Arthur J. Gallagher: An Expensive Stock Worth Its Price

Arthur J. Gallagher & Co. (NYSE:AJG) is an expensive stock from a valuation standpoint in relation to the insurance sector, but its ability to lead and grow over a long period justifies the high price. Investors are paying more for better and the risk-reward ratio makes the stock a good bet for decades ahead. The alpha in this stock is the company's merger and acquisition strategy and a pullback would be an optimal entry point.

Business overview and recent earnings

Founded in 1927, the international insurance brokerage and risk management company is based in the U.S. The company provides insurance brokerage, third-party claims settlement, consulting and administration services.

The stock is also one of the oldest S&P 500 stocks with an initial public offering dating back to 1984. The shares were priced at $1.72 (post stock splits) and never revisited this price level. The stock currently trades on the New York Stock Exchange above $230 a share, down 10% from the all-time high reached two months ago. If an investor bought $10,000 worth of stock in 1984, the value would now have reached over $1.30 millon. The stock remains an attractive opportunity despite its strong valuation.

The business remains concentrated on the insurance brokerage segment, which represents over 87% of the company's revenue. Arthur J. Gallagher's core business is to act as a middleman between the insured and the insurers. It advises people on their insurance needs and negotiates insurance contracts on their behalf, receiving a commission for every successful match. The company benefits, therefore, from sector tailwinds, while at the same time avoiding being exposed to the risks the insurance carriers are exposed to, such as natural disasters. The company's revenue is concentrated in the U.S. with approximately two-thirds of the revenue being domestic, and one third from abroad (primarily the U.K.). In my view, this is an attractive revenue split for a U.S. company as it mitigates potential headwinds on the U.S. insurance sector (e.g., decline in consumer income if unemployment starts to rise) while not being excessively exposed to currency risk.

The earnings release on Jan. 25 confirmed Arthur J. Gallagher remains on a path of growth. The fourth-quarter non-GAAP earnings per share hit $1.85, in line with expectations. The revenue grew a whopping 19.7% to reach $2.43 billion, beating expectations by $20 million. The revenue growth is supported both by inorganic growth (11.60% of the growth) and organic growth (8.1.%). J. Patrick Gallagher Jr., chairman and CEO of the company, announced the business completed 14 new mergers in the quarter with estimated annualized revenue of $410 million.

As an investor, this is music to my ears. Indeed, I know the money I would invest in the business would provide some return, even if the business itself would be facing some headwinds. The fact revenue growth is both inorganic and organic gives me the confidence that if things slow down internally, there is always the highly-performing mergers and acquisitions that will support the business growth.

The stock is expensive, but is justified with solid financials

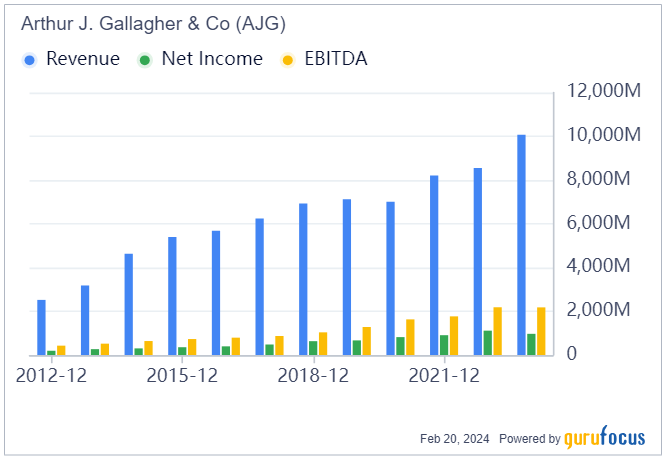

Arthur J. Gallagher has demonstrated an unmatched financial resilience throughout the years, even during the Covid-19 pandemic, with revenue, Ebitda and net income registering growth practically every year as the business kept expanding.

Revenue growth averaged 12.35% with a median of 10.55% in the last 10 years. In the meantime, the net income margin averaged 9.48% with a median of 9.55%. What I find even more interesting is the net income margin in the last five years averaged 11.36% with a median of 11.40%. This clearly indicates the company has been on a path of increased efficiency despite high M&A activity. Usually when a company grows too quickly inorganically (remember that 60% of the growth is currently inorganic), it is usually reflected in the financials with decreased margins while revenue grows. This makes the stock even more attractive and further proves its strong ability to manage inorganic growth.

Ebitda has increased every year since 2011 between 3.62% and 34.71%. The markets have priced in similar growth levels for the next decade. And that is the reason why the stock is expensive by every metric. At first glance, it even appears unattractive from a valuation standpoint despite solid financial growth. Indeed, the stock is expensive relative to the sector medians.

Taking one of the most important metrics, the price-book ratio stands at 4.84 for the last 12 months and 4.70 for the next 12. The price-book ratio is one of the most useful tools when conducting a stock valuation analysis as it uses the balance sheet as a metric. Indeed, the ratio is calculated in the following three steps:

Subtract liabilities from the assets to obtain the book value.

Then divide the book value by the total number of outstanding shares to obtain the book value per share.

