ArrowMark Colorado Holdings LLC Boosts Stake in Axogen Inc

ArrowMark Colorado Holdings LLC (Trades, Portfolio), a Denver-based investment firm, has recently increased its stake in Axogen Inc. This article will delve into the details of the transaction, provide an overview of both the guru and the traded company, and analyze the stock's performance. We will also compare ArrowMark's holdings with the largest guru investor in Axogen Inc.

Details of the Transaction

On July 31, 2023, ArrowMark Colorado Holdings LLC (Trades, Portfolio) added 774,018 shares of Axogen Inc to its portfolio. This transaction, priced at $8.64 per share, increased the firm's total holdings in Axogen to 4,431,629 shares. The addition had a 0.08% impact on ArrowMark's portfolio and increased its stake in Axogen Inc to 10.34%.

Profile of ArrowMark Colorado Holdings LLC (Trades, Portfolio)

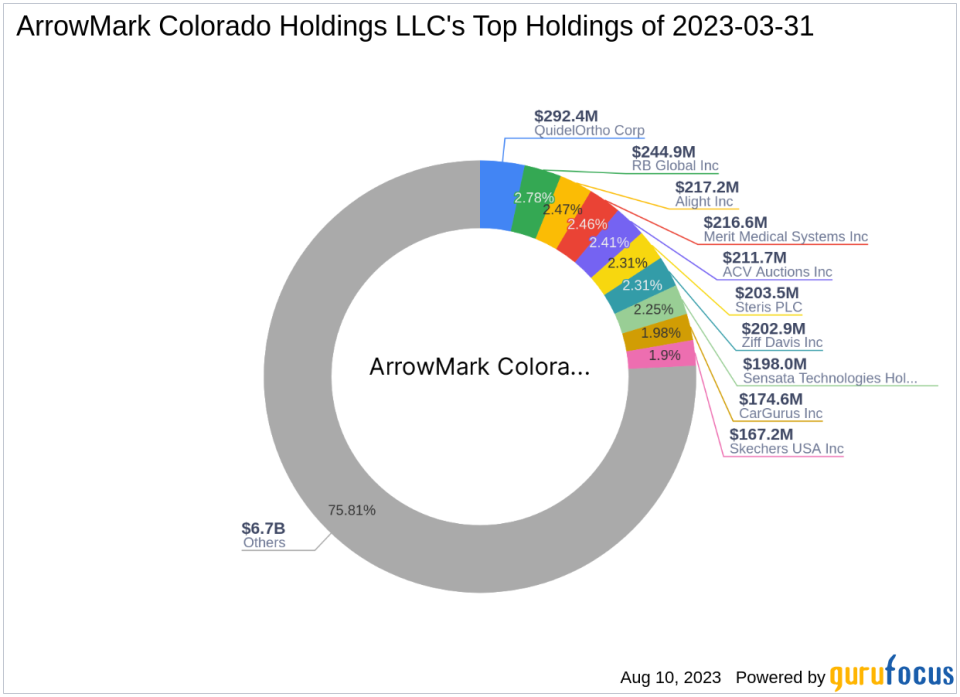

ArrowMark Colorado Holdings LLC (Trades, Portfolio) is an investment firm based in Denver, Colorado. The firm manages a diverse portfolio of 307 stocks, with a total equity of $8.8 billion. Its top holdings include Merit Medical Systems Inc(NASDAQ:MMSI), QuidelOrtho Corp(NASDAQ:QDEL), RB Global Inc(NYSE:RBA), ACV Auctions Inc(NASDAQ:ACVA), and Alight Inc(NYSE:ALIT). The firm's investment philosophy is primarily focused on the healthcare and technology sectors.

