Arrowhead Pharmaceuticals, Inc.'s (NASDAQ:ARWR) Shares Climb 25% But Its Business Is Yet to Catch Up

Those holding Arrowhead Pharmaceuticals, Inc. (NASDAQ:ARWR) shares would be relieved that the share price has rebounded 25% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 31% over that time.

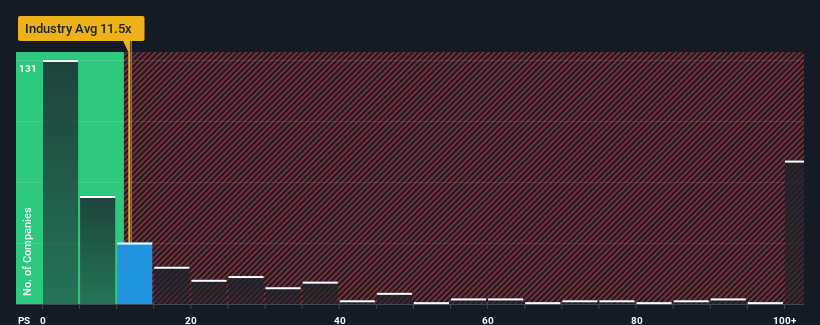

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Arrowhead Pharmaceuticals' P/S ratio of 11.9x, since the median price-to-sales (or "P/S") ratio for the Biotechs industry in the United States is also close to 11.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Arrowhead Pharmaceuticals

How Has Arrowhead Pharmaceuticals Performed Recently?

Recent times have been advantageous for Arrowhead Pharmaceuticals as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on Arrowhead Pharmaceuticals will help you uncover what's on the horizon.

How Is Arrowhead Pharmaceuticals' Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Arrowhead Pharmaceuticals' to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 93% last year. The latest three year period has also seen an excellent 70% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the analysts covering the company suggest revenue growth is heading into negative territory, declining 1.4% each year over the next three years. That's not great when the rest of the industry is expected to grow by 92% per year.

With this information, we find it concerning that Arrowhead Pharmaceuticals is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Key Takeaway

Arrowhead Pharmaceuticals' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

While Arrowhead Pharmaceuticals' P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Arrowhead Pharmaceuticals (of which 1 shouldn't be ignored!) you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here