Arteris Inc CFO Nicholas Hawkins Sells 20,000 Shares: An Insider Sell Analysis

Arteris Inc (NASDAQ:AIP), a company specializing in the development of network-on-chip interconnect semiconductor intellectual property and tools, has recently witnessed a significant insider transaction. Nicholas Hawkins, the Vice President and Chief Financial Officer of Arteris Inc, sold 20,000 shares of the company on December 11, 2023. This move has caught the attention of investors and market analysts, prompting a closer look at the implications of such insider activity.

Who is Nicholas Hawkins?

Nicholas Hawkins is the financial steward of Arteris Inc, holding the critical roles of Vice President and Chief Financial Officer. His responsibilities include overseeing the company's financial operations, ensuring accurate financial reporting, and contributing to strategic planning. Hawkins's position places him in a unique situation to understand the company's financial health and future prospects, making his trading activities particularly noteworthy to investors.

Arteris Inc's Business Description

Arteris Inc is at the forefront of semiconductor technology, providing advanced network-on-chip interconnect solutions. These solutions are crucial for the development of complex system-on-chip (SoC) designs, which are integral to a wide range of electronic devices, from smartphones to automotive systems. Arteris's technology enables SoC designers to achieve higher performance, lower power consumption, and more efficient use of silicon area, thereby enhancing the overall value and capabilities of electronic products.

Analysis of Insider Buy/Sell and Relationship with Stock Price

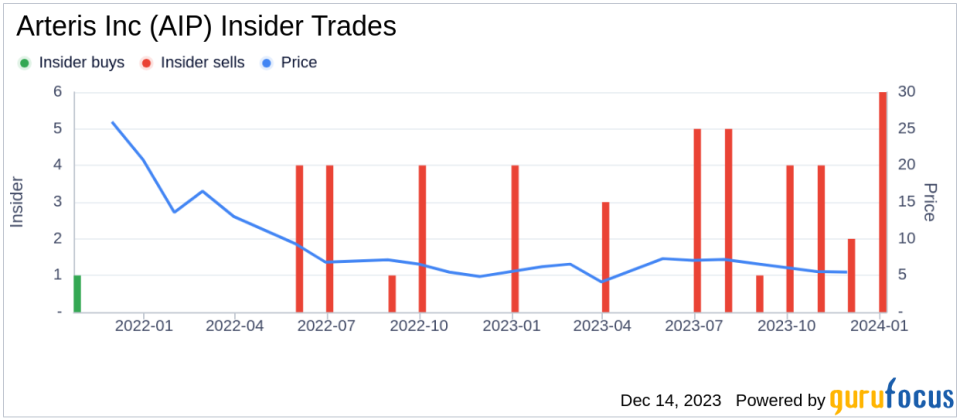

Insider trading activities, such as buys and sells, can provide valuable insights into a company's internal perspective on its stock's value. In the case of Arteris Inc, the insider transaction history over the past year shows a distinct pattern: there have been zero insider buys and 31 insider sells. This trend could suggest that insiders, including Nicholas Hawkins, may perceive the stock's current price as being on the higher end of its value spectrum, prompting them to realize gains.

On the day of the insider's recent sale, shares of Arteris Inc were trading at $5.63, giving the company a market cap of $224.075 million. The sale of 20,000 shares by the insider, therefore, represents a significant transaction, both in terms of the number of shares and the total value involved.

It is important to consider the context of these sales. If the insider's sales are part of a pre-determined trading plan, they may carry less weight in terms of signaling their belief about the company's future prospects. However, if these sales are discretionary, they could indicate the insider's view that the stock may not appreciate much further in the near term.

Moreover, the absence of insider purchases over the past year could be interpreted as a lack of confidence in the company's potential for short-term growth or a belief that the stock is not undervalued at current levels.

When analyzing the relationship between insider trading activity and stock price, it is also crucial to consider the overall market conditions and company-specific news. For instance, if the broader market is experiencing a downturn, insider sales might not necessarily reflect a negative outlook on the company itself. Similarly, if Arteris Inc has recently announced news that could impact its stock price, insider trades around that time could be more significant.

Insider Trend Image Analysis

The insider trend image above provides a visual representation of the buying and selling activities of insiders at Arteris Inc. The absence of green markers, which would indicate insider purchases, and the presence of numerous red markers, signifying sales, paint a picture of insiders consistently offloading their shares over the past year.

This pattern of behavior could be a signal to investors that insiders might not expect substantial upside potential in the near term. However, it is also essential to note that insiders may sell shares for various reasons unrelated to their outlook on the company, such as diversifying their personal investment portfolios, tax planning, or personal financial needs.

Conclusion

The recent sale of 20,000 shares by Nicholas Hawkins, the VP and CFO of Arteris Inc, is a significant event that warrants attention from the investment community. While insider selling alone is not a definitive indicator of a stock's future performance, the consistent pattern of insider sales at Arteris Inc, coupled with the absence of insider purchases, could suggest a cautious approach from those with intimate knowledge of the company.

Investors should consider this insider activity as one of many factors in their overall analysis of Arteris Inc's stock. It is always recommended to look at a comprehensive set of data, including company performance, industry trends, and broader market conditions, before making investment decisions. As always, due diligence is key when interpreting insider trading patterns and their potential impact on stock prices.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.