Arrow Electronics Inc (ARW) Navigates Market Challenges with Solid Year-End Cash Flow

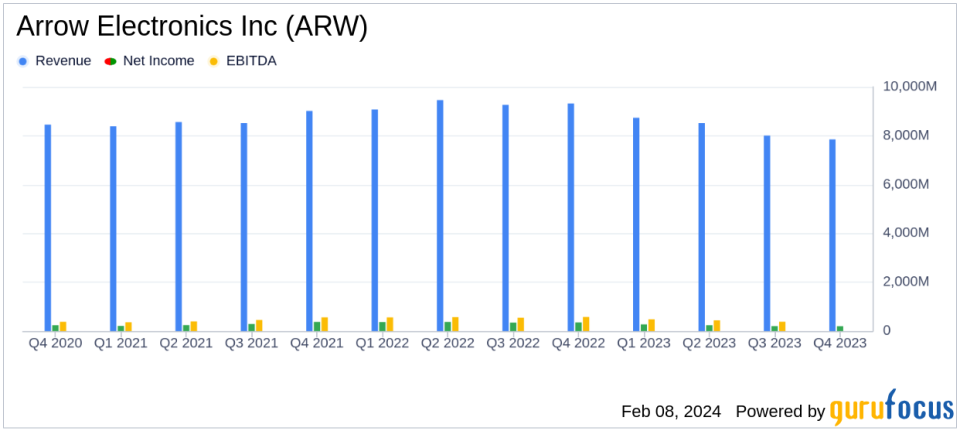

Q4 Sales: $7.849 billion, in line with guidance but down 16% year-over-year.

Q4 Earnings Per Share: $3.54 GAAP and $3.98 non-GAAP, both exceeding guidance.

Full-Year Sales: $33.107 billion, an 11% decrease from the previous year.

Full-Year Net Income: $904 million, reflecting a decrease from $1.427 billion in the prior year.

Operational Cash Flow: Generated $705 million for the full year, with $287 million in Q4.

Share Repurchase: Approximately $750 million of shares repurchased throughout the year.

On February 8, 2024, Arrow Electronics Inc (NYSE:ARW) released its 8-K filing, detailing the financial outcomes for the fourth quarter and the full fiscal year of 2023. Arrow Electronics, a global provider of electronic components and enterprise computing solutions, reported a dip in sales but managed to exceed earnings expectations, highlighting the company's resilience in a challenging market.

Company Overview

Arrow Electronics operates through two main business segments: components and enterprise computing solutions. The company offers a wide range of products and services to industrial and commercial users of electronic components and enterprise computing solutions. Arrow's extensive portfolio and services aim to help customers accelerate time to market and enhance competitiveness in a rapidly evolving industry.

Financial Performance and Challenges

For the fourth quarter of 2023, Arrow Electronics reported consolidated sales of $7.849 billion, a 16% decrease compared to the same quarter in the previous year. The company's net income attributable to shareholders was $195 million, with GAAP earnings per diluted share at $3.54 and non-GAAP earnings at $3.98, both surpassing the high end of Arrow's guidance. The full-year sales saw an 11% year-over-year decrease, totaling $33.107 billion, with net income for the year at $904 million.

Despite the sales decline, Arrow's ability to exceed earnings expectations is significant as it demonstrates the company's operational efficiency and ability to manage costs effectively. The electronic components and IT spending markets faced headwinds, including excess inventory and softer demand, which Arrow navigated by focusing on cash flow generation and share repurchases.

Financial Achievements and Importance

Arrow's financial achievements in a challenging market underscore the importance of robust cash flow management and strategic capital allocation. The company generated a healthy $705 million in cash flow from operations for the year and strategically repurchased approximately $750 million of shares, signaling confidence in its long-term value proposition. These actions are particularly important for hardware companies like Arrow, where market volatility can significantly impact sales and earnings.

Key Financial Metrics

Arrow's financial strength is further evidenced by its operational cash flow, which stood at $287 million for the fourth quarter. The company also reduced its inventory by more than $600 million sequentially, showcasing its effective working capital management. With a remaining purchase authorization of approximately $580 million, Arrow is well-positioned to continue its share repurchase program, providing potential value to shareholders.

"Despite excess inventory throughout the supply chain leading to softer demand in our components business, and a mixed IT spending environment for our enterprise computing solutions business, full-year 2023 results were solid," said Sean Kerins, Arrows president, and chief executive officer.

Analysis of Company's Performance

Arrow's performance in the fourth quarter and full-year 2023 reflects a company adept at navigating market challenges. The decrease in sales is a reflection of broader industry trends, yet the company's ability to surpass earnings estimates and maintain strong cash flow is a testament to its operational excellence and strategic focus. Arrow's commitment to growth initiatives, even in a difficult market, positions it to leverage its differentiated value proposition effectively.

As Arrow Electronics looks ahead to the first quarter of 2024, the company remains cautious about market dynamics but is focused on managing its cost structure and working capital. With a solid track record of execution and a clear strategy for growth, Arrow is poised to continue delivering value to its suppliers, customers, and shareholders.

For more detailed information and financial tables, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Arrow Electronics Inc for further details.

This article first appeared on GuruFocus.