management, released his fourth-quarter portfolio on Tuesday. The following are his top buys of the quarter.

Warning! GuruFocus has detected 5 Warning Signs with CHK. Click here to check it out.

The intrinsic value of CHK

The Chesapeake Energy Corp. (CHK) holding was increased 80.81%, expanding the portfolio by 3.97%.

The oil and gas producer has a market cap of $2.49 billion and an enterprise value of $14.31 billion.

GuruFocus gives the company a profitability and growth rating of 5 out of 10. Its return on assets (ROA) of 2.24% and return on capital (ROC) of 5.20% are outperforming 71% of companies in the Global Oil and Gas E&P industry. Its financial strength is rated 3 out of 10. The cash-debt ratio is -0.08.

The company's largest shareholder among the gurus is Mason Hawkins (Trades, Portfolio) with 4.72% of outstanding shares, followed by Bill Nygren (Trades, Portfolio) with 2.2% and Barrow, Hanley, Mewhinney & Strauss with 1.18%.

Schneider boosted his Mallinckrodt PLC (MNK) position by 417.20%, impacting the portfolio by 3.29%.

The drug manufacturer has a market cap of $1.52 billion and an enterprise value of $6.98 billion.

GuruFocus gives the company a profitability and growth rating of 5 out of 10. While its return on equtiy (ROE) of 7.28% is outperforming the sector, its ROA of 2.49% is underperforming 54% of companies in the Global Drug Manufacturers, Specialty and Generic industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.06 is below the industry median of 2.31.

John Paulson (Trades, Portfolio) is the company's largest guru shareholder with 6.98% of outstanding shares, followed by Steven Cohen (Trades, Portfolio) with 0.62% and Chuck Royce (Trades, Portfolio) with 0.43%.

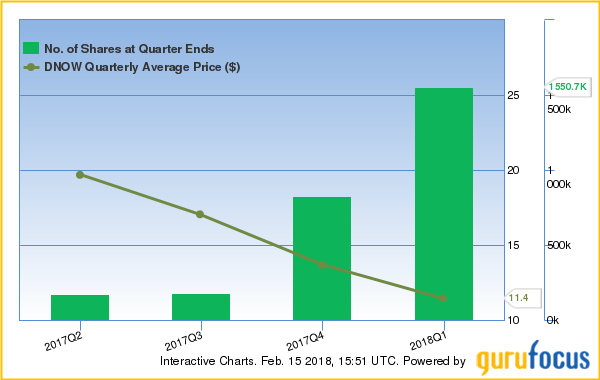

The investor added 87.58% to his Now Inc. (DNOW) stake. The transaction had an impact of 1.75% on the portfolio.

The oil and gas equipment services company has a market cap of $1.05 billion and an enterprise value of $1.12 billion.

GuruFocus gives the company a profitability and growth rating of 5 out of 10. The ROE of -10.02% and ROA of -7.10% are underperforming 68% of companies in the Global Oil and Gas Equipment and Services industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.61 is above the industry median of 0.49.

First Eagle Investment (Trades, Portfolio) is Now's largest shareholder among the gurus with 7.3% of outstanding shares, followed by Schneider with 1.44%, CI Can Am Small Cap (Trades, Portfolio) with 0.21% and Jim Simons (Trades, Portfolio) with 0.16%.

Schneider increased his holding in Alexander & Baldwin Inc. (ALEX) by 45.13%. The portfolio was impacted by 0.63%.

The real estate investment trust has a market cap of $1.64 billion and an enterprise value of $2.26 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. Its ROE of 1.37% and ROA of 0.76% are underperforming 84% of companies in the Global REIT - Diversified industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.02 is below the industry median of 0.07.

Another notable guru shareholder of the company is Ron Baron (Trades, Portfolio) with 0.2% of outstanding shares, followed by Charles Brandes (Trades, Portfolio) with 0.07%.

The guru boosted his stake in KeyCorp (KEY) by 10.80%. The trade had an impact of 0.6% on the portfolio.

The bank has a market cap of $21.97 billion and an enterprise value of $34.16 billion.

GuruFocus gives the company a profitability and growth rating of 5 out of 10. While its ROE of 8.09% is underperforming the sector, its ROA of 0.95% is outperforming 57% of companies in the Global Banks - Regional - US industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.05 is below the industry median of 2.10.

With 2.19% of outstanding shares, Barrow, Hanley, Mewhinney & Strauss is the company's largest guru shareholder, followed by the T Rowe Price Equity Income Fund (Trades, Portfolio) with 0.84%, Richard Pzena (Trades, Portfolio) with 0.65% and Pioneer Investments (Trades, Portfolio) with 0.34%.

Schneider established a position in Everest Re Group Ltd. (RE), giving it 0.48% portfolio space.

The insurance company has a market cap of $9.73 billion and an enterprise value of $9.21 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. While its ROE of 5.60% is underperforming the sector, its ROA of 2.06% is outperforming 53% of companies in the Global Insurance - Reinsurance industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 1 is above the industry median of 0.57.

The company's largest shareholder among the gurus is Donald Smith (Trades, Portfolio) with 0.84% of outstanding shares, followed by Chris Davis (Trades, Portfolio) with 0.56%.

Schneider boosted his position in Ardmore Shipping Corp. (ASC) by 41.94%, which had an impact of 0.43% on the portfolio.

The company, which owns and operates a fleet of oil and chemical tankers, has a market cap of $235.03 million and an enterprise value of $642.49 million.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. Its ROE of -3.15% and ROA of -1.44% are underperforming 49% of competitors. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.09 is below the industry median 0.32.

Smith is the company's largest guru shareholder with 9.12% of outstanding shares, followed by Royce with 6.28%, Schneider with 2.48% and Arnold Van Den Berg (Trades, Portfolio) with 2.32%.

The investor established a 102,730-share holding in Range Resources Corp. (RRC), expanding the portfolio by 0.38%.

The oil producer has a market cap of $3.16 billion and an enterprise value of $7.14 billion.

GuruFocus gives the company a profitability and growth rating of 5 out of 10. Its ROE of -0.90% and ROA of -0.43% are outperforming 58% of companies in the Global Oil and Gas E&P industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.48 is below the industry median of 0.56.

With 0.75% of outstanding shares, John Griffin (Trades, Portfolio) is the company's largest guru shareholder, followed by Cohen with 0.71% and Richard Snow (Trades, Portfolio) with 0.68%.

Disclosure: I do not own any stocks mentioned in this article.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 5 Warning Signs with CHK. Click here to check it out.

The intrinsic value of CHK