Arthur J. Gallagher (AJG) Boosts Insurance Business With Buyout

Arthur J. Gallagher & Co. AJG recently acquired Benchmark Commercial Insurance Services. The terms of the transaction have not been revealed yet.

Carlsbad, CA-based Benchmark Commercial Insurance Services is a retail insurance agency that provides commercial and personal risk management and insurance solutions to business owners in San Diego and the neighbouring area for the past 25 years.

The addition of this entity to the acquirer’s portfolio is a strategic fit as it will enhance its existing growth opportunities in Southern California.

Inorganic Growth Story

Arthur J. Gallagher seeks opportunities that align with its business objectives and allow it to enter new markets, strengthen its service offerings and increase its global footprint. Historically, AJG has successfully utilized strategic acquisitions to enhance its competitive position and drive growth. As the company continues to pursue strategic acquisitions, it strengthens its position as a leading global insurance brokerage and risk management firm.

The company has an impressive inorganic story with several buyouts in Brokerage and Risk Management segments. This insurance broker acquired 10 entities in the first quarter of 2023 that contributed about $69 million to estimated annualized revenues and 11 buyouts in the second quarter. AJG has a strong merger and acquisition pipeline with about $350 million of revenues, associated with about 45 term sheets either agreed upon or being prepared.

AJG’s revenues are geographically diversified with strong domestic and international operations, with the latter contributing about one-third of revenues. The company expects an increase in international contribution to total revenues, given the number and size of non-U.S. acquisitions.

A solid capital position supports this insurance broker in its growth initiatives and it thus remains focused on continuing its tuck-in mergers and acquisitions. The company expects an M&A capacity of more than $3 billion through the end of 2023.

Price Performance

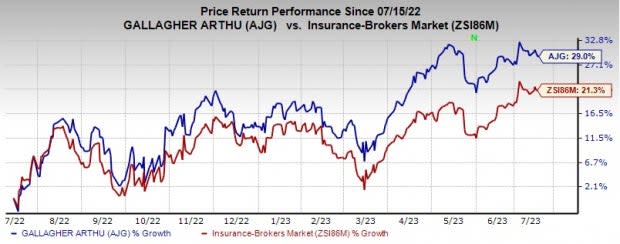

Shares of this Zacks Rank #3 (Hold) insurance broker have gained 29% in the past year, outperforming the industry’s growth of 21.3%. The insurer’s efforts to ramp up its growth profile and capital position should continue to drive the share price. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

Acquisitions in the Insurance Space

Marsh & McLennan Companies’ MMC Marsh McLennan Agency recently fortified its position in the healthcare industry with the acquisition of Trideo Systems. The deal marks another strategic acquisition for Marsh McLennan Agency as it continues to expand its portfolio and enhance its offerings in the insurance and risk management sector.

With multiple purchases across different operating units, MMC has expanded its geographical reach, entered new markets and developed specialized services. By continuously expanding its portfolio through strategic acquisitions, Marsh McLennan Agency has been solidifying its position as a leader in the insurance and risk management industry.

Brown & Brown, Inc.’s BRO subsidiary acquired assets of Brownlee Agency, Inc. The addition of Brownlee Agency will boost Brown & Brown’s presence in Georgia.

BRO and its subsidiaries continuously make strategic acquisitions to expand globally, add capabilities and boost operations. Also, these strategic buyouts help the company increase commissions and fees, which, in turn, drive revenues. Its impressive growth is driven by organic and inorganic means across all segments. Consistent operational results have been aiding Brown & Brown in generating solid cash flows for deployment in strategic initiatives.

American Financial Group, Inc. AFG has acquired Crop Risk Services ("CRS"), a primary crop insurance general agent based in Decatur, IL, for a cash consideration of $240 million from American International Group. The inclusion of CRS into the fold will reinforce Great American's position as the fifth largest provider of multi-peril crop insurance in the United States.

AFG has a track record of reaping the rewards of strategic acquisitions. It is actively involved in startups, small-to-medium-sized acquisitions and product launches. It is prudently investing in businesses.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marsh & McLennan Companies, Inc. (MMC) : Free Stock Analysis Report

Arthur J. Gallagher & Co. (AJG) : Free Stock Analysis Report

American Financial Group, Inc. (AFG) : Free Stock Analysis Report

Brown & Brown, Inc. (BRO) : Free Stock Analysis Report