Profile of Axogen Inc

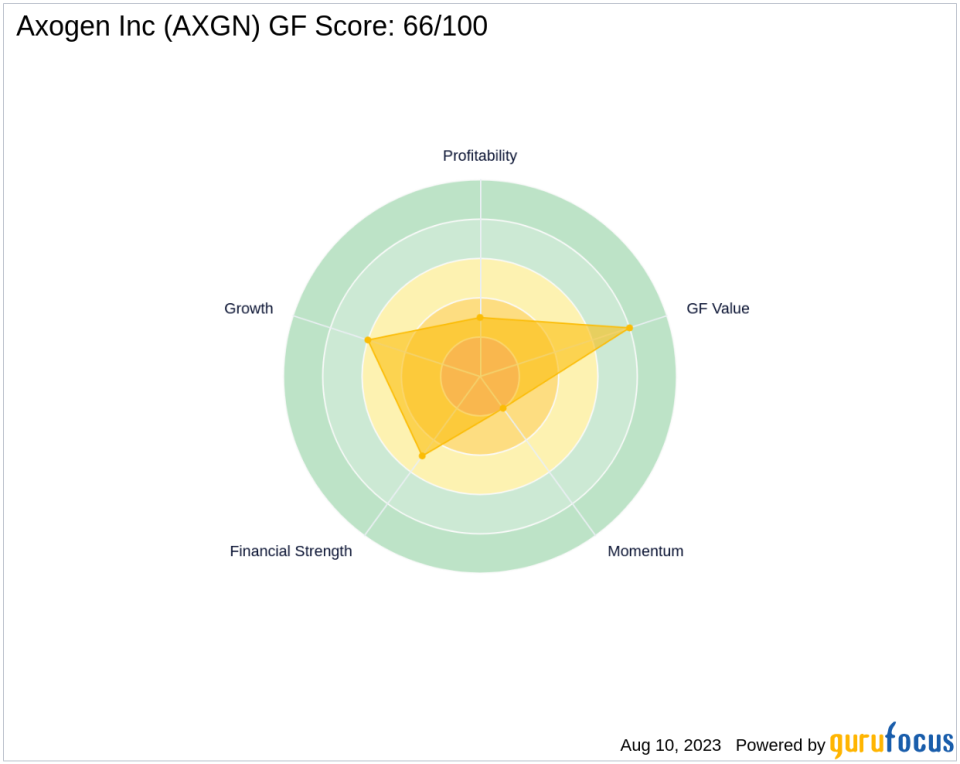

Axogen Inc, a US-based company, specializes in the science, development, and commercialization of technologies for peripheral nerve regeneration and repair. The company's products are available in several countries, including the United States, Canada, Germany, the United Kingdom, Spain, and South Korea. As of August 10, 2023, Axogen Inc has a market capitalization of $271.632 million and a current stock price of $6.32. The company's GF Score is 66/100, indicating a moderate future performance potential.

Analysis of the Stock's Performance

Since the transaction, Axogen Inc's stock has decreased by 26.85%. However, since its IPO in 1986, the stock has seen a 58% increase. The company's year-to-date price change ratio stands at -36.03%. Axogen Inc's financial strength is ranked 5/10, its profitability rank is 3/10, and its growth rank is 6/10. The company's GF Value Rank is 8/10, indicating that the stock is undervalued.

Comparison with the Largest Guru

The largest guru investor in Axogen Inc is GAMCO Investors. However, the exact share percentage held by GAMCO Investors is not available at the moment. Despite this, ArrowMark Colorado Holdings LLC (Trades, Portfolio)'s 10.34% stake in Axogen Inc is significant and demonstrates the firm's confidence in the company's potential.

Conclusion

In conclusion, ArrowMark Colorado Holdings LLC (Trades, Portfolio)'s recent addition of Axogen Inc shares to its portfolio is a noteworthy move. The transaction not only increases the firm's stake in Axogen Inc but also reflects its investment strategy. While Axogen Inc's stock has experienced a decrease since the transaction, its GF Score and GF Value Rank suggest a moderate future performance potential. As such, this transaction could have significant implications for value investors.

This article first appeared on GuruFocus.