Arthur J. Gallagher (AJG) Q3 Earnings Top Estimates, Rise Y/Y

Arthur J. Gallagher & Co. AJG reported third-quarter 2023 adjusted net earnings of $2.00 per share, which beat the Zacks Consensus Estimate by 3.1%. The bottom line increased 16.3% on a year-over-year basis.

Arthur J. Gallagher’s performance was driven by higher adjusted revenues and margin expansion across the Brokerage and Risk Management segments, partially offset by higher expenses.

Operational Update

Total revenues of $2.5 billion beat the Zacks Consensus Estimate by 1.8%. The top line also improved 22% year over year.

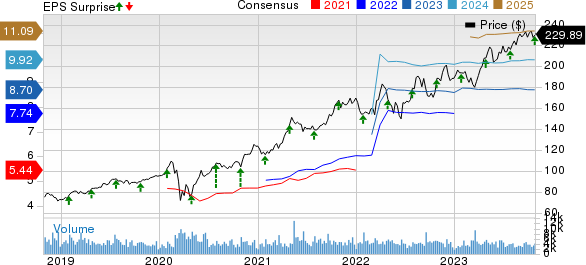

Arthur J. Gallagher & Co. Price, Consensus and EPS Surprise

Arthur J. Gallagher & Co. price-consensus-eps-surprise-chart | Arthur J. Gallagher & Co. Quote

Arthur J. Gallagher’s total expenses increased 23.1% year over year to $2.1 billion in the reported quarter due to higher compensation, operating, reimbursements, interest and amortization. Our estimate was $2.1 billion.

Earnings before interest, tax, depreciation and amortization and change in estimated acquisition earnout payables (EBITDAC) grew 19% from the prior-year quarter to $606.1 million. The figure was higher than our estimate of $593 million.

Segmental Results

Brokerage: Revenues of $2.1 billion increased 22.2% year over year on higher commissions, fees, supplemental revenues, contingent revenues, investment income and net gains on divestitures. The figure matched the Zacks Consensus Estimate as well as our estimate.

Expenses jumped 22.2% from the year-ago quarter to $1.7 billion due to higher compensation, operating expense, amortization and depreciation. Our estimate was $1.7 billion.

Adjusted EBITDAC climbed 14.3% from the year-ago level to $688 million. Margin expanded 50 basis points (bps) to 32.4%.

Risk Management: Revenues were up 20.1% year over year to $369.4 million, mainly owing to higher fees. Our estimate was $356.8 million.

Expenses rose 15.5% from the prior-year period to $313 million on higher compensation, operating and reimbursements. Our estimate was $293.2 million. Adjusted EBITDAC improved 34.7% year over year to $67.6 million. Margin expanded 220 bps to 20.4%.

Corporate: EBITDAC was a negative $97.3 million compared with a negative $53.1 million in the year-ago quarter.

Financial Update

As of Sep 30, 2023, total assets were $53.2 billion, up 38.7% from the 2022-end level. At the end of the quarter, cash and cash equivalents of $1 billion increased 39.4% from the 2022-end level. As of Sep 30, 2023, shareholders’ equity increased 14.4% to $10.5 billion from the level on Dec 31, 2022.

Dividend Update

The board of directors approved a quarterly cash dividend of 55 cents per share.

Acquisition Update

In the quarter, Arthur J. Gallagher closed 12 acquisitions with estimated annualized revenues of about $57.2 million.

Zacks Rank

AJG currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Players

Marsh & McLennan Companies, Inc. MMC reported third-quarter 2023 adjusted earnings per share of $1.57, which surpassed the Zacks Consensus Estimate by 13.8%. The bottom line climbed 33% year over year. Its consolidated revenues amounted to $5,382 million, which improved 13% year over year. The figure grew 10% on an underlying basis. Also, the top line beat the consensus mark by 3.7%.

Total operating expenses increased 10.2% year over year to $4,386 million in the third quarter due to higher compensation and benefits and other operating expenses. The reported figure also came higher than our estimate of $4,282.7 million. Total expenses in the Risk and Insurance Services segment escalated 10.4% year over year, while the same in the Consulting segment witnessed an 11.3% year-over-year increase.

Total adjusted operating income of $1,059 million advanced 24% year over year and beat our estimate of $992.3 million. The adjusted operating margin improved 170 bps year over year to 21.3% in the quarter under review.

Brown & Brown, Inc.’s BRO third-quarter 2023 adjusted earnings of 71 cents per share beat the Zacks Consensus Estimate by 16.4%. The bottom line increased 42% year over year. Total revenues of $1.06 billion beat the Zacks Consensus Estimate by 3.8%. The top line improved 15.1% year over year. The upside can be primarily attributed to commission and fees, which grew 13.4% year over year to $1.04 billion. Our estimate for commission and fees growth was 8.7%.

Organic revenues improved 9.6% to $1 billion in the quarter under review. Brown & Brown’s investment income increased year over year to $16.6 million from $1.2 million in the year-ago quarter. The Zacks Consensus Estimate for the metric was pegged at $7.2 million and our estimate was $2.4 million. Adjusted EBITDAC was $370.3 million, up 27% year over year. EBITDAC margin expanded 350 bps year over year to 34.7%. Our estimate for adjusted EBITDAC was $314.5 million.

Willis Towers Watson Public Limited Company WTW delivered third-quarter 2023 adjusted earnings of $2.24 per share, which beat the Zacks Consensus Estimate by 8.2%. The bottom line increased 2% year over year. Willis Towers posted adjusted consolidated revenues of $2.16 billion, up 11% year over year on a reported basis. Revenues increased 9% on an organic basis and a constant currency basis. The top line beat the Zacks Consensus Estimate by 4.2%.

Adjusted operating income was $351 million, which increased 24% year over year. Margin contracted 170 bps to 16.2%. Adjusted EBITDA was $436 million, up 6.8% year over year. Adjusted EBITDA margin was 20.1%, down 80 bps.

Willis Towers expects to deliver mid-single-digit organic revenue growth. The insurer projects to deliver adjusted operating margin expansion for 2023. Willis Towers expects to deliver approximately $160 million of incremental run-rate savings from the Transformation program in 2023. WTW expects approximately $112 million in non-cash pension income for 2023. Willis Towers anticipates approximately 12% free cash flow margin for 2023.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marsh & McLennan Companies, Inc. (MMC) : Free Stock Analysis Report

Arthur J. Gallagher & Co. (AJG) : Free Stock Analysis Report

Brown & Brown, Inc. (BRO) : Free Stock Analysis Report

Willis Towers Watson Public Limited Company (WTW) : Free Stock Analysis Report