Arnold Van Den Berg's Q2 2023 Portfolio Update

Renowned investment firm, Arnold Van Den Berg, recently disclosed its portfolio for the second quarter of 2023, which concluded on June 30, 2023. The firm, led by Arnold Van Den Berg (Trades, Portfolio), is known for its value-oriented investment philosophy, focusing on companies with strong fundamentals and attractive valuations. This approach has led to a diverse portfolio of 106 stocks, valued at $278 million.

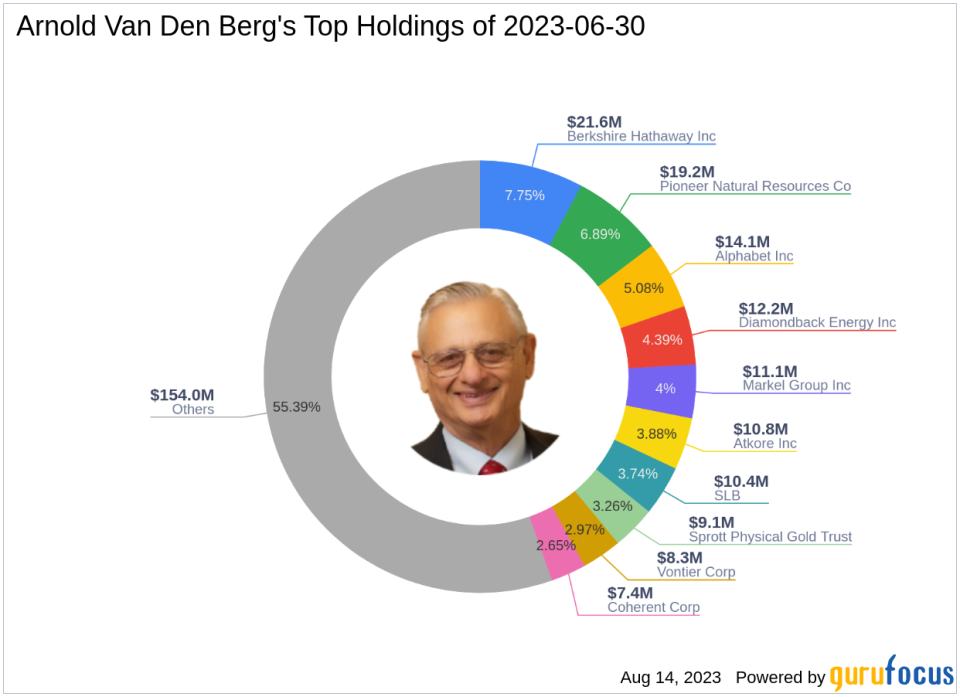

Top Holdings

The firm's top holdings for the quarter were BRK.B (7.75%), PXD (6.89%), and GOOG (5.08%). These stocks represent a mix of sectors, reflecting the firm's diversified investment strategy.

Significant Trades

Among the notable trades of the quarter, Arnold Van Den Berg (Trades, Portfolio) significantly reduced its stake in Powell Industries Inc (NAS:POWL) by 90,642 shares, impacting the equity portfolio by 1.44%. The stock traded at an average price of $51.81 during the quarter. As of August 14, 2023, POWL's price stood at $80.56, with a market cap of $955.49 million. The stock has seen a substantial return of 202.49% over the past year. GuruFocus rates the company's financial strength and profitability at 8/10 and 6/10, respectively. The valuation ratios indicate a price-earnings ratio of 26.41, a price-book ratio of 2.95, a EV-to-Ebitda ratio of 14.46, and a price-sales ratio of 1.51.

The firm also increased its position in Coherent Corp (NYSE:COHR), purchasing an additional 48,186 shares for a total holding of 144,292 shares. This trade had a 0.88% impact on the equity portfolio. The stock traded at an average price of $37.13 during the quarter. As of August 14, 2023, COHR's price was $47.2, with a market cap of $6.58 billion. Despite a negative return of -11.26% over the past year, the firm's investment suggests confidence in the company's future performance. GuruFocus rates the company's financial strength and profitability at 5/10 and 9/10, respectively. The valuation ratios show a price-book ratio of 1.37, a EV-to-Ebitda ratio of 17.25, and a price-sales ratio of 1.28.

Lastly, the firm reduced its stake in AmerisourceBergen Corp (NYSE:ABC) by 14,196 shares, impacting the equity portfolio by 0.85%. The stock traded at an average price of $172.83 during the quarter. As of August 14, 2023, ABC's price was $187.57, with a market cap of $37.67 billion. The stock has returned 26.05% over the past year. GuruFocus rates the company's financial strength and profitability at 6/10 and 7/10, respectively. The valuation ratios indicate a price-earnings ratio of 22.85, a price-book ratio of 55.33, a EV-to-Ebitda ratio of 12.77, and a price-sales ratio of 0.15.

In conclusion, Arnold Van Den Berg (Trades, Portfolio)'s Q2 2023 portfolio update reveals a strategic mix of holdings and trades, reflecting the firm's value-oriented investment philosophy. The firm's moves provide valuable insights for investors looking to understand market trends and potential investment opportunities.

This article first appeared on GuruFocus.