Arthur J. Gallagher & Co. Reports Robust Growth in Q4 and Full Year 2023 Earnings

Revenue Growth: Q4 adjusted revenue increased to $2.39 billion, with full-year adjusted revenue reaching $9.92 billion.

Net Earnings: Q4 adjusted net earnings rose to $408.4 million, while full-year adjusted net earnings climbed to $1.93 billion.

Earnings Per Share (EPS): Adjusted EPS for Q4 was $1.85, with a full-year adjusted EPS of $8.76.

Organic Growth: Brokerage segment reported 7.2% organic growth in Q4 and 8.9% for the full year.

Acquisitions: Completed 50 acquisitions in 2023, with estimated annualized revenues of $826 million.

Brokerage and Risk Management: Combined segments reported adjusted EBITDAC of $718.4 million for Q4 and $3.22 billion for the full year.

On January 25, 2024, Arthur J. Gallagher & Co (NYSE:AJG) released its 8-K filing, announcing financial results for the fourth quarter and full year ended December 31, 2023. The company, a global leader in insurance brokerage, risk management, and consulting services, reported significant growth in revenue and net earnings, bolstered by organic growth and strategic acquisitions.

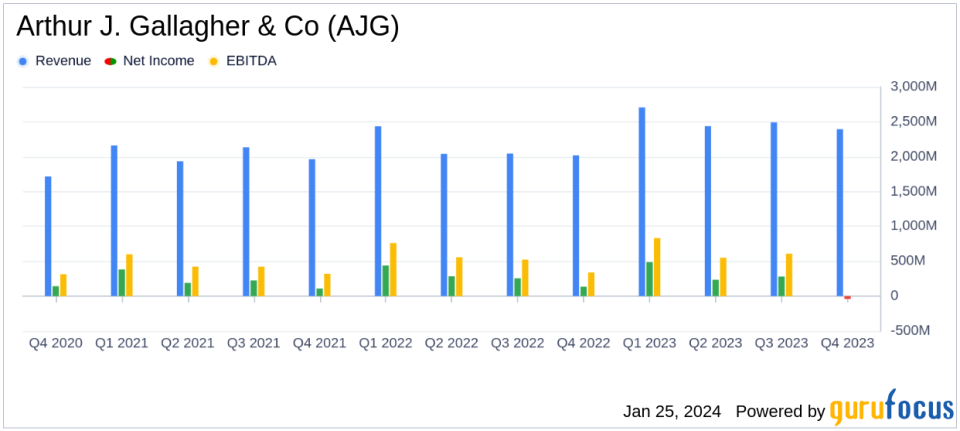

For the fourth quarter, AJG's adjusted revenue increased to $2.39 billion, up from $2 billion in the same period last year. Full-year adjusted revenue also saw a rise, reaching $9.92 billion compared to $8.38 billion in the previous year. Adjusted net earnings for the quarter were reported at $408.4 million, a substantial increase from $321.6 million in Q4 of the prior year. The full-year adjusted net earnings climbed to $1.93 billion, up from $1.62 billion in 2022.

The company's adjusted earnings per share (EPS) for the fourth quarter stood at $1.85, while the full-year adjusted EPS was $8.76, reflecting the company's strong financial performance throughout the year.

Organic Growth and Acquisition Strategy

AJG's Brokerage segment reported a robust 7.2% organic growth in the fourth quarter and 8.9% for the full year, showcasing the company's ability to grow its core business. The company also completed 50 acquisitions in 2023, with estimated annualized revenues of $826 million, highlighting its aggressive expansion strategy.

The combined Brokerage and Risk Management segments reported an adjusted EBITDAC of $718.4 million for the fourth quarter and $3.22 billion for the full year, demonstrating the strength of AJG's diversified business model.

Leadership Commentary

We had a strong fourth quarter, to wrap up another fantastic year! said J. Patrick Gallagher, Jr., Chairman and CEO. During the quarter, our core brokerage and risk management segments combined to deliver 20% growth in revenue, of which 8.1% was organic revenue growth. We also completed 14 new mergers in the quarter with estimated annualized revenues of $410 million.

The CEO also noted the rational behavior of insurance and reinsurance carriers, which continue to push for rate increases where needed to generate an underwriting profit. Positive mid-year policy endorsements and audits were ahead of last year's levels, suggesting strong customer business activity.

Financial Position and Outlook

As of December 31, 2023, AJG had a total debt of $7.74 billion, with a weighted average interest rate of 5.97% per annum. The company's effective tax rate for the fourth quarter was (51.8)%, primarily due to planning associated with the 2021 and 2022 UK loss deferral reflected in the 2022 filed tax returns.

Arthur J. Gallagher & Co. remains optimistic about its performance for 2024 and beyond, with a focus on continued growth in non-farm payrolls, a low unemployment rate, and strong client retention within its risk management segment, Gallagher Bassett.

For a detailed analysis of AJG's financial results, including reconciliations of non-GAAP measures to GAAP, please refer to the full 8-K filing.

Investors and analysts are encouraged to review the company's financial results and consider the opportunities that AJG's strategic growth initiatives may present for the future.

Explore the complete 8-K earnings release (here) from Arthur J. Gallagher & Co for further details.

This article first appeared on GuruFocus.