Arthur J Gallagher (AJG) Rises 20% in a Year: More Upside Left?

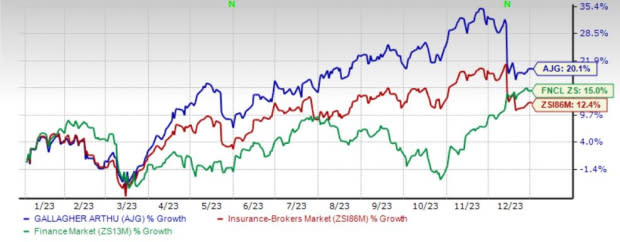

Arthur J. Gallagher’s AJG shares have gained 20.1% in a year, outperforming the 12.4% and 15% growth of the industry and the Finance sector, respectively. With a market capitalization of $48.6 billion, the average volume of shares traded in the last three months was 0.9 million.

Solid performance of the Brokerage and Risk Management segments, strategic buyouts to capitalize on growing market opportunities and effective capital deployment continue to drive AJG’s performance.

Earnings of this Zacks Rank #3 (Hold) insurance broker have increased 19.9% over the last five years, better than the industry average of 11.4%. The largest property/casualty third-party claims administrator has a stellar record of beating estimates for the last 21 quarters.

Return on invested capital hovered around 11% over the last few years. The company has raised its capital investment over some time. A stable ROIC reflects its efficiency in effective management of its investments to generate income.

Image Source: Zacks Investment Research

Can It Retain the Momentum?

The Zacks Consensus Estimate for Arthur J. Gallagher’s 2024 EPS is pegged at $10.06, indicating an increase of 14.8% on 12.1% higher revenues of $11.1 billion.

The long-term earnings growth rate is currently pegged at 12%, better than the industry average of 11.1%. It has a Growth Score of B.

AJG remains on track to generate both organic (particularly international) and inorganic growth. Focus on tapping opportunities across the globe bodes well.

In the Brokerage segment, management expects brokerage organic growth to be between 7% and 9% in 2024. Adjusted EBITAC margin is expected to expand about 50 bps in 2024.

In the Risk Management segment, it estimates 9-11% organic growth with EBITDAC margin around 20% in 2024. Rising claim counts and continued growth from recent new business wins will likely help the insurer achieve the goal.

AJG’s inorganic growth story is impressive, with a strong pipeline with about $450 million of revenues, associated with almost 45 term sheets, either agreed upon or being prepared. This insurance broker acquired 37 entities in the first nine months of 2023, which contributed about $475.3 million to estimated annualized revenues. It expects M&A capacity of about $3.5 billion in 2024 without using any equity.

AJG’s solid capital position helps it increase payouts to shareholders. Its dividend has risen at a four-year CAGR of 5.1%, currently yielding 0.9%. Its board of directors also approved a $1.5 billion share-buyback program.

Notably, its free cash flow conversion has remained more than 100% over the last many quarters, reflecting the superior quality of its earnings.

Stocks to Consider

Some better-ranked stocks from the insurance industry are Ryan Specialty Holdings RYAN, Brown and Brown BRO and CNA Financial CNA, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for RYAN’s 2024 earnings indicates a 22.3% rise from a year ago. The consensus estimate has risen 2 cents for 2024 in the past 30 days. RYAN delivered a four-quarter average earnings surprise of 5.05%. Shares have gained 2.9% in a year.

The Zacks Consensus Estimate for Brown and Brown’s 2024 earnings suggests a 9.7% jump from the prior-year levels. The consensus estimate has inched up 1 cent for 2024 in the past 30 days. BRO delivered a four-quarter average earnings surprise of 12.25%. Shares of BRO have gained 22.8% in a year.

The Zacks Consensus Estimate for CNA’s 2024 earnings implies 7.4% growth from 2023 estimated figure. The expected long-term earnings growth rate is 5%. The consensus estimate for 2024 earnings has moved up 1.5% in the past 30 days. Shares have lost 0.9% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CNA Financial Corporation (CNA) : Free Stock Analysis Report

Arthur J. Gallagher & Co. (AJG) : Free Stock Analysis Report

Brown & Brown, Inc. (BRO) : Free Stock Analysis Report

Ryan Specialty Holdings Inc. (RYAN) : Free Stock Analysis Report