Artisan Partners (APAM) Q1 Earnings Beat Estimates, AUM Rises

Artisan Partners Asset Management Inc. APAM reported first-quarter 2023 adjusted net income per adjusted share of 64 cents, which surpassed the Zacks Consensus Estimate of 59 cents. The bottom line, however, plunged 35% year over year. Our estimate for adjusted net income per adjusted share was 56 cents.

Results benefited from a rise in assets under management (AUM), lower expenses and an improved balance sheet position. However, lower management fees earned from Separate accounts and the Artisan Funds & Artisan Global Funds weighed on the overall top line.

Net income attributable to Artisan Partners (GAAP basis) was $50.8 million, down from $65.4 million in the prior-year quarter.

Revenues & Expenses Down

First-quarter revenues were $234.5 million, down 16.7% from the year-ago quarter. The top line, however, beat the Zacks Consensus Estimate of $229.6 million. Our estimate for total revenues was $225.6 million.

Management fees earned from the Artisan Funds & Artisan Global Funds fell 17.6% year over year to $144.6 million. Management fees earned from Separate accounts declined 15.2% to $89.8 million.

Total operating expenses amounted to $166.2 million, down 4.8% year over year. The fall was primarily due to lower compensation and benefits and distribution, servicing and marketing costs. We had projected operating expenses of $161.7 million.

Operating income was $68.3 million, down 36.2% year over year.

AUM Balance Increase

As of Mar 31, 2023, the ending AUM was $138.5 billion, up 8.3% from the previous quarter, mainly due to lower Artisan funds' distribution not reinvested and a decrease in net client cash outflow.

Average AUM totaled $135.4 billion, up 6.3% from the prior quarter.

Balance Sheet Position Improves

Cash and cash equivalents were $150.6 million compared with $114.8 million as of Dec 31, 2022. Artisan Partners’ debt leverage ratio, calculated in accordance with its loan agreements, was 0.6 as of Mar 31, 2023.

Dividend Update

The company’s board of directors declared a variable first-quarter dividend of 50 cents per share of Class A common stock. The total amount will be paid out on May 31 to shareholders of record as of May 17.

Our Take

A decline in management fees earned and a worsening operating backdrop are major near-term concerns. A volatile trend in net outflows over the past years keeps us apprehensive.

However, a manageable expense level and decent liquidity position are expected to support financials. Also, diverse investment strategies across multiple asset classes and investments in new teams and operational capabilities are likely to drive revenues in the upcoming period.

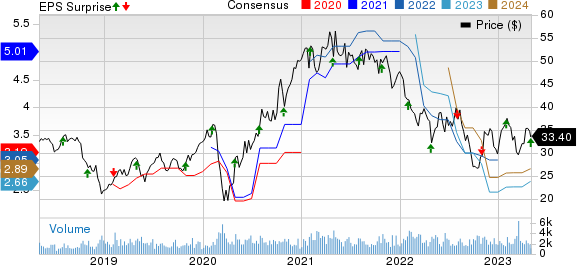

Artisan Partners Asset Management Inc. Price, Consensus and EPS Surprise

Artisan Partners Asset Management Inc. price-consensus-eps-surprise-chart | Artisan Partners Asset Management Inc. Quote

Currently, Artisan Partners carries a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Asset Managers

Invesco’s IVZ first-quarter 2023 adjusted earnings of 38 cents per share surpassed the Zacks Consensus Estimate of 36 cents. The bottom line, however, plunged 32.1% from the prior-year quarter. Our estimate for earnings was 31 cents.

IVZ's results benefited from a decline in operating expenses. On the other hand, lower AUM balance and long-term outflows hurt revenues.

Franklin Resources Inc. BEN reported second-quarter fiscal 2023 (ended Mar 31) adjusted earnings of 61 cents per share, which beat the Zacks Consensus Estimate of 57 cents. However, the bottom line declined 36% from the prior-year quarter. Our estimate for earnings was 55 cents.

While a rise in AUM was a tailwind, BEN’s results display top-line weakness in the quarter. Rising expenses affected the bottom line to some extent.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Franklin Resources, Inc. (BEN) : Free Stock Analysis Report

Invesco Ltd. (IVZ) : Free Stock Analysis Report

Artisan Partners Asset Management Inc. (APAM) : Free Stock Analysis Report