ArrowMark Colorado Holdings LLC Reduces Stake in Sonendo Inc

Overview of ArrowMark Colorado Holdings LLC (Trades, Portfolio)'s Recent Transaction

ArrowMark Colorado Holdings LLC (Trades, Portfolio) has recently adjusted its investment portfolio by reducing its stake in Sonendo Inc (NYSE:SONX). On October 31, 2023, the firm sold 3,887,500 shares of Sonendo Inc, resulting in a 65.27% decrease in its holdings. This transaction had a minor impact of -0.01% on the firm's portfolio, with the shares being traded at a price of $0.2547. Post-trade, ArrowMark Colorado Holdings LLC (Trades, Portfolio) now holds 2,068,411 shares in Sonendo Inc, which represents a 3.93% stake in the company and a 0.01% position in the firm's portfolio.

Profile of ArrowMark Colorado Holdings LLC (Trades, Portfolio)

ArrowMark Colorado Holdings LLC (Trades, Portfolio), based at 100 Fillmore Street, Suite 325, Denver, CO, is a firm known for its strategic investment decisions. The firm's investment philosophy is centered around a disciplined approach, seeking to identify undervalued opportunities. With a diverse portfolio of 306 stocks, ArrowMark Colorado Holdings LLC (Trades, Portfolio) has significant holdings in the Healthcare and Technology sectors. Its top holdings include QuidelOrtho Corp (NASDAQ:QDEL), RB Global Inc (NYSE:RBA), Steris PLC (NYSE:STE), ACV Auctions Inc (NASDAQ:ACVA), and Alight Inc (NYSE:ALIT), with an equity portfolio valued at $9.11 billion.

Sonendo Inc's Company Overview

Sonendo Inc, trading under the symbol SONX in the USA, is a commercial-stage medical technology company with a focus on saving teeth from decay. Since its IPO on October 29, 2021, the company has developed the GentleWave System, a novel technology for treating tooth decay. Sonendo operates in two business segments: Product and Software. Despite its innovative approach, the company's market capitalization stands at a modest $13.805 million, with a current stock price of $0.2543. The company's financial performance has been challenging, with a PE Percentage of 0.00, indicating it is currently operating at a loss.

Analysis of the Trade's Significance

The recent sale by ArrowMark Colorado Holdings LLC (Trades, Portfolio) marks a significant reduction in its investment in Sonendo Inc. The trade's position size and its impact on the firm's portfolio are minimal, yet it reflects a strategic decision by the firm. The reduction in shares has decreased ArrowMark Colorado Holdings LLC (Trades, Portfolio)'s holding percentage in Sonendo Inc to 3.93%, which may suggest a shift in the firm's confidence in the stock's future performance.

Sonendo Inc's Financial Health and Market Performance

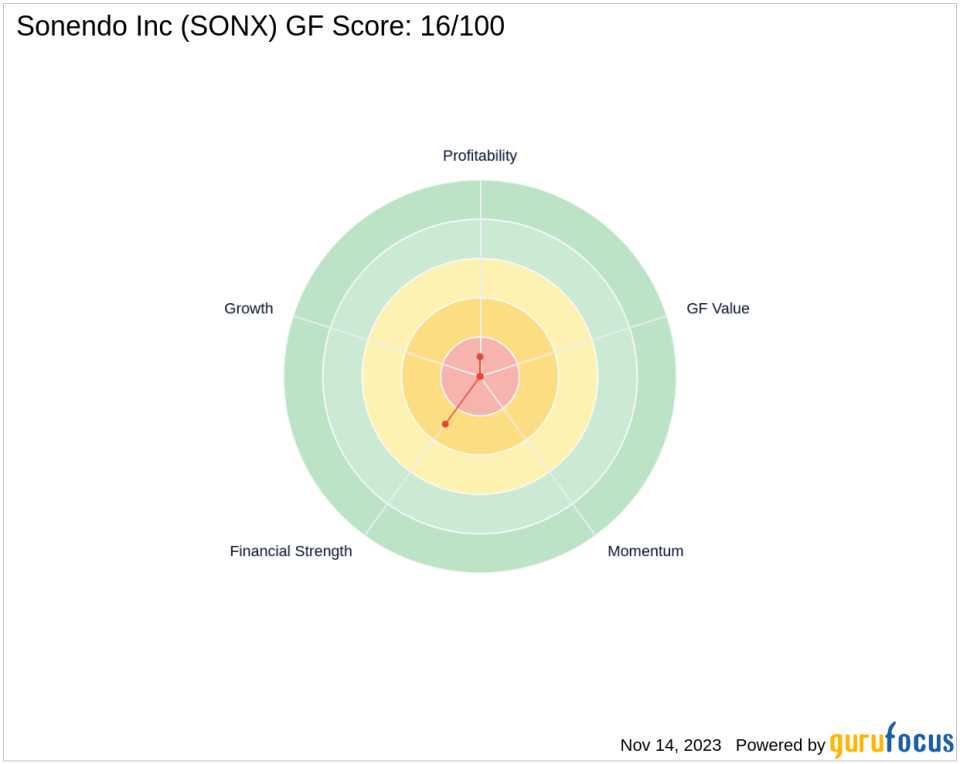

Sonendo Inc's financial health is a concern, with key metrics indicating a precarious position. The company has a GF Score of 16/100, suggesting poor future performance potential. Its Financial Strength is ranked at 3/10, and its Profitability Rank is at a low 1/10. The stock has experienced a significant decline since its IPO, with a -97.17% change, and a year-to-date performance of -88.75%. The lack of a GF Value makes it challenging to assess the stock's valuation.

Market and Industry Context

In the Medical Devices & Instruments industry, Sonendo Inc's standing is relatively weak. The company's performance has not kept pace with industry standards, which is reflected in its stock's poor growth and profitability metrics. The industry itself is competitive and innovation-driven, which may pose additional challenges for Sonendo Inc to maintain its market position.

Investment Considerations

For value investors, Sonendo Inc presents a complex case. The low GF Score and the absence of a GF Value data point complicate the assessment of the stock's intrinsic value and potential for growth. Investors must weigh the company's innovative product offerings against its financial instability and poor market performance.

Conclusion

In summary, ArrowMark Colorado Holdings LLC (Trades, Portfolio)'s recent reduction in Sonendo Inc shares reflects a strategic move within its investment portfolio. While the firm maintains a small position in the company, the transaction suggests a reassessment of Sonendo Inc's prospects. For value investors, the company's financial health, market performance, and industry context present a challenging investment landscape, requiring careful consideration of potential risks and rewards.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.