Arrow Electronics (ARW) Q4 Earnings Top Estimates, Sales Decline Y/Y

Arrow Electronics ARW reported fourth-quarter 2023 adjusted earnings of $3.98 per share, which beat the Zacks Consensus Estimate by 7.57%. However, the bottom line declined 30% on a year-over-year basis (down 31% in cc) due to lower revenues and unfavorable foreign currency exchange rates.

In the fourth quarter, ARW reported revenues of $7.84 billion, down 16% from the year-ago quarter's level (down 31% at cc). The top line beat the Zacks Consensus Estimate by 0.41% due to the adverse impact of foreign exchange rates.

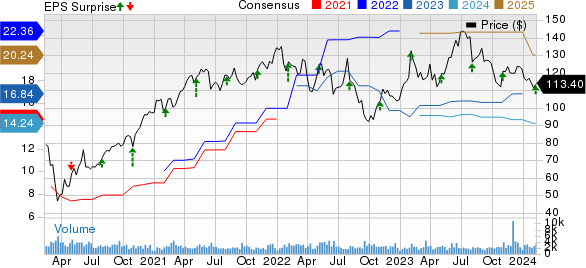

Arrow Electronics, Inc. Price, Consensus and EPS Surprise

Arrow Electronics, Inc. price-consensus-eps-surprise-chart | Arrow Electronics, Inc. Quote

Fourth-Quarter Details

In the fourth quarter of 2023, global component sales decreased 17% year over year to $5.6 billion due to the ongoing semiconductor inventory correction. Region-wise, the segment’s revenues from EMEA declined 14%, while the same from the Americas and Asia-Pacific regions plunged 23% and 15%, respectively.

Global Enterprise Computing Solutions (ECS) revenues totaled $2.21 billion, which decreased 11% year over year. Region-wise, the segment’s revenues from America and Europe declined 18% and 2%, respectively.

The non-GAAP operating income from Global Components and Global ECS came in at $288 million and $146 million, respectively.

Arrow Electronics’ non-GAAP operating income plunged 32% to $364 million from the year-ago quarter's level. The non-GAAP operating margin shrunk 110 basis points to 4.6%.

Balance Sheet and Cash Flow

Arrow Electronics exited the fourth quarter with cash and cash equivalents of $218.05 million compared with the previous quarter’s $333.2 million.

The long-term debt was $2.15 billion, down from $2.61 billion at the end of the previous quarter.

The New York-based electronic component distributor generated $286.7 million in cash from operating activities in the reported quarter.

In the reported quarter, ARW returned $50 million to its shareholders through share repurchases. It has approximately $580 million remaining under its current share repurchase authorization.

First-Quarter 2024 Guidance

For the first quarter of 2024, sales are estimated between $6.7 billion and $7.3 billion.

Global Components sales are projected in the band of $5-$5.4 billion. Global ECS sales are anticipated between $1.7 billion and $1.9 billion.

Interest expenses are expected to be $80 million. As a result, the company projects diluted earnings per share in the band of $1.95-$2.15.

Arrow Electronics expects changes in foreign currencies to increase first-quarter sales by $31 million and earnings per share by 2 cents on a quarter-over-quarter basis.

Zacks Rank & Stocks to Consider

Currently, Arrow Electronics carries a Zacks Rank #4 (Sell). Shares of ARW have lost 7.2% year to date.

Some better-ranked stocks from the broader Computer and Technology sector are BlackLine BL, Arista Networks ANET and Badger Meter BMI. While BlackLine and Arista Networks sport a Zacks Rank #1 (Strong Buy) each, Badger Meter carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of BlackLine have lost 3.5% in the year-to-date period. The long-term earnings growth rate for BL is 50.56%.

Shares of Arista Networks have risen 13.7% in the year-to-date period. The long-term earnings growth rate for ANET is 20.15%.

Shares of Badger Meter have lost 7.3% in the year-to-date period. The long-term earnings growth rate for BMI is 12.27%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Arrow Electronics, Inc. (ARW) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

BlackLine (BL) : Free Stock Analysis Report