Arrowhead Pharmaceuticals Inc CFO Kenneth Myszkowski Sells 40,000 Shares

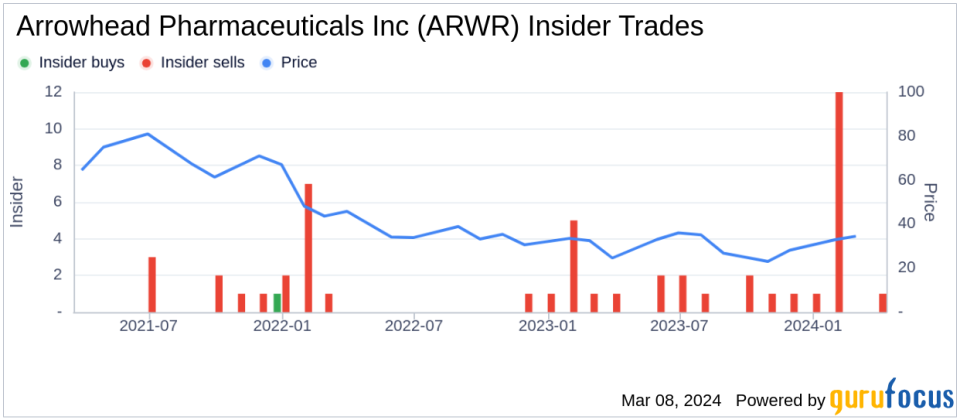

Arrowhead Pharmaceuticals Inc (NASDAQ:ARWR) CFO Kenneth Myszkowski sold 40,000 shares of the company's stock on March 6, 2024, according to a recent SEC filing. The transaction was executed at an average price of $35.19 per share, resulting in a total value of $1,407,600.Arrowhead Pharmaceuticals Inc is a biopharmaceutical company that develops medicines to treat intractable diseases by silencing the genes that cause them. Using a broad portfolio of RNA chemistries and efficient modes of delivery, Arrowhead therapies trigger the RNA interference mechanism to induce rapid, deep, and durable knockdown of target genes.Over the past year, Kenneth Myszkowski has sold a total of 71,104 shares of Arrowhead Pharmaceuticals Inc and has not made any purchases of the stock. The insider transaction history for the company shows a pattern of 23 insider sells and no insider buys over the same timeframe.

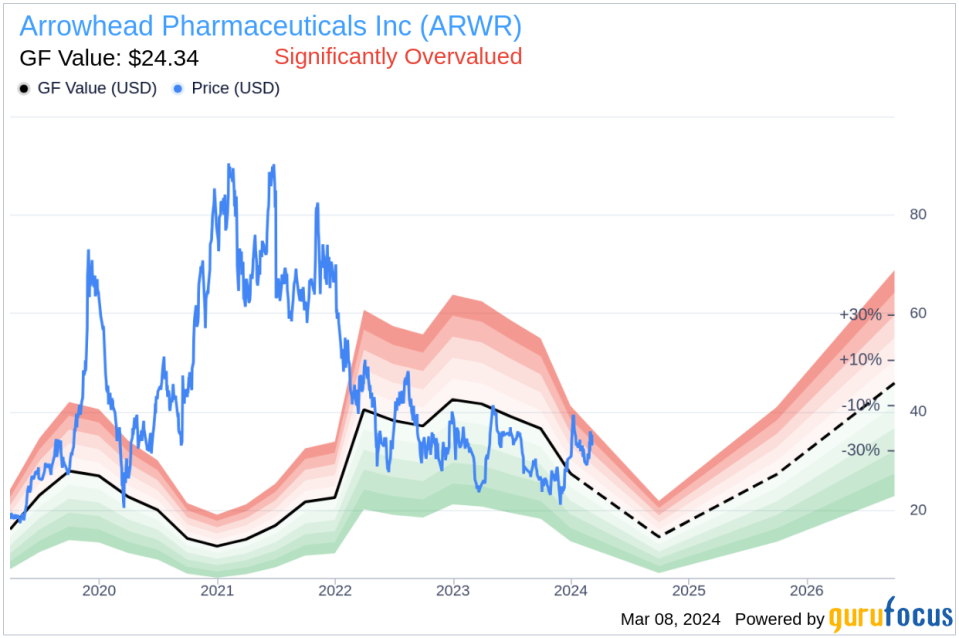

On the day of the insider's recent sale, shares of Arrowhead Pharmaceuticals Inc were trading at $35.19, giving the company a market capitalization of $4.145 billion.The stock's valuation, according to GuruFocus, indicates that Arrowhead Pharmaceuticals Inc is significantly overvalued. The price-to-GF-Value ratio stands at 1.45, with the GF Value estimated at $24.34 per share. The GF Value is a proprietary intrinsic value estimate from GuruFocus, which is calculated based on historical trading multiples, an adjustment factor for past returns and growth, and future business performance estimates from Morningstar analysts.

The recent insider sell by CFO Kenneth Myszkowski may provide investors with insight into the company's current valuation and insider sentiment. However, it is important for investors to consider a range of factors, including broader market conditions and the company's future growth prospects, when evaluating the significance of insider transactions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.