Arrow's (ARW) Q2 Earnings and Revenues Beat Estimates

Arrow Electronics ARW reported second-quarter 2020 adjusted earnings per share of $1.59, which beat the Zacks Consensus Estimate $1.45. However, quarterly earnings were down a penny on a year-over-year basis.

Revenues came in at $6.61 billion, down 11% from the year-ago quarter. Adjusted revenues dropped 8% year over year. The revenue figure, however, beat the consensus mark of $6.37 billion.

The company witnessed impressive demand for software, cloud and security solutions during the second quarter as firms needed to enable business continuity and remote working amid social-distancing measures.

Segmental Details

Adjusted revenues from Global Components decreased 8% year over year to $4.72 billion. On a reported basis, revenues declined 10%. Region wise, the segment’s adjusted revenues from the Americas decreased 18% year over year. Adjusted sales from the Asia Pacific declined 7% year over year. Global Components’ contribution from Europe fell 18% on an adjusted basis.

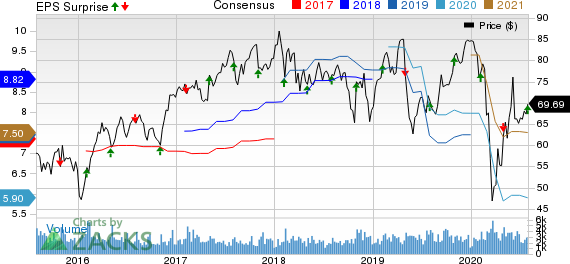

Arrow Electronics, Inc. Price, Consensus and EPS Surprise

Arrow Electronics, Inc. price-consensus-eps-surprise-chart | Arrow Electronics, Inc. Quote

Adjusted revenues from Global Enterprise Computing Solutions (ECS) came in at $1.89 billion, down 8% year over year. Region wise, the segment’s adjusted revenues from the Americas slid 11% year on year. Global ECS’s contribution from Europe fell 4% on an adjusted basis.

Margins

Arrow’s non-GAAP gross profit slipped 12.1% from the prior-year quarter to $739.8 million.

Operating income dropped 17.5% to $200.3 million.

Balance Sheet and Cash Flow

Arrow exited the June-end quarter with cash and cash equivalents of $203 million compared with the previous quarter’s $201 million.

Long-term debt was $2.1 billion compared with the $2.22 billion witnessed at the end of the prior quarter.

The company’s cash flow from operations was $418.2 million.

In the second quarter, Arrow returned $72.8 million to shareholders through the stock-repurchase program. The company, on Jul 30, announced a new share-repurchase program worth $600 million.

Guidance

For the third quarter of 2020, sales are estimated between $6.325 billion and $6.925 billion.

Global Components sales are projected at $4.675-$4.975 billion. Global ECS sales are estimated to be $1.65-$1.95 billion.

Interest expenses will presumably be about $33 million. As a result, the company projects non-GAAP earnings per share at $1.54-$1.70.

Zacks Rank and Key Picks

Currently, Arrow carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader technology sector include Dropbox DBX, Zoom Video Communications ZM and Analog Devices ADI. While both Dropbox and Zoom sport a Zacks Rank #1 (Strong Buy), Analog Devices carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The long-term earnings growth rate for Dropbox, Zoom and Analog Devices is currently pegged at 32.5%, 25%, and 13.3%, respectively.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Arrow Electronics, Inc. (ARW) : Free Stock Analysis Report

Analog Devices, Inc. (ADI) : Free Stock Analysis Report

Dropbox, Inc. (DBX) : Free Stock Analysis Report

Zoom Video Communications, Inc. (ZM) : Free Stock Analysis Report

To read this article on Zacks.com click here.