Divide the current market share price by the book value per share to obtain the price-book ratio.

The lower the ratio, the better the valuation. If the ratio is below 1, it would mean the book value per share is worth more than the price per share and hence the stock would be undervalued. It does not necessarily mean it's automatically a good purchase for the long term. Similarly, an expensive stock does not always mean it is intrinsically overvalued. Indeed, given the growth and the return ratios over time, Arthur J. Gallagher fully justifies its high valuation. The dividend yield is also fairly unattractive with a yield below 1% despite consistent dividend payment over the years. The last year the dividend yield was below 1% was back in 2011. The stock should not be bought primarily for its dividend. Also, it shows that despite the dividend payment growing from 51 cents per share in 2022 to 55 cents in 2023 (8% year-over-year growth), the yield remained under downward pressure due to a higher growth in stock price. In my view, this shows the buying pressure is high and the stock is sought after by investors. Therefore, it could be a wise strategy to wait for the pressure to come down and enter a position once a pullback materializes.

The company is properly managed

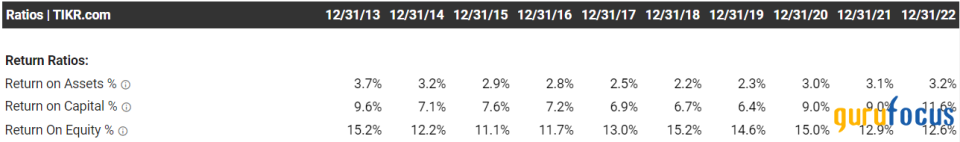

Over the years, we can see strength in the financials with a consistent growth in revenue, Ebitda and net income. Revenue today is more than three times higher than 10 years ago. Some of the most favored decision tools for investors are the return ratios, in particular the return on equity.

Financial ratios, source tikr.com

The consistent double-digit ROE of Arthur J. Gallagher indicates the business is well run and managed efficiently. Indeed, consistent positive ROE essentially shows that the business has onsistent profits and net income over time and an acceptable debt level.

The business' fundamentals are not the only attractive points about the stock. The overall business is headed to prospects that keep the markets optimistic for a bright future. Indeed, the insurer's ambitious expansion plan opens for great prospects for the continued sector leadership. Positive ROE shows that Arthur J. Gallagher is able to acquire a large number of new entities (37 confirmed acquisitions in the first three quarters of 2023) and consolidate them into the larger business group while ensuring synergies and preserving profitability. The efficiency of its M&A strategy leads me to believe that, even if the organic growth were to become challenged in the future, the inorganic growth would be able to take the lead and ensure the business continues on its path of consistent growth over the coming decades.

Thanks to both its inorganic growth (strong M&A activity) and organic growth (quality management), the company has outperformed its main rivals of comparable size. I selected them based on geography (U.S. and U.K.), revenue size and market cap. Given the trendline, the company is likely to continue performing well, especially given the probable interest rate cuts later this year, providing additional liquidity to continue acquiring aggressively other companies and reducing the M&A leveraged buyout costs. From my view, the outperformance relative to rivals is yet another argument that justifies the stark valuation: the business simply performs better than its competitors because its M&A is truly Arthur J. Gallagher's moat and lower interest rates will further boost the company's edge relative to its competitors in the next several years.

Risks

The key risk to observe for Arthur J. Gallagher, which could invalidate the bullish case for the stock, is actually its main attribute: growth. Acquiring 40 to 50 entities in different jurisdictions every year over the next few years could cause serious challenges from different aspects. There is only so much a management team can oversee. The sector is heavily regulated relative to other sectors in most countries, so ensuring every entity (new or old) is compliant from a regulatory perspective poses a real challenge.

Further, the group needs to make sure the entities are not overlapping in their product and geographic offerings, otherwise this could lead to corporate cannibalization. Keeping control of an aggregation of hundreds of entities (including keeping local management teams motivated) involves having clear communication from the top, new incentives to grow and making the corporate culture understood throughout all the layers of the corporate structure.

In the last decade, the business' revenue has tripled from $3.10 billion in 2013 to $9.50 billion in 2023 and the net income practically quadrupled from $268 million to $970 million in the same period, indicating its efficiency has improved. However, the earnings per share only doubled during this period (from $2.08 to $4.51), which indicates share dilution. We do not know the prices paid for these acquisitions in most cases, but it is prudent to assume a large portion is funded with stock offering rather than cash. The active M&A of the company, therefore, regularly dilutes existing investors and poses a key risk in the event it abruptly ceases to grow as quickly.

Bottom line

Arthur J. Gallagher is an expensive stock of a well run 40-year international insurance business. Valuation points to the upper end of the sector's valuations, but the singular consistency of the financial growth, of the business expansion, of the dividend payments and of the stock price increases make the markets price the stock higher than its peers.

Existing investors who have enjoyed years of double-digit returns on shareholders' equity refuse to sell their shares. New investors may find the price high, but once the stock is analyzed, they come to understand the valuation may understandably not be in line with its peers. The main challenge of the business is and has been to ensure it keeps control of its growth amid macroeconomic uncertainty.

This article first appeared on GuruFocus.